It has been noted many times over recent weeks and months (not to mention years) that the current market structures are complex and difficult to understand as an outsider. For those of us trading in the markets every day, we use terms like market makers, buy side and sell side unthinkingly; we know how trades get to market (i.e. the exchange) – who they go via, and how they are executed. What we haven’t been accustomed to considering, is that there may be others who are interested in understanding how their markets work.

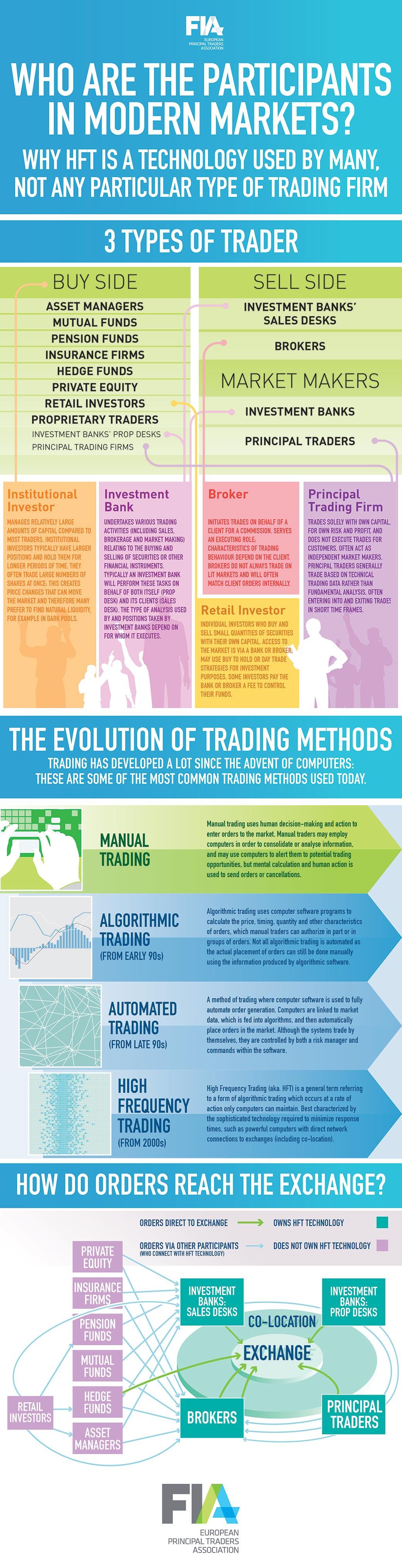

To try to redress this balance we have created an infographic which endeavours to explain: the types of participants in modern markets, the trading methods used, and how they’ve evolved, and how all these participants may interact as they send orders to the exchange. The infographic also aims to demonstrate why we believe the concept of a ‘high frequency trading firm’ gives a misleading idea of today’s market structure.

Traders and investors have different needs to execute their trading strategies and this includes their connections to the exchange and use of technology. I’d like to explore some of these differences (and similarities) and the place of high frequency trading in the market structure by looking at the last part of the infographic: how orders reach the exchange.

As well as divisions of the market by their role in trades (buy side, sell side, and market makers - outlined in the first section of the infographic); it is also possible to divide participants by how they send orders to the exchange.

Today it is possible for anyone to purchase a direct connection to the exchange (where just a few decades ago the entry criteria for buying a seat on the floor were stringent). There are four types of participant that tend to have these direct connections: investment banks (both sales and proprietary (prop) desks), brokers, hedge funds and principal traders. The common ground between these participants is that they trade in the markets most of the day, and therefore the cost of the direct connection is a reasonable investment for their businesses

Within these participants with direct connections to the exchanges, the majority choose to co-locate their servers at the exchange, allowing them to use speed as part of their trading strategies. Co-location is the practice of placing computer equipment in close physical proximity to the order matching computers of exchanges or other trading venues (which complete the trades). This allows participants to minimize the delays caused by distance in receiving public market data and submitting orders. Co-location is an investment usually associated with companies or traders who tend to be in the market most of the day, including algorithmic and high frequency traders. It is usually accompanied by other investments technology such as super-fast network access. (You can read more about co-location in this blog). The use of co-location also allows participants to manage risk on a real time basis, which is a high priority for European regulators.

Some hedge funds co-locate their servers through third parties, while others prefer not to because they tend to be investing participants rather than trading: in other words, they are interested in taking long term positions in assets and seeing major growth over days and weeks, rather than the fractional gains made by traders using speed-based strategies.

As you can see in the infographic, even participants who can connect directly to the exchange do not always choose to: depending on the strategy, an investment bank may prefer to have a broker execute a certain set of orders, rather than doing so themselves. Strategies that are not speed-dependent may be best executed through independent brokers to achieve anonymity at the exchange.

Brokers are the only category of market participant which invariably send orders directly to the exchange. This is natural, as brokers exist only as intermediaries for executing others’ orders. Investment banks’ sales desks can also act as brokers, and this is why brokers and investment banks’ sales desks are used for routing orders by the majority of buy side participants.

Retail investors (the man on the street) have the greatest number of routes to the exchange, as retail investors can choose whether they control how their money is traded, or to have it controlled on their behalf. Retail investors who choose to control each trade will have their trades executed by a broker or investment bank, as with other buy side participants. Those who choose to delegate their trading to another (hopefully better informed) participant, invest through pension funds, hedge funds, or asset managers. As retail investors only consider their investment portfolios at most once a day, buying a direct connection to the exchange (let alone high frequency trading technology) would be like using a sledge-hammer to crack a nut. (At the point that individuals are trading all day in the market, they cease to be classed as retail investors, and instead are known as ‘day traders’.)

In today’s markets, as indeed there have always been, there are traders and investors: traders stay in the markets most of the day, while investors take long term positions and enter and leave the market only when they want to change those positions. Investments in technology are made according to each participant’s strategic needs. There are several trading participants in the markets who benefit from using high frequency trading technologies and speed-dependent strategies, but these ‘high frequency traders’ are found across several different market participants, not just small trading firms. As the technology becomes cheaper, high frequency trading is only likely to spread further through the market structure as algorithmic and automated trading have done already.

The views expressed in this blog post are the personal opinions of the author and do not necessarily reflect the official policies or positions of the FIA European Principal Traders Association or the Futures Industry Association.