High frequency trading has been a hot topic for debate this year, as well as the focus of regulators’ attention, but are we talking about the wrong thing?

Fuelled by technological and regulatory developments, the markets are evolving rapidly. The majority of the market is already automated today, and recent legislation in Europe is encouraging further automation across the markets to ensure trading transparency and accountability. Similarly, there’s no single type of ‘high frequency trader’: trades at high speeds occur across many types of participants, not just principal traders. Automation in the markets will continue to grow, and use of high speed technology will spread until in a few years’ time, the whole conversation will be entirely irrelevant, as the majority of the market will trade at the same ‘high speeds’.

Algorithmic trading is a method of trading widely used across the market: the algorithm executes pre-programmed trading instructions, making decisions based on variables including the timing, price, or quantity of the order. HFT is a type of algorithmic trading, where participants use low latency technologies, such as co-location and direct connections to the exchange, and consequently a high messaging frequency. This technology also allows traders to send regular order updates to manage their risk: a useful addition to any trading strategy.

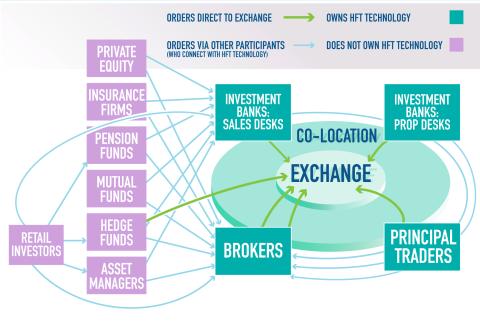

Like algorithmic trading, high frequency technologies are used across all three categories of market participant (buy side, sell side and market makers). You can see in the diagram below, that in the majority of cases, those who send their orders direct to the exchange own high frequency technology and co-locate at the exchange (hedge funds are often an exception to this).

Of the four groups of participant that most often use HFT technology, two trade on their own behalf (principal traders and investment banks’ prop desks), and two trade on behalf of clients (brokers and investment banks’ sales desks). This distinction between trading for yourself or on behalf of clients is one of the fundamental strategic differentiators between participants and yet HFT is able to cover both: this would surely be impossible if HFT were (as some have argued) tied to a particular trading strategy.

The section of the market which relies most on HFT tech is the market makers. Being a market maker is a highly complex profession. Market makers have to understand not only the products for which they make a market, but also their relationship to other financial products across many other markets. By committing to having quotes in the market, market makers are exposed to significant risk – in particular the risk of trading at stale quotes (“being picked off” by better informed investors). HFT technologies enable market makers to manage this risk better by processing all publicly available information as quickly as possible and updating quotes regularly in real-time to avoid that their prices become stale.

Think about weather reports: pilots need information from weather reports as fast and accurately as possible so they can steer flights on the most efficient (straight) route and react immediately if a sudden danger arises. They must use all available weather data, from real-time to forecasts before and during the flight, to make decisions that maintain safety in the skies. If this information weren’t available, storms would more often catch pilots off-guard and/or routes would be set with bigger detours to maintain safety margins.

In the same way, modern farming equipment uses sensors to help farmers manage their fleet and to decrease downtime of their tractors as well as save on fuel. The sensors reflect real-time data on weather prediction, soil conditions and crop features in order to helper farmers figure out which crops to plant where and when, when and where to plough, where the best return will be made with the crops and even which path to follow when ploughing. Real-time technology increases the productivity and efficiency of the crops that will in the end lead to higher production and revenue.

Market makers are in a similar position: they cannot make markets without real-time data to see what the current market price is. Trading on out-of-date quotes could result in significant economic losses for the market marker, as well as causing price movements that increase volatility. This means they need the fastest possible connection to receive the data that it is relevant to the markets at that time: the equivalent to real-time weather data for pilots or farmers.

Like modern technology leads to higher production and revenue in agriculture, the additional benefit of market makers’ ability to manage risk through speed is that they are able to offer tighter bid-ask spreads, which leads to cost-savings for those who trade with them, and therefore to the end customers.

A quick look at the recent history of the markets can tell you what the future of high frequency trading will be: just as once mobile phones were large bricks carried around by CEOs and journalists and have become an essential of everyday life, so too, HFT technology will become the norm for market trading. As the technology develops and gets cheaper, more and more participants will invest in it, just as they have done already with algorithmic trading, meanwhile others will explore new technologies which may, one day, change the way we interact with markets again.

Given this, the pressing need is for enduring regulation that will remain relevant as the markets continue to evolve. This will best be achieved by establishing broad principles to capture the entire universe of automation risk.

The views expressed in this blog post are the personal opinions of the author and do not necessarily reflect the official policies or positions of the FIA European Principal Traders Association or the Futures Industry Association.