Data Resources

In support of its mission to promote better understanding of and greater transparency into the global derivatives markets, FIA publishes several types of statistics. These include levels of trading activity on exchanges and swap execution facilities as well as the number of clearing firms in the U.S. and the amount of customer funds held by these firms.

ETD Tracker

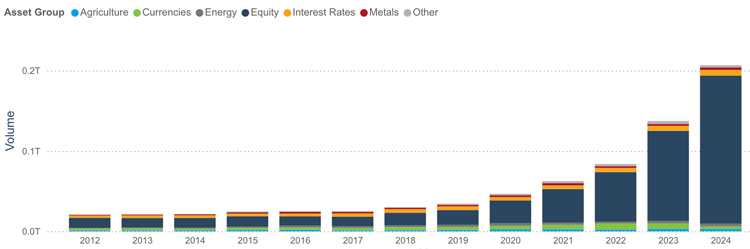

Insights on volume and open interest in the global futures and options markets

Volume by Year

The ETD Tracker provides insights on trends in the trading of futures and options on exchanges worldwide. The ETD Tracker consists of interactive visualizations that allow users to view data on volume and open interest, with filters based on year and month, region and jurisdiction, asset group and type of product.

Access NowCCP Tracker

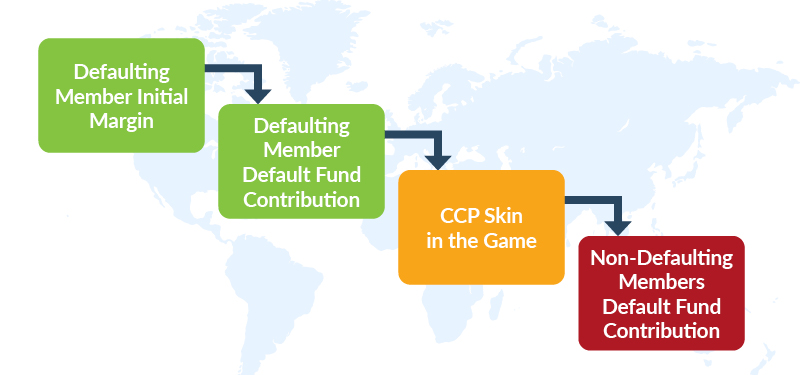

Quarterly data on risk exposures at derivatives clearinghouses

The CCP Tracker is designed to provide greater transparency into the amount of risk in the global clearing system and the financial resources available to protect the system from losses. Using the public quantitative disclosures published by derivatives clearinghouses on a quarterly basis, the CCP Tracker contains a set of charts and tables that allow users to compare several key metrics for each quarter going back to the second half of 2015.

Access NowFCM Tracker

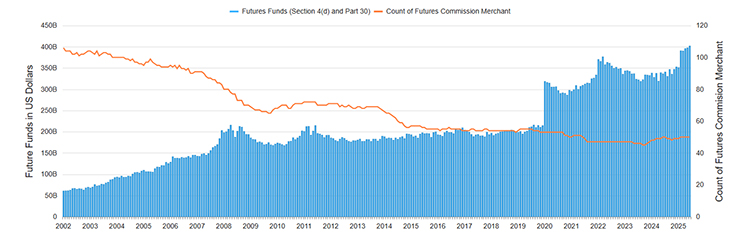

Monthly data on customer funds held at U.S. futures commission merchants

Customer Seg Funds in Futures Accounts and FCM Count over Time

The visualizations show the level of customer segregated funds held by FCMs as well as the number of FCMs holding those funds. The visualizations also include a table showing the amount of customer funds held by each FCM and the percent change over time, and a special "lookup" page that displays key data points for individual FCMs. Sign up to receive monthly alerts.

Access Now2026 ETD Volume Reports

DOWNLOAD REPORTRecent Articles & Analysis

-

18 Feb 2026

ETD Volume - January 2026

Worldwide volume of exchange-traded derivatives reached 13.43 billion contracts in January. This increased 17.4% from December 2025 and increased 30.6% from January 2025. CONTINUE READING -

12 Jan 2026

ETD Volume - December 2025

Worldwide volume of exchange-traded derivatives reached 11.44 billion contracts in December. This increased 8.8% from November 2025 but decreased 12.8% from December 2024. CONTINUE READING -

12 Dec 2025

ETD Volume - November 2025

Worldwide volume of exchange-traded derivatives reached 10.52 billion contracts in November. This decreased 10.7% from October 2025 and decreased 37.4% from November 2024. CONTINUE READING -

18 Nov 2025

ETD Volume - October 2025

Worldwide volume of exchange-traded derivatives reached 11.77 billion contracts in October. This increased 7.4% from September 2025 but decreased 43.1% from October 2024. CONTINUE READING -

24 Oct 2025

ETD Volume - September 2025

Worldwide volume of exchange-traded derivatives reached 10.96 billion contracts in September. This increased 13.4% from August 2025 but decreased 45.2% from September 2024.

CONTINUE READING -

03 Oct 2025

ETD Volume - August 2025

Worldwide volume of exchange-traded derivatives reached 9.66 billion contracts in August. This decreased 4.7% from July 2025 and decreased 49.8% from August 2024. CONTINUE READING

Data Webinars

2024 Annual ETD Volume Review

past webinar

Trading volume in the global exchange-traded derivatives markets is on track to another record for the sixth year in a row. Join us for a discussion with Michael du Plessis and Alex Grinfeld of Liquidnet on the trends that are driving up volume and open interest across interest rate, equity and commodity futures and options.

Download PresentationTrends in ETD Trading Q3 2024

past webinar

FIA’s quarterly review of volume and open interest on derivatives exchanges worldwide. This webinar will provide insights into trends in trading activity in the global listed derivatives markets for the year to date. Areas of focus will include equity index derivatives in India, the US and Europe, interest rate futures and options in the US and Europe, and commodity futures and options in Europe, APAC and the US.

Download PresentationQ2 2024 ETD Volume Trends

past webinar

FIA’s quarterly review of volume and open interest on derivatives exchanges worldwide. This webinar will provide insights into trends in trading activity in the global listed derivatives markets. Areas of focus will include equity index derivatives in India, the US and Europe, interest rate futures and options in the US and Europe, and the changing composition of the global markets for commodity futures and options. This quarter’s guest speakers will be Scott Klipper, a portfolio manager for GreshamQuant, the systematic arm of Gresham Investment Management.

Download PresentationQ1 2024 ETD Volume Trends

past webinar

FIA’s quarterly review of volume and open interest on derivatives exchanges worldwide. This webinar provides insights into trends in trading activity in the global listed derivatives markets. Areas of focus include equity index derivatives in India, the US and Europe, interest rate futures and options in the US and Europe, and the changing composition of the global markets for commodity futures and options. This quarter’s guest speakers are Davesh Dubal, EMEA Head Electronic Trading for ETD and FX, UBS, and Giovanni Martelli, Head of EMEA ETD Voice Execution, UBS.

Download Presentation

Key IssuesCapitalCCP Risk Commodities Cross-Border Digital Assets Diversity & Inclusion Operations and Execution Sustainable Finance All Advocacy |

News & ResourcesPress ReleasesFIA MarketVoice Webinars Podcasts Data Resources Documentation FIA Markets Academy CCP Risk Review Hall of Fame |

AboutContact UsAbout FIA Governance Staff Directory Affiliates List of Members Membership Member Forums Careers |

EventsBocaL&C IDX Commodities Conference Expo Asia FIA-SIFMA AMG Webinars Register as Speaker All Events |

|---|---|---|---|

BrusselsOffice 502 |

LondonLevel 28 |

SingaporeOne Raffles Quay North Tower |

Washington, DC2001 K Street NW |