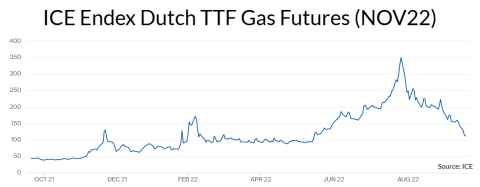

As we enter the colder months at the end of the year, natural gas prices around the world remain incredibly volatile after hitting record highs recently. This is particularly the case in Europe, where I recently visited policymakers in Brussels and Paris with FIA board members. In our conversations, the energy crisis crowded out every other issue on our agenda – and with good reason.

The supply shock brought on by the Russian invasion of Ukraine has already had a significant impact on the budgets of consumers and small businesses across the European Union and UK. There is increasing fear that blackouts may be unavoidable in the coldest months of the year when energy is needed most.

This is deeply unsettling. FIA has members and staff across Europe that are experiencing this war on their very doorsteps, impacting basic food and energy supplies. It’s hard to think about our day-to-day jobs when we’re not sure about heating our homes. At FIA, our hearts go out to those affected.

During my trip, I was encouraged by the response of EU policymakers who appreciated the role as well as limits of our markets. I was struck by the comments of Commissioner Mairead McGuinness, head of the European Commission’s financial services portfolio, who indicated that policymakers must be pragmatic and expeditious in dealing with this crisis.

In these discussions with the European Commission and the European Securities and Markets Authority, we engaged in a productive dialogue on the importance of price discovery and market integrity, and the policy measures that can be taken to ensure orderly and rational markets. They asked about circuit breakers and how they are currently used in our markets. We discussed the idea of cautiously expanding the kinds of acceptable collateral for margin while being mindful of not adding liquidity risk to the system. FIA discouraged the use of artificial price caps because of the unintended consequences this would bring to the energy markets, and policymakers listened intently and asked good questions.

At the end of our visit, we were pleased to see that our efforts were fruitful. On September 22, ESMA sent a letter to the European Commission providing advice on ways to address the volatility in the energy markets, including many of the ideas we discussed. Importantly, it avoided more draconian measures like price caps or market closures. Following Commissioner McGuinness’s advice, these were pragmatic recommendations that will help keep markets discovering prices in an orderly way.

While these discussions were focused on the near-term challenges caused by the energy crisis, FIA also hosted public forums in Brussels and Paris, which provided important context for long-term issues that our industry is facing. And just this week, FIA held yet another forum in Milan where we once again explored the evolving response to the energy crisis, and what it means for derivatives markets. This problem is bigger than just gas prices this winter. There are long-term structural issues related to commodity supply chains and a global response to climate change that will continue to impact energy markets for many years to come.

Responding to those issues will require all of us working together. And I’m proud that FIA can host forums like these to foster productive and open dialogue on how best to move forward.

The cleared derivatives industry has faced a series of unique challenges in 2022. And as usual, we have risen to the occasion. Our forums in Europe this fall have been proof of that, and an indicator of the vital role FIA plays in bringing together disparate stakeholders in service of open, transparent and competitive derivatives markets.

We have a few more in-person events left this year, including Expo in Chicago and FIA Asia in Singapore, and I'm confident that these events will be additional forums for valuable dialogue on the issues of the day.

I hope you join us and add your voice and perspective to the conversation.