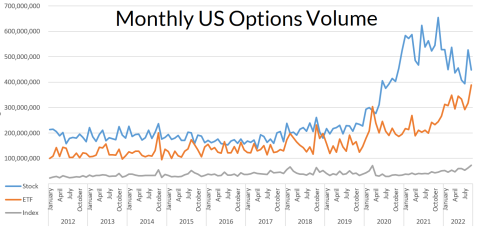

In 2022, US equity options trading volume is going strong – and, based on current forecasts, appears to be charging towards yet another record year. Based on the latest FIA data through the end of September, US options markets are on pace to 10 billion contracts traded for the first time ever.

Amid this general surge in options activity, a closer look at the makeup of the market shows an evolving landscape. The trading of single stock options, which had been the main driver of increased volume, appears to have peaked, while trading of ETF and index options experience big gains.

Henry Schwartz, global head of client engagement for data and access solutions at Cboe, noted that over the last several years the trading of single stock options was boosted by a surge in retail participation.

Although that took off during the pandemic, when many people began trading at home, he argues that the trend actually began in late 2017, when discount broker Robinhood introduced commission-free trades for options. That prompted competitors to follow suit, and lowered barriers to entry for traders with smaller accounts.

Although volatility in 2022 has shaken out some of these retail investors, US options markets are still seeing significantly higher volume than years past, he noted.

"It's safe to say that the retail wave has crested," Schwartz said. "That said, retail participation is still above where it was before the pandemic, and significantly above where it was before the Robinhood effect and commission-free trading."

Furthermore, a look at the makeup of US options trading shows that while previously fashionable trades among retail investors such as single stock call options have seen a decline in interest, a new wave of options activity is moving into different product categories including index and ETF options.

Both of these later categories are on pace for record levels in 2022 even as single stock option volume is in decline.

New products meet demand

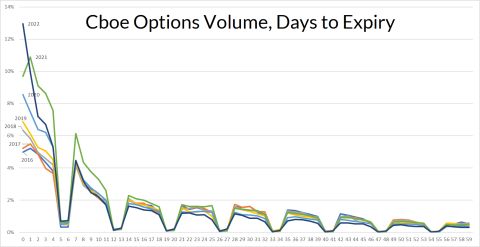

As the largest US options exchange operator, Cboe has tried to meet this shift in demand through new products that target retail investors. For instance, in February Cboe filled out its weekly SPX options suite to include Tuesday and Thursday expiries. That means it now offers its contracts for every trading day of the week.

"Weekly options allow investors to gain more targeted exposure to market events and manage their positions with greater flexibility to keep pace with movements in the broad US equity market," said Ed Tilly, chairman and CEO of Cboe. "As interest in short-term options trading continues to grow, we are pleased to expand our SPX product suite with these new listings to meet customer demand."

Based on recent trading activity, that customer demand has certainly been there. On Cboe, SPX options trading set a record in August and then another record in September. That included a new single-day volume record on September 23 with 3.8 million contracts traded, beating the previous record of 3.6 million on February 28, 2020, during the thick of pandemic-related uncertainty.

Digging deeper, Cboe also reported record volume of 1.42 million SPX contracts on trade date – that is, options with zero days to expiry. Cboe now sees roughly 13% of options trading across all products taking place on the day of expiry.

Furthermore, 54% of SPX contracts that changed hands on trade date were sized in lots of 10 or less, hinting that much of the volume in this index contract is coming from smaller investors instead of institutional traders.

"In a volatile and highly correlated market, it's not surprising that some retail investors are choosing to trade index options on trade date instead of longer-dated and single stock options. It's a simple and cost-effective way to make a bet that the S&P is going to move big in a single session based on comments from Jerome Powell, inflation data, or other macro headlines,” Schwartz said.