US oil and gas producers are reducing the amount of protection they are buying against the risk of falling prices, according to an analysis of public disclosures by Wood Mackenzie, the consulting firm.

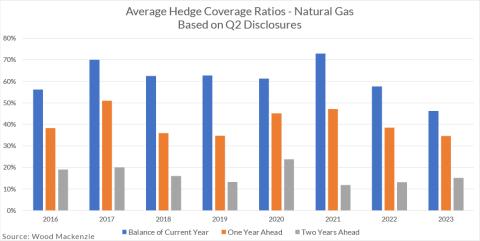

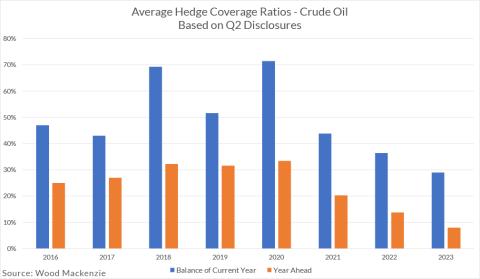

Hedge coverage ratios, which measure the percent of future production that is protected through the use of derivatives, have fallen to the lowest level in at least five years, the consulting firm said. Although hedging strategies vary considerably across the industry, one general factor is that these companies expect prices to continue rising, reducing the need for this type of protection.

Wood Mackenzie's analysis is based on disclosures by roughly 40 independent exploration and production companies operating in the US and Canada. These companies historically have been heavy users of derivatives—typically options and swaps—to protect their businesses from the risk that energy prices might fall below their cost of production.

In its most recent report, which is based on disclosures for the second quarter, Wood Mackenzie estimates that these companies have derivatives positions in place to hedge 29% of their crude oil production for the remainder of 2023. That is down from 36% at the comparable time a year ago. Wood Mackenzie also estimates that 46% of their natural gas production for this year is hedged, down from 58% a year ago.

The second quarter data fits into a longer-term pattern. The oil and gas producers tracked by Wood Mackenzie have been steadily reducing their coverage ratios for the last five years and looking to capture more of the gains when prices rise.

A hedge position designed to provide downside protection typically will lose value when prices rise. Publicly traded companies have to report those losses in their quarterly financial reports. While the majority of the energy producers tracked by Wood Mackenzie are continuing to maintain some hedging, the cost of that protection is harder to justify to shareholders when prices are rising.

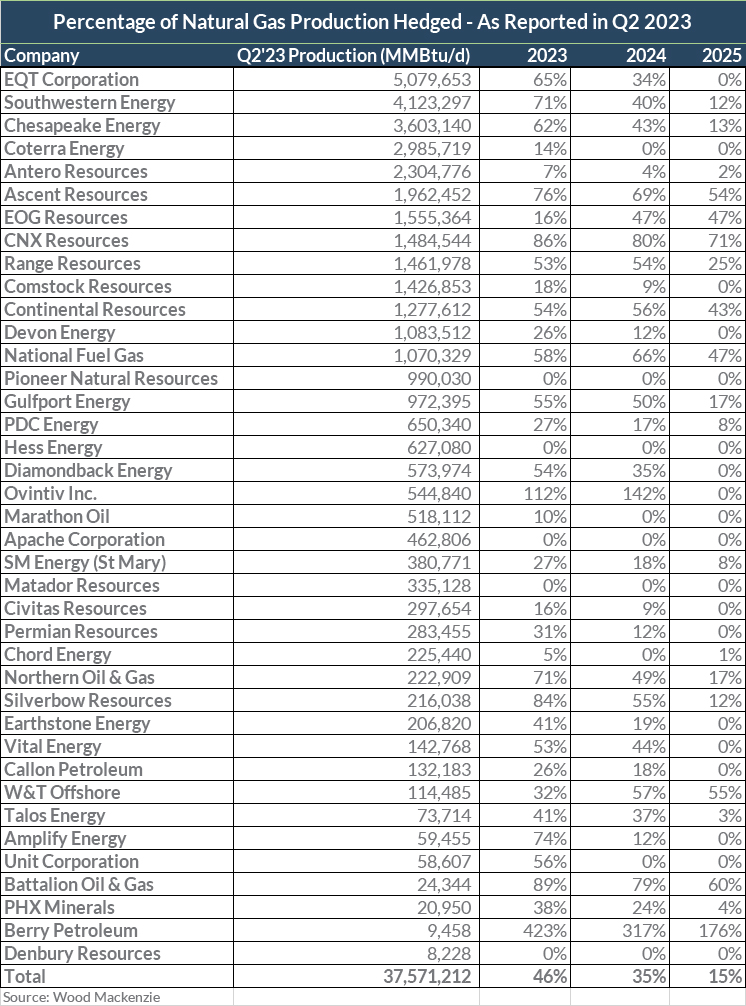

One example of this trend is EQT, the largest producer of gas in the group of companies analyzed by Wood Mackenzie. EQT disclosed in its second quarter report that it used a combination of options and swaps to hedge 65% of its 2023 gas production. That is relatively high compared to other companies in the group, but down significantly from the level of 90% that the company maintained in previous years.

Wood Mackenzie noted that EQT expects higher prices on the horizon and accordingly has "tilted" its hedge position towards the first half of 2024.

"Looking forward EQT has strategically tilted their hedge position towards the first half of 2024, where they see the most potential downside risk," commented Wood Mackenzie analyst Damien Weleschuk. "By protecting near-term free cash flow and prioritizing debt repayment goals, EQT is intentionally creating flexibility to maintain maximum upside price exposure in late 2024, 2025 and beyond when the natural gas market looks increasingly tight."

Wood Mackenzie's analysis is based on quarterly disclosures to shareholders that are filed with the US Securities and Exchange Commission. These disclosures include information about open derivatives positions, which are primarily over-the-counter derivatives linked to benchmarks such as WTI, Brent and Henry Hub. They include fixed price contracts, basis swaps, call and put options, call and put spreads, swaptions, and two-way and three-way collars.

The analysis does not include hedging by the US operations of large integrated energy companies such as BP and Shell or government-owned oil companies such as Equinor. Wood Mackenzie estimates that the independent producers in its sample group account for 25% and 38% of US oil and gas production, respectively.

In addition to the reduction in hedging, the Wood Mackenzie report revealed several other trends in hedging practices among these energy producers.

More hedging of gas: Gas producers generally hedged more of their production than oil producers. For the balance of 2023, gas producers reported hedges covering 46% of production, while oil producers only covered 29%. Looking farther out, gas producers have hedged 35% of their 2024 production and 15% of 2025. Oil producers have hedged only 8% for 2024 and almost none for 2025.

Higher prices expected in gas, but not for oil: Across the companies analyzed by Wood Mackenzie, the average floor for natural gas was $3.30 per MMBtu for 2023 hedges, $3.40 per MMBtu for 2024, and $3.37 per MMBtu for 2025. The average floor for oil was $68 for 2023 and 2024, and $66 in 2025.

Shift in hedging strategy: Wood Mackenzie observed a move away from options-based strategies and a greater use of swaps. "In the highly volatile gas market, we saw operators converting collars and put options to swaps with modestly higher floor prices," Weleschuk said. "Quarter-on-quarter, producers in our sample dataset added approximately 589 million cubic feet per day of swaps, at the same time reducing approximately 219 million cubic feet per day of options for FY23."

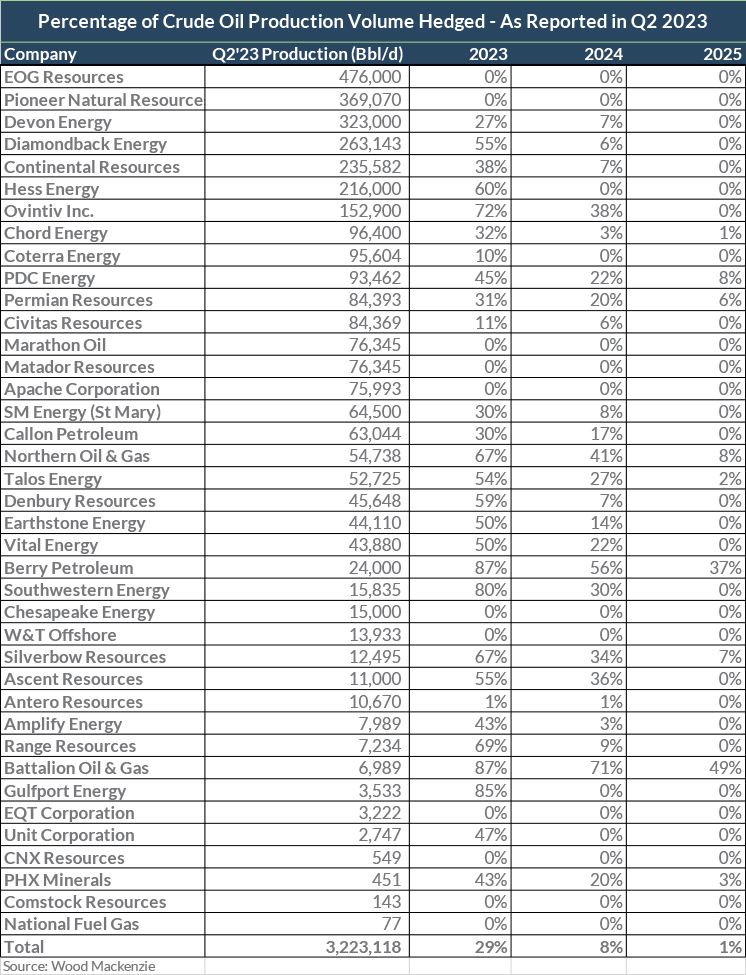

Differing appetites for risk: The second quarter disclosures revealed sharp differences among producers in terms of how much protection against market risk they had purchased. Some locked in hedges covering 50% of their production, a few hedged almost 100%, and some had no hedges at all.

For example, EOG Resources and Pioneer Natural Resources, the two largest publicly traded independent producer of oil in the US, had no hedges in place for their 2023 production, according to Wood Mackenzie.

In contrast, Devon Energy, the third largest, had hedges in place to cover 27% of its 2023 production, and DiamondBack Energy, the fourth largest, had hedges in place to cover 56% of its 2023 production.

Link to M&A: For some companies, the decision to hedge was linked to the financing of acquisitions. For example, in June, Ovintiv, a Canadian-based energy producer, spent $8 billion to buy oil producing assets in the Midland area of Texas and realized $825 million from the sale of assets in the Bakken area of North Dakota.

Wood Mackenzie noted that the company has hedged almost 60% of its 2023 production, a relatively high level compared to other oil producers, but added that company management has promised to "drive that hedging level down" as it reduces its debt.

Hedging Ratios - Independent US Oil and Gas Producers

Ranked by Q2 Production Volume