Singapore Exchange's CEO Loh Boon Chye discusses his plans for strengthening the exchange's position as a "trusted offshore exchange" for investors seeking access to Asia

Since joining Singapore Exchange as chief executive officer in July 2015, Loh Boon Chye has been busy reinforcing the exchange's position as a gateway to Asia's financial and commodity markets. Under his leadership, the exchange has completed a major technology overhaul and introduced a new bond trading platform. The exchange also has rolled out several new products to complement its existing suite of equity index contracts and has continued to invest in educational initiatives aimed at encouraging greater use of futures and options to manage risk exposures.

Derivatives are only one part of the exchange's business model, of course. The exchange is also looking to strengthen its securities markets by attracting more listings of stocks and bonds, and like many other exchanges around the world, it is increasing its revenues from market data and exchange connectivity services. But the trading and clearing of derivatives remains one of the most important parts of the business model. During the first three months of this year, more than 48.6 million derivatives contracts were traded or cleared at the exchange, up 24% from the same quarter one year ago. Revenues from this line of business did not grow at the same rate, partly because of lower average fees per contract, but even so, it accounted for 40% of the exchange's total revenues.

Loh came to the exchange from the banking world, where he played a key role in the development of the debt capital markets of Southeast Asia. Starting in 1995, he spent 17 years with Deutsche Bank in Asia, culminating in his role as head of global markets for Asia-Pacific and Asia-Pacific head of the corporate and investment banking division. In 2012 he moved to Bank of America Merrill Lynch, where he was deputy president for Asia-Pacific and head of Asia-Pacific Global Markets.

Loh is well known in Asian banking circles for his foresight in anticipating the growth of Asia's bond markets in the wake of the Asian financial crisis of 1997. He spearheaded Deutsche Bank's investment in building up trading desks in local bond markets in the region. He also played a role in helping Singapore develop into a regional center for foreign exchange and money market trading, serving as chairman of the Singapore Foreign Exchange Committee from 2003 to 2010.

Although he is not well known in the exchange world, Loh has some history with SGX. He was on the board of directors from 2003 to 2012, giving him a high-level perspective on the exchange's position in the Singapore financial ecosystem. He also serves on the board of directors of GIC, a sovereign wealth fund operated by the Singapore government that has more than US$100 billion in assets.

Since taking over as CEO from Magnus Böcker, Loh has not announced any dramatic changes in business strategy. Instead he has focused on reorganizing the internal management structure and sharpening the focus on serving the exchange's customers. In an interview with MarketVoice, Loh explained that he sees SGX as the "trusted offshore exchange" for global investors looking for access to the Asia-Pacific region. To that end, SGX has rolled out futures and options on the MSCI China Free Index, which is comprised of more than 100 large and mid-cap Chinese companies that have listed their shares outside of China. A critical aspect of these contracts is that they have been certified by the U.S. Commodity Futures Trading Commission, enabling U.S. investors to directly trade them from within the U.S.

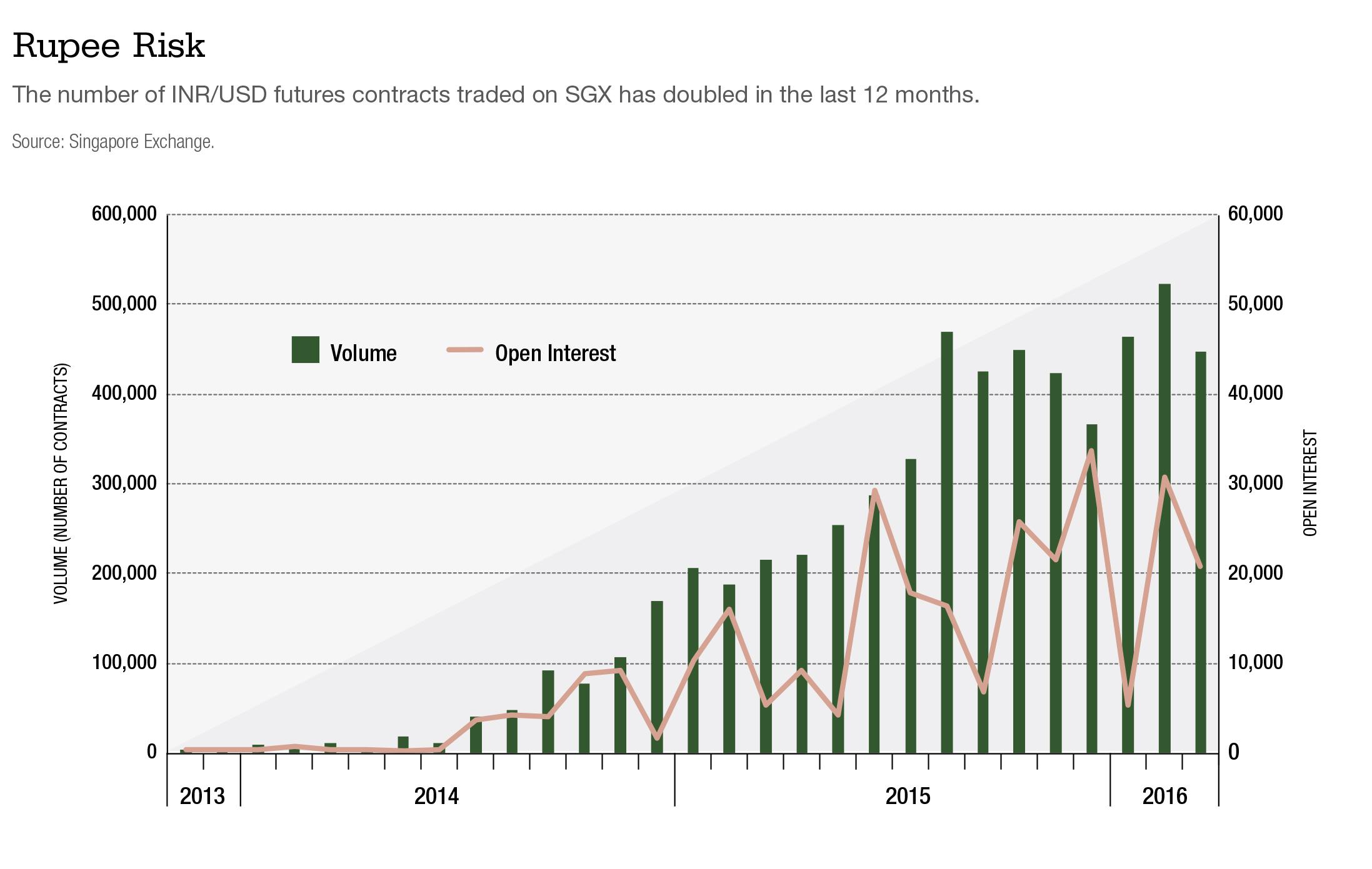

India is another critical area of growth. In March, SGX announced the launch of four sector-specific index futures in cooperation with India's National Stock Exchange. The goal is to complement the existing SGX Nifty 50 Index Futures, one of the exchange's most heavily traded products, and give offshore investors access to specific trading opportunities in the key growth sectors of the world’s fastest growing economy.

The key to the strategy is offering international traders a simple and efficient way to access these markets, and Loh recognizes the importance of recognition from foreign regulators. In the interview he emphasized that the exchange has invested in making all the necessary changes to meet the new regulatory standards emerging in the U.S. and Europe in response to the financial crisis of 2008. SGX's clearinghouse was the first in the region to meet the CPMI-IOSCO Principles for Financial Market Infrastructure, he pointed out with pride, and it has been recognized by both the Commodity Futures Trading Commission in the U.S. and the European Securities and Markets Authority.

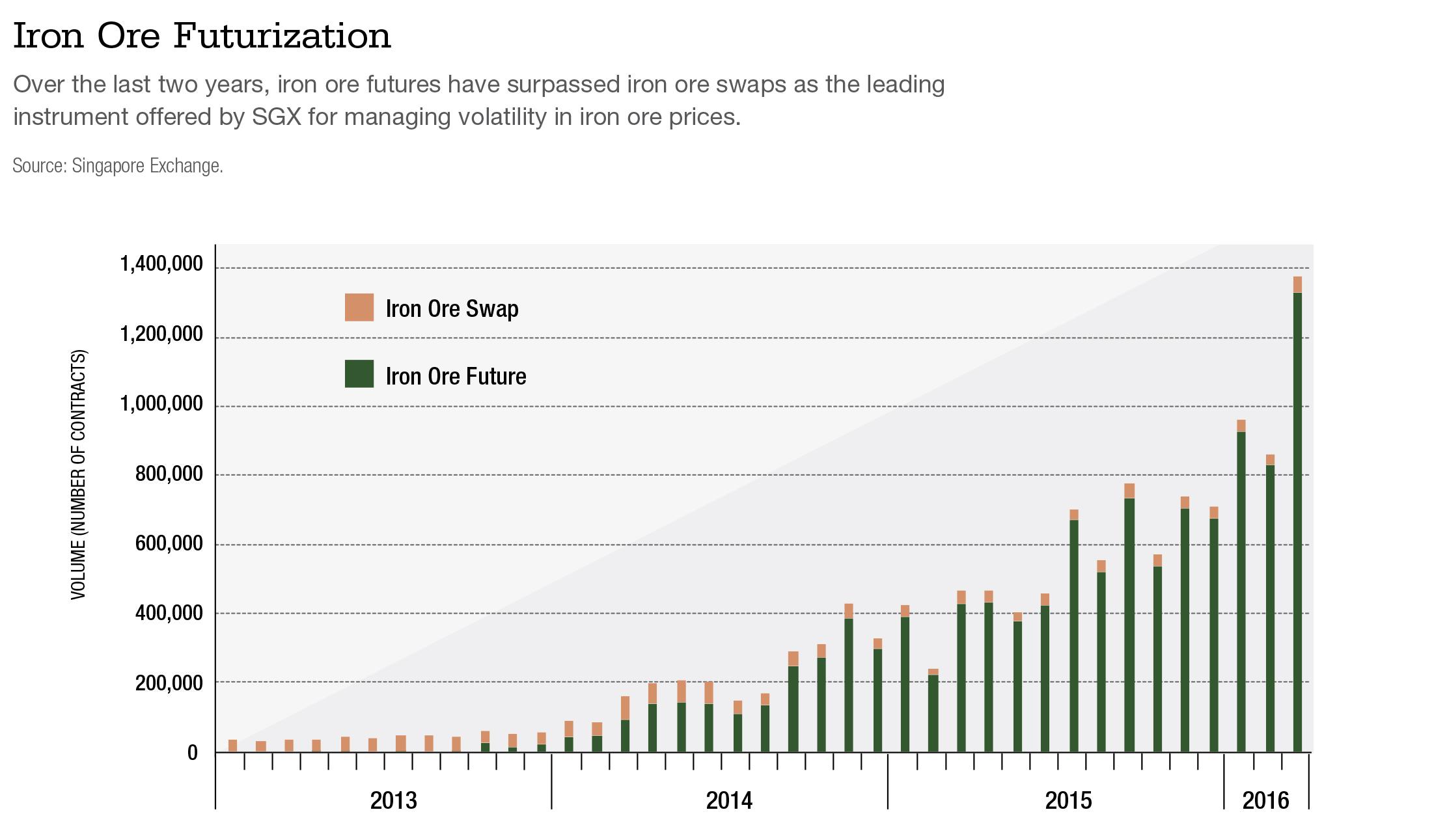

Commodity markets are another important dimension of his strategy for growth. Loh said the exchange is agnostic on how the market trades, offering registration and clearing services for customers who prefer to trade OTC, and offering screen trading for those who want a more futures-like experience. The exchange's iron ore contracts have exploded in popularity and have become a vital price benchmark and hedging tool for iron ore producers and steel mills. The exchange is now looking to replicate this model with liquefied natural gas, starting with the introduction of a new index of Singapore prices that it hopes will become an Asian benchmark in the coming years. Although commodity trading is still a small part of SGX's overall business, Loh framed this set of products as another way to leverage Singapore's position as a regional trading center and gateway to Asian markets.

MARKETVOICE: Asia is a very fragmented market. How does SGX fit into that environment?

LOH BOON CHYE: When investors look at Asia, it’s never macro-Asia. It’s always a country selection. This is why we think about offering products that provide country access. We want to be a trusted offshore exchange for this region. This means we focus on providing access within an infrastructure that holds the relevant international regulatory passports. These regulatory credentials are key to ensuring we are able to offer open access to investors across the world.

How do you operate as a global exchange in an environment where regulations are not harmonized?

It's always better for the markets to have a harmonized regulatory framework. But if we don’t have harmonization, there is a role for exchanges to provide access to markets. We want to be the access point into Asia. Our customers operate across jurisdictions and they need to operate across exchanges that are recognized by the regulators globally. For that reason, SGX has invested in its infrastructure to be consistent with international best practices. For example, we were the first clearinghouse in Asia to meet the PFMI standards set by IOSCO and CPSS and the first to receive DCO status from the CFTC, and we have been recognized by ESMA as meeting the EMIR requirements.

Can you update us on your technology roadmap?

Currently, we are upgrading our derivatives trading engine. We hope to launch it sometime later this year. The new system will have risk controls that are more dynamic in terms of how risks are evaluated and adjusted to market levels. We’re also upgrading our OTC derivatives system in terms of registration to complete the workflow. We’ve completed our bond trading system, which was launched late last year. So we’re actually through our technology upgrading cycle.

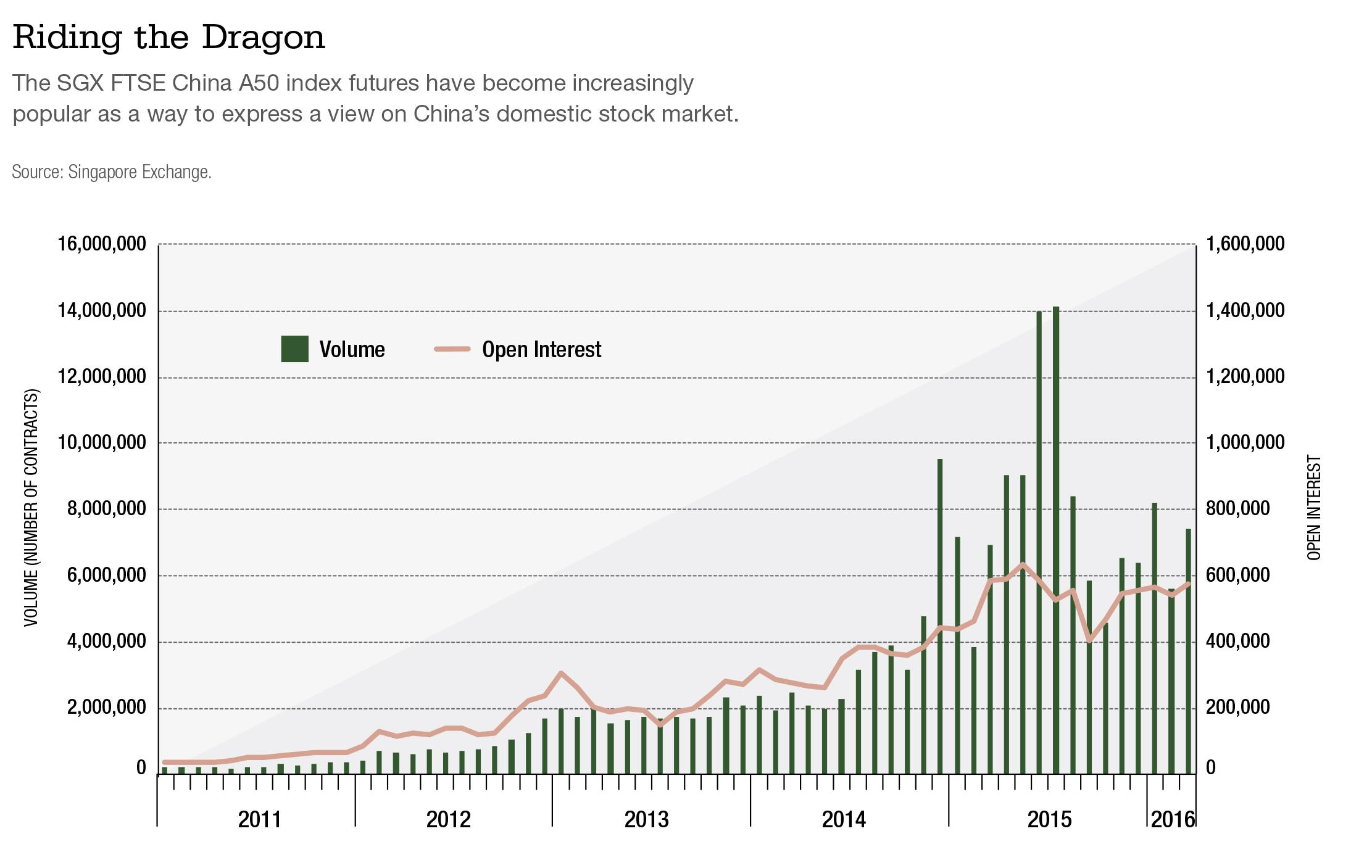

One of your most successful products is the FTSE China A50 stock index futures, which gives investors a way to gain exposure to the domestic Chinese equity markets. But there is also a very successful onshore stock index futures contract traded in Shanghai. What is your long-term vision for SGX’s relationship with China and China’s markets?

As a general rule, our approach has always been to grow the market together. Let me give you the example of Japan's Nikkei 225. We started the market 30 years ago and today the market is about 50 times bigger than when it was first started. JPX has a bigger share of the market than SGX, but our volumes are higher than they were 30 years ago. So whether it’s Japan or China or any other country, our approach has always been to grow the market together, because in the end, there will always be a bigger market.

Aside from the A50 contract, what other asset classes are you targeting in terms of providing exposure to China?

We have our iron ore contract, which plays to China's role in the commodity markets. We also have a contract based on the Chinese currency, which has done very well since it was launched. We also recently introduced futures and options on the MSCI China Free Index, which tracks large and mid-cap Chinese companies that are listed outside of mainland China. So we are covering equities, FX and commodities.

Singapore is the world’s largest fuel trade and second largest oil refining hub. How can SGX capitalize from Singapore's position as a global hub for commodity trading?

SGX benefits from being at the heart of Asia’s physical trading community, particularly with seaborne commodity trading. Singapore provides an ecosystem of buyers and sellers in a neutral and well-governed framework, and SGX has evolved to meet the specific needs of this growing market with risk management, clearing and price discovery infrastructure.

Iron ore is a key example of our ability to build an industry ecosystem. We worked with the industry, which had a clear demand for spot pricing, to ensure independent price transparency and a robust clearing platform. SGX now clears over 90% of the world’s seaborne iron ore derivatives.

The number of iron ore swaps, futures and options traded in March was almost double the total one year ago, and open interest was up by almost 80%. What is driving this growth?

With ongoing price volatility in the underlying market, SGX has been successful in encouraging the use of hedging tools, particularly among Chinese end-users. This has been the result of education initiatives and collaboration with OTC market participants as well as our efforts to offer a full suite of products to the iron ore market.

With financial futures like the Nikkei 225 or the FTSE China A50, the market has enough liquidity to support continuous trading in the exchange's central order book. But in some markets where there's less liquidity, particularly in commodities, the exchange serves more as a place where the trade is booked after it's been negotiated among brokers and customers. Do you see yourself supporting that type of market?

Depending on the market, we can take either approach. With some commodities, we have some screen trading, and with others we play a role in clearing. In that type of market, if we make the trade registration process smooth and efficient, I think we will help bring the users of OTC trading into the exchange.

In the FX market, SGX offers both traditional order book trading for futures and clearing-only services for non-deliverable forwards. How do you see these two approaches evolving over time?

Industry-wide trading volumes in exchange-traded FX products have grown tenfold over the past 10 years, and we expect this trend to further accelerate in the near future as market participants become more familiar with non-traditional FX trading venues such as exchanges.

Case in point, the Indian rupee market has been evolving towards exchange-traded products, which are today actively traded on both domestic and offshore exchanges with an estimated daily turnover of US$4 billion cumulatively. SGX launched INR futures in November 2013, and trading in this contract has grown significantly, with more than US$750 million in average daily turnover and US$1.5 billion in open interest. So I think the signs are very encouraging for us.