Perspectives on current commodity market trends

Experts discuss falling prices and the impact on hedging strategies during a panel at FIA’s annual International Futures Industry Conference in Boca Raton, Fla.

For the last two years, markets for many physical commodities have suffered from an extraordinary imbalance. Supply has outstripped demand by a wide margin and prices have fallen to exceptionally low levels. At the same time, the commodity futures markets are going through their own structural changes as market participants adjust to higher volatility, new regulations and lower liquidity. In this article, a group of industry experts discuss these trends and their impact on hedging strategies and market composition. The article is based on a panel discussion held on March 17 during FIA’s annual International Futures Industry Conference in Boca Raton, Fla.

Societe Generale’s Michael Haigh discusses the supply-side factors weighing on commodity prices.

Over-production

Michael Haigh, the head of commodities research at Societe Generale, kicked off the discussion with an extended analysis of current price trends in global commodity markets. In contrast to past booms and busts driven by sudden changes in demand, he said this time it is the supply side that is driving commodity prices. In fact, approximately 90% of the downward trend in commodity prices has been driven by over-production, according to Societe Generale’s analysis.

While there have been times in the past when supply outweighed demand, Haigh argued that this time is different because market forces, rather than government policy, are causing oversupply. Those market forces fall into two sets of factors, one related to the pricing of oil, the other to exchange rates.

First, in the oil market, there has been a fundamental transformation in how prices are set. In late 2014, the Saudi government ended its policy of adjusting production to maintain the balance between supply and demand. The result was a historic collapse in oil prices, with Brent dropping from over $100 in June 2014 to less than $40 by the end of 2015. Haigh explained that the Saudi decision of how the oil markets have operated for decades. Rather than having supply set by agreement among oil producers, the Saudis decided to allow supply to be balanced by the market itself.

This was a “complete game change,” Haigh commented. The price of oil is now effectively determined by the hundreds of companies drilling in shale rock formations in the U.S. such as Eagle Ford, Permian and Bakken. Declining prices eventually will drive out the higher cost producers, but any rally in the price becomes self-limiting, because the remaining shale producers will respond by stepping up their drilling.

Going forward, the key question is how long these shale producers can stay in business at current price levels. Banks are under pressure from their regulators to reduce the amount of risk in their loan portfolios, Haigh said, and in response they are cutting back on the credit they provide to shale oil producers. This is leading to a “credit crunch” that will make it difficult for these companies to maintain their capital expenditures, but no one is quite sure exactly when this will lead to lower production.

“Because of the uncertainty of how much credit is going to be redrawn, how much capex is going to be cut back, and the timing of that, volatility is very, very high. And, it’s not going to go away any time soon,” Haigh said.

Other participants in the discussion commented that the effects of this game-changer are not limited to the oil complex. Olivier Raevel, head of commodities at Euronext, explained that the collapse in energy prices has reduced the cost of producing wheat, corn and other crops because it has brought down the price of fuel and fertilizer. Ocean freight costs also have come down, which allows producers to reach more markets and leads to further pressure on price.

“All of a sudden, prices that were geographically more disbursed are tending to be more in sync due to the fact that the freight price drives competitive offerings for the same agricultural markets,” Raevel said. “Conversely, if you are an exporter, you have, all of a sudden, a lot more access to distant markets.”

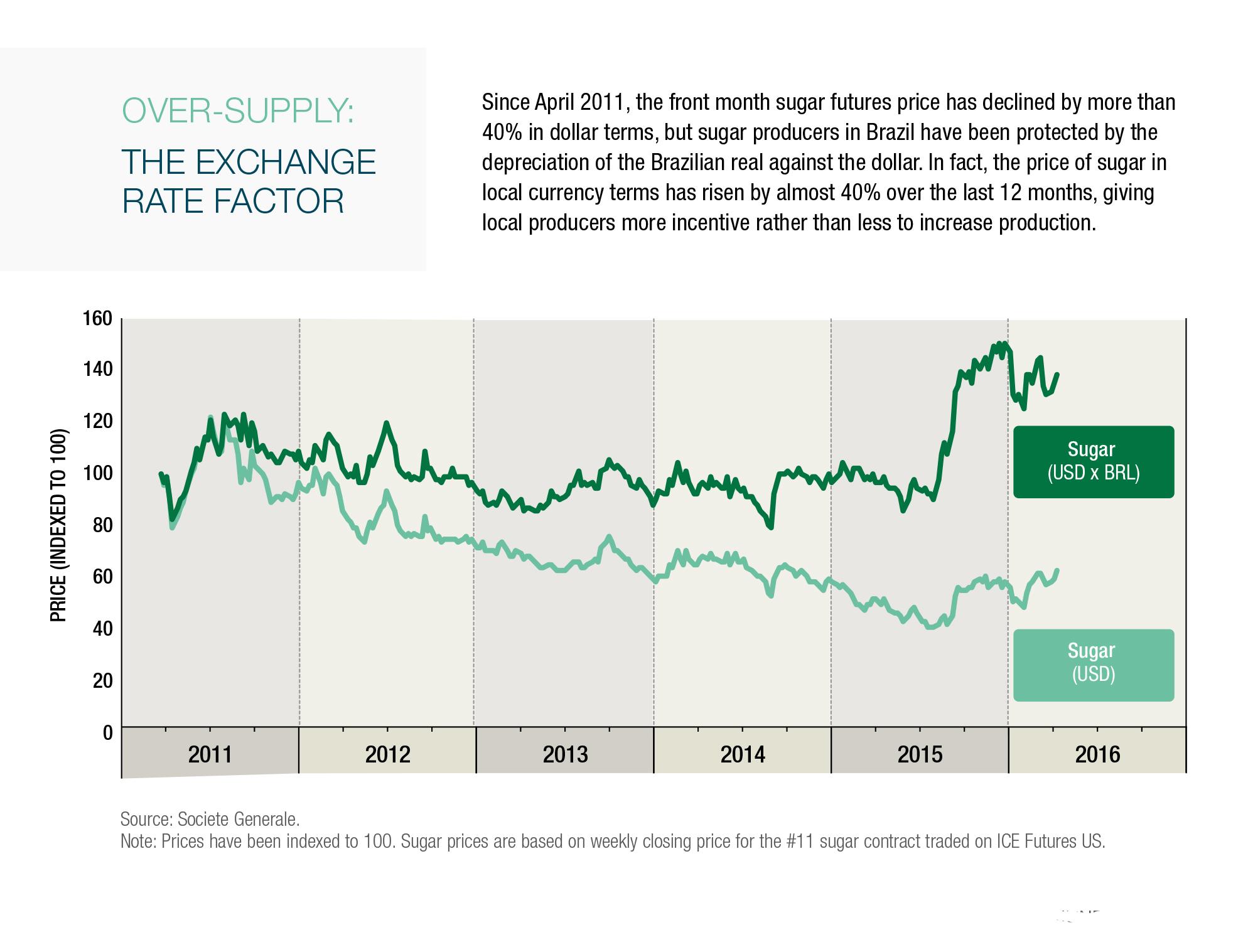

Currency depreciation

Haigh also pointed to exchange rates as another reason why commodity prices are so low. The currencies of commodity-producing countries such as Brazil, Chile, Russia and South Africa have depreciated so much against the U.S. dollar that production costs are much lower in local currency terms.

Why is this important? Imagine a Brazilian sugar company selling its production outside Brazil. The dollar price of that sugar may be lower, but after the proceeds are translated back into the local currency, the sugar company comes out with approximately the same amount. “If I’m a sugar refiner in Brazil and I convert export sales back into Brazilian real, I don’t care about the depressed commodity price for sugar because I’m getting the same amount in real terms,” Haigh explained.

The same thing is happening with Chilean copper, Russian oil and South African gold, he said. In effect, the depreciation of these currencies against the dollar has protected producers from the effects of lower prices on the global market. In fact some producers are actually enjoying record high prices in local currency terms even though global prices are down. As a result, excess supply will continue to weigh on the market, Haigh predicted.

Market impact

The discussion then turned to the impact of these trends on the commodity derivatives markets. One impact has been showing up in the term structure. In nearly every commodity futures market, prices for the front month contract are lower than the prices for more distant months. This structure, known as contango, makes certain commodity investment strategies less profitable. Strategies that track a commodity index by buying a distant month contract, holding it until it becomes the front month, and then rolling the positions into a more distant month, automatically generate a loss when the futures markets are in contango.

Hedging strategies also have changed. To avoid the cost of rolling futures positions, producers are using options. And to reduce the cost of buying protection, they are entering into more complicated transactions that involve both buying and selling options. For example, a producer will buy a put option at one price to lock in its profit margin, and sell a put option at a higher price to offset the cost of the hedge.

“What I see on our energy desk is that, for every three or four or five dollar increase in the price of oil, our phones start ringing because people want to lock in the price one or two years out,” Haigh explained. “But the problem is that, when the market is in contango and you’re an energy

producer and you want to sell, that’s not going to benefit you going forward because of the shape of the curve. So a lot of the producers are looking for much more complex solutions for their hedging. For example, they will buy a put, even though the volatility in the market makes buying a put very expensive, and sell a put at a much higher price to subsidize that premium.”

Peter Reitz, chief executive officer of the European Energy Exchange, said he is seeing similar trading behavior on his exchange and noted that the number of options traded on EEX has exploded in the last couple of years. “Our options volume last year more than doubled and we’re up 150% in the first two months this year. People are really starting to use these more sophisticated instruments for hedging.”

Changes in market composition

Another trend noted by the group is the decline in the number of financial participants. Societe Generale estimates that there are currently about 100 hedge funds that focus exclusively on commodity markets, whereas before the financial crisis there were 300. Furthermore, of that 100, only 25 have more than $100 million in assets. Banks also have pulled back from the physical commodity business due to regulatory restrictions like the Volcker rule and the constraints of higher capital requirements. The result of these two trends is that commodity derivatives markets have fewer participants and less liquidity, leading to more volatility in commodity prices.

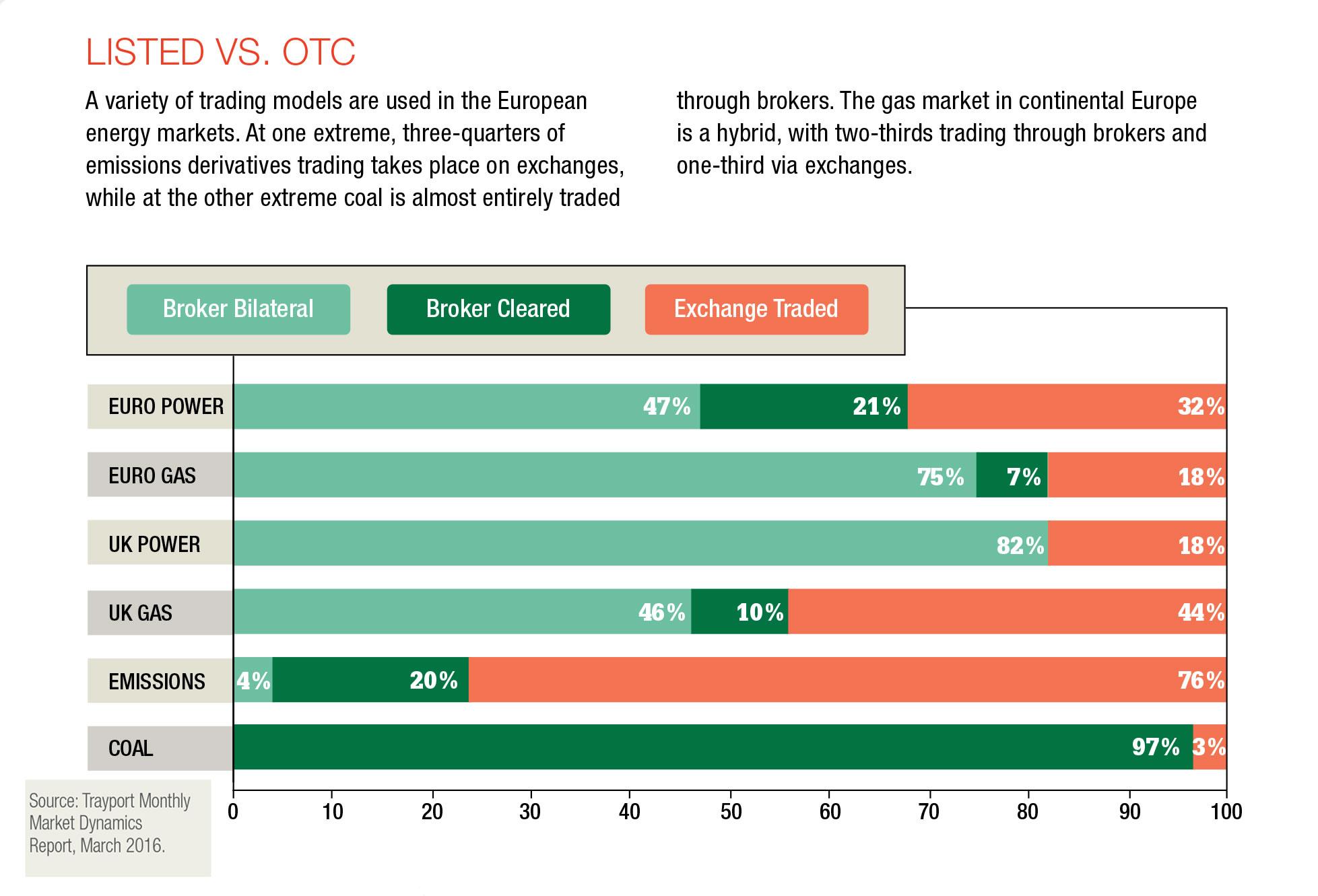

On the other hand, some non-financial participants are stepping forward and filling the gap. Commodity trading firms are buying the physical commodity businesses that banks are looking to unload, and some participants in the underlying physical markets are shifting from being price takers to price makers. For example, European utilities are becoming more active participants in the European power and gas markets, according to Reitz. In fact, several utilities have signed market-making agreements with EEX that commits them to provide liquidity to the rest of the market.

Reitz also noted that some traders jettisoned by banks are forming their own trading shops. These firms tend to migrate towards the exchange-traded derivatives world, he explained. “They don’t have the balance sheet that they used to have when they were trading for a bank. So for them clearing becomes more important, and meeting everybody else in an exchange order book.”

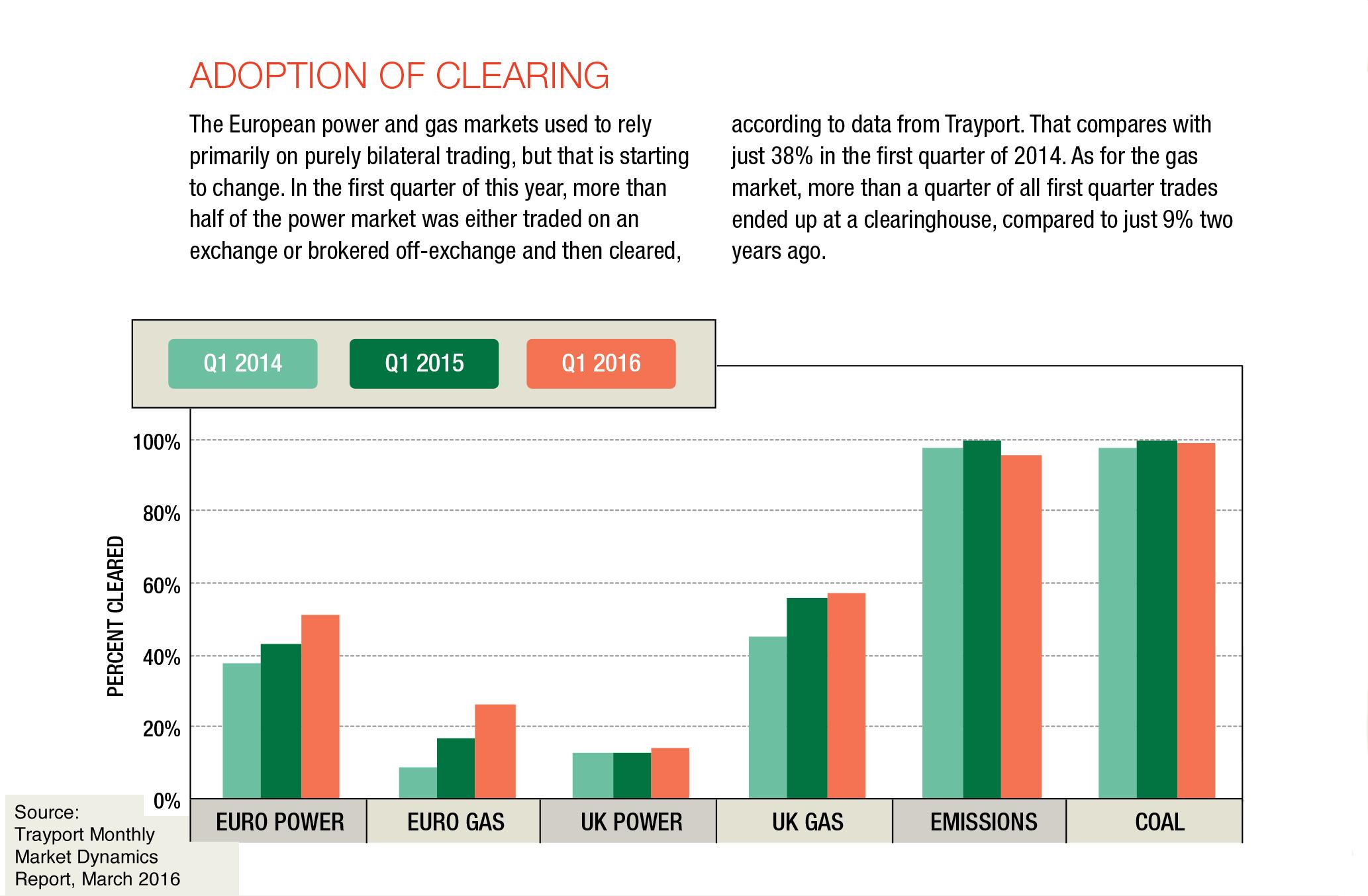

Clearing is already well established in some commodity derivatives markets such as the OTC power and gas market in North America, but now it is gaining ground rapidly in other markets such as European power and gas. Combie Cryan, head of sales and client relations at Trayport, explained that these markets are moving towards a hybrid solution, where trading continues to be negotiated by brokers but post-execution the trade is submitted to clearing. This solves credit issues for producers and banks and at the same time eases market access for proprietary trading firms.

There is a countervailing trend, however. Due to the impact of capital requirements, banks are cutting back on their derivatives clearing business by raising prices, reducing the number of customers they support and in some cases exiting the business altogether. This is especially a concern for smaller players, said Raevel.

“A lot of banks have been retreating from providing those kind of services,” he said. “Even the banks that keep on doing those agency businesses tend to be a bit more picky about the conditions and looking for economics that are meeting the new thresholds.”

Large utilities and other well-capitalized firms in the energy markets may not be affected by this trend, he added, but his exchange is worried about the impact on small and mid-size firms in the agricultural sector such as agricultural cooperatives.

“We have to realize that we are moving into a world where the regulators are putting a significantly higher capital charge burden on agency business. We want to make sure, as a market operator, that we’re not going to move into a world where only the larger market participants will be able to transact.”

Position limits and the role of speculation

Another concern raised by several participants is the public antipathy to speculation in commodity markets. Franck Borgel, head of commodity agency business at Societe Generale, noted that in February, Switzerland held a referendum on whether to ban speculation in agricultural products.

Although the proposal was defeated, the topic was heavily debated and discussed in the months leading up to the referendum, a sign that there was significant public support for this idea. Borgel warned that there is an urgent need to invest in education so that the public has a better understanding of how the derivatives markets work and what kind of market players are needed to make sure that clients can hedge their business.

At the European level, regulators are working on new rules that will apply limits on the size of speculative positions. One concern for market participants is that the regulatory definition of hedging is too simplistic, Cryan commented. Regulators should be careful to avoid ruling out more complex strategies, such as selling one option to finance the purchase of another.

“The majority of people in this space are physical players,” said Cryan. “The regulators seem to think that this means you’re either permanently selling into the marketplace, because you’re an energy producer, or you’re permanently buying, because you are a consumer. But life isn’t like that.”

Cryan predicted that big utilities and other large participants will be able to adjust to the new regulations, but mid-size players may opt to reduce their presence or exit altogether. The markets are already suffering from lower liquidity due to the reduction of bank activity, he warned. Anything that caused an additional reduction in participation would further reduce the market’s ability to provide price discovery and hedging.

Raevel added that the price discovery function is especially important for agricultural producers. “It’s very important that those price discovery mechanisms remain unimpaired,” Raevel said. “Farmers have to decide if they want to sow or not, and what kind of crop they want to sow. So it’s really resource allocation that we’re talking about.”

He pointed to the European rapeseed industry to show the value of this approach. Two decades ago, when Euronext began offering futures on rapeseed, known as canola in North America, Europe was a net importer of rapeseed. Today, Europe is a net exporter. Raevel said the price discovery function of Euronext’s rapeseed futures contract is an important part of an ecosystem that has brought greater efficiencies into agricultural production and greater economic advantage to Europe.

Reitz echoed these views and stressed the importance of education. “The agricultural markets in Europe are just at the very early stage of development,” commented Reitz. “We are coming out of decades of subsidies and people only now are facing some real price risks. We’re seeing that in the dairy industry, for example. Just last year, the subsidies were reduced, and now farmers understand that they have a price risk. We have to provide some education about the risk management tools that futures markets offer, and why it can be useful for them to use futures to take care of these risks.”