|

ADVERTISEMENT

|

FIA continues ambitious

|

|---|

|

In 2020, FIA published a policy paper "How derivatives markets are helping the world fight climate change." And this year, FIA's work has continued in earnest on sustainability issues and market-driven solutions to climate change. FIA was invited to join a consultative group of market and climate change experts to develop recommendations for the Taskforce on Scaling Voluntary Carbon Markets under the leadership of former Bank of England Governor and current UN Special Envoy for Climate Action Mark Carney. This global private sector-led initiative is working to scale an effective, efficient and functioning voluntary carbon market to help meet the goals of the Paris Climate Agreement. The final report, published on 27 January, reflects numerous FIA member recommendations. FIA is currently participating in several working groups focused on implementing the report's recommendations. Additionally, in February FIA signed on a to a statement of principles sponsored by a joint group of trade associations, "Financing a U.S. Transition to a Sustainable Low-Carbon Economy," FIA also sent a letter to President Biden highlighting sustainability issues as a shared priority, and offering recommendations on how our industry can partner with the White House on climate initiatives. "Climate change poses real risks to financial stability and our global economy," said FIA President and CEO Walt Lukken. "These risks include direct financial risks from extreme weather, as well as the transition risks associated with fundamental changes in how the world does business." |

Carbon markets operate under a few different names, including informal labels like "cap-and-trade" systems or the more bureaucratic term "emissions trading scheme." But fundamentally, they do one thing: provide incentives to reduce pollution and fight global warming through both regulated and voluntary carbon markets.

There is rising global support for these market-based initiatives as part of the transition to a more sustainable global economy. The launch of China's first national carbon trading market in February marks an important new development in these markets, and President Biden is racing to roll out a comprehensive emissions reduction strategy in the US. As these regions begin these efforts, Europe's mature Emissions Trading System continues to thrive after seeing a record 8 billion emission allowances traded in 2020. The UK is also in the process of setting up its own emissions trading scheme after having left the EU regime as part of Brexit.

Not all carbon markets are the same, however, and they continue to evolve differently. Here's a brief summary of major trading markets for emissions around the world, how they differ from each other, and what the future may hold for emissions markets and related derivatives.

China

When it comes to evolving carbon markets, China is the place to watch for a host of reasons. A national market for emissions went live on 1 February, marking the first such effort in a nation that is currently the world's largest source of CO2 emissions.

These efforts were developed by the Ministry of Ecology and Environment, which carries less legal weight than State Council regulation. But some observers consider a ministry-level ordinance as simply the fastest way to establish a compliance market. That hints this is simply a first step, before a transition into the legislation developed at higher levels of China's government.

At launch, China's market for emissions covers roughly 2,000 power generation facilities. According to media reports, simply covering power plants alone gives these local carbon markets coverage over 30% of the nation's total emissions. In the long term, the carbon markets are expected to phase in other industries that include cement, steel, chemicals and energy production that are also big sources of emissions.

The recently launched emissions scheme is also expected to pave the way for China's first carbon emission futures on the new Guangzhou Futures Exchange later this year. It will be the first new futures exchange in 14 years, and Hong Kong Exchanges and Clearing has made its first offshore investment in China in the venture, with a 7% stake in the Guangzhou Futures Exchange.

These efforts show China is increasingly focused on sustainability issues. President Xi Jinping pledged last year that China would see peak emissions in the next several years before achieving carbon neutrality by 2060. And looking forward, China's most recent Five-Year Plan for 2021-2025 also stresses green technology and emissions reductions as a key part of the central planning document.

European Union Emissions Trading System

In contrast to China's recent foray into carbon markets, Europe has run a market for emission allowances since 2005. It is now the biggest market worldwide in terms of both the value and volume of contracts traded.

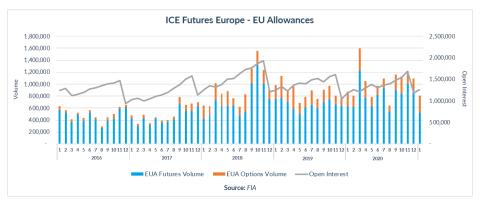

In 2020, more than 8 billion emission allowances changed hands on the European Union Emissions Trading Scheme (EU ETS). That was an increase of nearly 20% over 2019 levels. At the same time, carbon prices hit record highs of over €33 per tonne at the end of the year -- nearly seven times of recent lows of about €5 per tonne in 2018.

Experts have made a clear connection between all that activity on the EU ETS and real-world reductions of C02, too. The US National Academy of Sciences used an independent statistical model to find that the EU emissions trading model resulted in CO2 reductions of more than 1 billion tons between 2008 and 2016.

Phase 3 for the EU ETS, which ran from 2013 to 2020, targeted a 20% baseline reduction from 1990 levels but largely focused on emissions-intensive coal and fossil fuel electricity generation. The system has widely been credited as the source of Europe's big move into renewable sources of power, but Phase 3's free allocation of emissions allowances to industrial sectors didn't provide the same incentives for progress in other areas of the economy.

That may change in 2021, as the EU ETS entered Phase 4 in January. Running from 2021 to 2030, the new target is a 40% reduction from 1990 levels -- with recently introduced legislation proposing a substantial increase from previously proposed targets to a 55% baseline reduction. And while there are still free emission allowances for certain companies or industries, the system now prioritizes firms that have been designated as at risk of "carbon leakage" -- that is, a situation where any potential greenhouse gas reduction in the EU is offset by a rise in emissions elsewhere in a jurisdiction that has less strict climate policies.

However the system evolves, one thing is quite clear: The EU ETS is a mature and liquid marketplace. Intercontinental Exchange, Nasdaq, and European Energy Exchange all are active participants in primary auctions of European Emission Allowances as well as related futures and options.

UK Emissions Trading Scheme

Carbon markets are one of many areas that have been complicated by Brexit, since the UK was an active participant in the EU ETS before its vote to leave the European Union. As of 1 January, a UK Emissions Trading Scheme formally replaced participation in the EU ETS.

ICE Futures Europe will host the first auction of carbon allowances under the new UK ETS in May, and plans to launch related futures contracts around the same time.

At the time of the hand-over, the UK effectively copied the European scheme. But going forward, there is no hard link or clear partnership.

Publications from the European Commission immediately after the deal do note that "both sides agree that the fight against climate change, and in particular the 2015 Paris Agreement on climate, constitute an essential element of their partnership." But it remains to be seen what this partnership may look like in detail.

Particularly as the EU is in the very beginning of Phase 4 for its emissions trading scheme, it will be interesting to see how policies evolve in these jurisdictions. Both Europe and the UK are separately considering significant increases to targeted emission reductions through 2030, with the UK's aim of a 68% reduction from benchmark levels even more ambitious than the EU, but it's unclear what the final policies will be even if the two jurisdictions are pursuing similar goals.

North America's regional initiatives

When President Biden assumed the White House in January, he immediately rejoined the Paris Climate Agreement and entered the White House with clear plans to support significant reductions in greenhouse gas emissions.

Despite this change in Washington, there is no consensus yet on when or even if the US will establish a national market for emissions allowances. For the near term, the more important developments are happening at a regional level. However, amid the increased focus on federal efforts it should be noted that there is already a patchwork system of smaller, regional carbon markets.

The biggest is a linked initiative between California and parts of Canada, known as the Western Climate Initiative. Technically a not-for-profit corporation, the group administers a shared emissions trading market to support carbon cap-and-trade programs.

A second compliance market also exists on the other side of America, the Regional Greenhouse Gas Initiative (RGGI) that covers the northeastern and mid-Atlantic US including 11 states at present after Virginia began fully participating in January. That list is anticipated to grow to 12 in 2022 with the addition of Pennsylvania, a notable addition as it is one of the largest coal-producing states in America.

These regional initiatives vary by their geography and their scope. For instance, the RGGI only covers the power sector at present while California is much broader in scope and requires mandatory reporting of any entity with significant greenhouse gas emissions. A recent list of companies that are required to report carbon emissions to the state of California includes asphalt companies, dairies and pharmaceutical companies as well as the obvious list of oil and power companies.

These regional initiatives have provided the foundation for a small but growing number of futures and options. Two exchanges have emerged as the leaders in this emerging market--ICE Futures US and Nodal Exchange. In its recent monthly Global Environmental Report, ICE noted more than 25,500 lots of RGGI futures and options traded, representing a 127% increase over January 2020. Nodal Exchange, in cooperation with IncubEx, also offers physically deliverable futures and options on both Western Climate Initiative carbon allowances as well as RGGI allowances.