Investment strategies based on environmental, social and governance criteria, widely known as ESG investing, have become a huge trend in finance.

Assets invested in ESG strategies reached $30.7 trillion worldwide at the start of 2018, up 34% over the preceding two years, according to the Global Sustainable Investment Alliance.

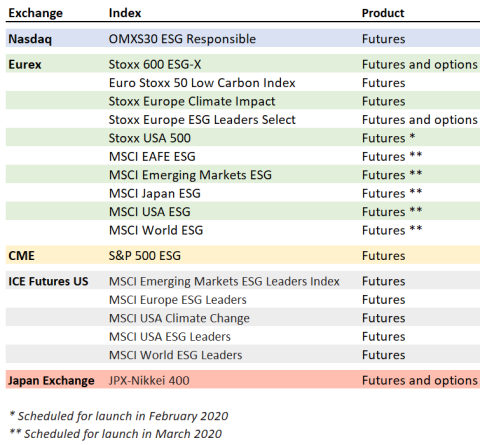

With so much capital flowing into ESG strategies, investment managers are seeking benchmarks to measure the performance of these investments, and index providers such as S&P Global and MSCI have been rushing to meet the demand. Dozens of new indices have been created to track various iterations of ESG themes. And where there are benchmarks, derivatives based on those benchmarks have followed.

The introduction of this class of derivatives has provided asset managers with new tools for protecting their investments from market risk, implementing their ESG investment strategies, and managing cash flows into and out of their ESG funds.

Liquidity in most of these contracts is still relatively low, but growing institutional demand is fueling off-exchange activity and beginning to spark activity in exchange order books.

Nasdaq, Eurex bring ESG derivatives to Europe

Nasdaq was the first exchange to launch ESG derivatives. In October 2018 it introduced futures based on the OMX Stockholm 30 index, which tracks the top Swedish stocks. The ESG variant excludes just one stock, Swedish Match, a tobacco company. Since its launch, more than 1 million OMXS30 ESG futures have changed hands, and as of Oct. 1 the open interest stood at 28,365 contracts, equivalent to SEK 4.6 million in value ($469 million).

Nasdaq subsequently launched ESG indices for Danish and Finnish stocks, but so far it has not introduced any additional ESG derivatives. Eurex, on the other hand, has rapidly developed a suite of products covering a wide range of indices.

In February 2019, Eurex began offering futures on three ESG indexes: the Euro Stoxx 50 low carbon index, which is based on the Euro Stoxx 50, the leading benchmark for the largest and most liquid stocks in the Eurozone; the Stoxx Europe 600 ESG-X index, which is based on the Stoxx Europe 600, one of the top pan-European indices; and the Stoxx Europe Climate Impact Index, which includes 260 European companies that are leaders in terms of climate change. In October, Eurex expanded its ESG complex by adding futures on the Stoxx Europe ESG Leaders Select 30 Index, a hybrid index designed for the structured products market.

One investment manager using the Eurex ESG futures is Olivier Rudez, head of flexible and absolute return at BNP Paribas Asset Management. Rudez, who oversees $10 billion in assets, told MarketVoice that his team met with the major exchanges early in 2019 to encourage issuance of ESG derivatives, and he gave several examples of their benefits to his firm.

Using ESG futures helps reduce trading costs, Rudez said, by reducing the turnover in cash equity positions. Another benefit is that they offer a way to fine-tune the beta of his portfolios, i.e. their exposure to general market movements. In addition, because the current environment features very low volatility, he needs to leverage exposure to equities to achieve an annual portfolio volatility target for certain types of funds, for example risk parity funds. To do so, he uses instruments such as the ESG futures.

Rudez cautioned, however, that the market is not big enough yet to absorb large trades. "We are definitely in the early stages," he said. "The liquidity is not great yet."

As of November, total contract volume across all ESG contracts listed on Eurex reached 486,785 contracts, with a value of 657.65 million euros ($728 million). The ESG-X futures have been the most popular by far, with more than 95% of volume across the complex.

"We think that this is just a start of a new ecosystem that we would like to build." - Michael Peters, Eurex

The contracts can be traded both on-exchange through the central limit order book and off-exchange through negotiation with banks and trading firms. Michael Peters, deputy chief executive of Eurex, said that 40% of ESG derivatives trades in recent months have been executed through the central order book, an indication that a liquid market is beginning to develop.

"We think that this is just a start of a new ecosystem that we would like to build, and futures are always the first step," he said. "You basically offer them on the off-book trading side and then, when critical mass is there, you also have market-makers paint the respective price picture in the order book."

In October, Eurex decided there was sufficient liquidity in the market to launch options on the ESG-X index and the ESG Leaders Select 30 index. Both options are cash settled, and Eurex has introduced incentive schemes to encourage banks and trading firms to provide liquidity

Susquehanna International Group, a proprietary trading firm, has supported the ESG-X futures since launch and has signed up to quote prices for the ESG-X options

"The fact that Eurex can launch options on ESG is a sure sign the market is maturing," commented Daniel Mannion, a derivatives sales trader at Susquehanna, in a post on the Eurex website. "There's genuine demand for these products and now investors can use options alongside the futures to tailor their risk profile in a way that best fits them and their strategies."

Next up is going global. In February Eurex plans to list an ESG version of the Stoxx USA 500 index future, and in March it plans to list futures on ESG versions of the MSCI World, Emerging Markets, EAFE, USA and Japan equity indices.

North American exchanges join the trend

ESG investing is more advanced in Europe than in the Americas thanks to several factors. These include European Union environmental legislation, sovereign and institutional fund investment policies, and general investor sentiment in Europe. However, the U.S. is catching up fast; according to data published by Morningstar, ESG-based mutual funds in the U.S. attracted $8.9 billion in investment in the first half of 2019, exceeding the $5.5 billion raised in all of 2018.

In an effort to capitalize on this growing investment ecosystem, both CME and ICE entered the ESG derivatives fray in November. CME kicked off with a single contract, an ESG version of its S&P 500 futures, while ICE launched a group of contracts based on MSCI indices.

Tim McCourt, CME’s global head of equity index products and alternative investments, said the decision to offer the E-mini S&P 500 ESG futures came after increasing interest from institutional clients. He explained that these clients are looking to manage their risk with benchmarks that better comport with their ESG values or investing theses.

"MSCI has gotten good traction from their ESG-linked indices, so we see our role in this ecosystem as providing transparent risk management tools." - Lynn Martin, Intercontinental Exchange

He expects institutional managers to use the ESG futures in the same way as conventional futures—to manage risk from a hedging perspective or to obtain index exposure without the need for stock purchases. In addition, ESG-related structured products are on the rise and the S&P ESG futures could facilitate the issuance of those structured products.

"Some asset managers and pension plans have an explicit ESG mandate or ESG fund," McCourt said. "They can now use the future to provide that exposure in the fund." He added that the future also can be used for "equitizing inflows and outflows" of cash, which reduces the drag on a fund's performance. A third benefit derives from the leverage embedded in the contract; using the future allows a fund to meet its target allocation in a more cash-efficient way than investing directly in the underlying stocks.

Steve Christian, head of future sales trading in North America at Citigroup, said CME's ESG futures "offer a solution to our clients' growing needs." Citi is supporting the contract as a market maker, posting bids and offers on the central orderbook as well as arranging block trades for clients "who need to trade in larger size than they think that can get done on the screens," Christian said.In November ICE Futures US launched futures tied to ESG variants of four widely used international indices produced by MSCI. It added a fifth future in December tied to the MSCI USA Climate Change Index, which re-weights equities in the parent MSCI USA index based on the opportunities and risks associated with the transition to a lower carbon economy.

Lynn Martin, president of ICE Data Services, said initial conversations with market participants were encouraging, but added that end users were still trying to figure out how to integrate the derivatives into their portfolios.

"The typical institutions generating the most interest are folks with assets already benchmarked to an ESG-type of product, so this a great way for them to lay off their exposure," Martin said. "MSCI has gotten good traction from their ESG-linked indices, so we see our role in this ecosystem as providing transparent risk management tools … to manage exposure."

Asia: The next ESG battleground

America is not the only growth area to watch in 2020. Increasingly, Asia is moving towards ESG investment strategies—and if a recent push towards more ESG disclosures in China takes hold, the region could ultimately become far more meaningful to derivatives investors than Europe or the U.S. in the years to come.

In 2018, the China Securities Regulatory Commission, the nation's main markets regulator, issued a revised code of corporate governance for listed companies. The document included greater emphasis on ESG disclosure, the accountability of board directors, and the importance diversity, among other areas.

Andrew Steel, global group head of sustainable finance with Fitch Ratings, said in a recent Bloomberg interview that efforts like this code of governance alongside compulsory ESG disclosure requirements on public bond issuers show how China's centrally controlled model may allow it to "move faster than anybody else" in the development of its ESG investment complex—particularly as it looks to open up its markets and harmonize them with international standards.

"In the next five years, we will see some very big changes in consistency and transparency of information disclosure across the markets and that will soon be led by China," Steel said.

Japan is also moving in this direction. According to the Global Sustainable Investment Alliance, the value of ESG investment in Japan quadrupled between 2016 and 2018, and major pension funds are increasingly adopting this approach.

The Japan Exchange Group was an early participant in the ESG trend through an emphasis on governance. Since 2014 the exchange has offered futures on the JPX-Nikkei 400 index, which is composed of stocks selected based on their high return on equity and the quality of their corporate governance processes. The contracts have been very successful, with 6.7 million contracts traded in 2019.