Chairman Boozman, Ranking Member Klobuchar and Members of the Committee, thank you for the opportunity to testify about the regulation of digital commodities.

I am President and CEO of FIA, the leading trade organization for the futures, options and cleared derivatives markets globally. Prior to FIA, I had the honor of working for this Committee during the passage of the Commodity Futures Modernization Act (CFMA) of 2000. I then went on to serve as a Commissioner and Acting Chairman of the Commodity Futures Trading Commission (CFTC) for seven years, which included leading the agency during the financial crisis of 2008.

My testimony today will focus on the strengths of the CFTC and its regulatory framework and offer the following recommendations for the Committee’s consideration:

- FIA strongly supports Congress’ efforts to create a new regulatory framework for digital assets. This offers an opportunity for the US to regain leadership regarding this important innovation in markets technology.

- We believe the CFTC is well-suited for the oversight of the digital commodity markets for five main reasons: principles-based regulations, an innovation-forward mission, robust customer protections, strong enforcement and an effective cross border framework.

- We want to emphasize that futures commission merchants and the risk management expertise and financial resilience they bring to bear play an important role in fostering the growth and stability of the digital asset ecosystem.

- We strongly support provisions included in the CLARITY Act that incentivize prudent risk management and hedging activity across digital asset and traditional markets through the recognition of risk offsets in the margin and capital framework.

- Regulations to manage conflicts of interest when a single entity takes on multiple registration categories will be important to reduce risk and foster confidence in market integrity.

The futures model for regulation

Digital assets have come of age as an industry and are beginning to converge with traditional finance. Today, there are more than ten thousand types of blockchain-based[1] digital assets with a combined market capitalization of more than $3.4 trillion.

The digital asset industry deserves and requires a proper regulatory framework that will keep these markets safe, innovative and growing. The US has an opportunity to lead in the global development of digital assets, but Congress must act quickly. Without this leadership, these markets will continue to expand overseas and outside of the reach of US influence.

Already, the US has the largest equity and derivatives markets in the world, the globe’s reserve currency and the most sophisticated and mature capital formation channels that span from angel investing to the public markets. The US should harness these strengths in building a best-in-class regulatory system for digital assets.

Fortunately, we can leverage the expertise within America’s existing regulatory framework and apply it to the new world of digital assets. And fortunately, the US has two strong markets regulators in the Securities and Exchange Commission (SEC) and CFTC that can collectively bring digital securities and digital commodities into a proper regulatory framework.

Based on my depth of experience on the Commission and Capitol Hill, I believe the Commodity Exchange Act (CEA) and CFTC are well-suited for the oversight of the digital commodity markets, which will be my focus today.

The CFTC’s regulatory framework has several strengths I would like to highlight. These include principles-based regulations, an innovation-forward mission, robust customer protections, strong enforcement and an effective cross border framework.

Flexible legal framework

First, I would like to highlight principles-based regulation. This outcomes-based regulatory framework allows regulators to tailor rules and guidance for new products like digital assets without hampering innovation.

Congress enacted principles-based regulation as part of the CFMA in 2000, recognizing the value of this approach in helping the agency keep pace with technological advances and changing market dynamics.

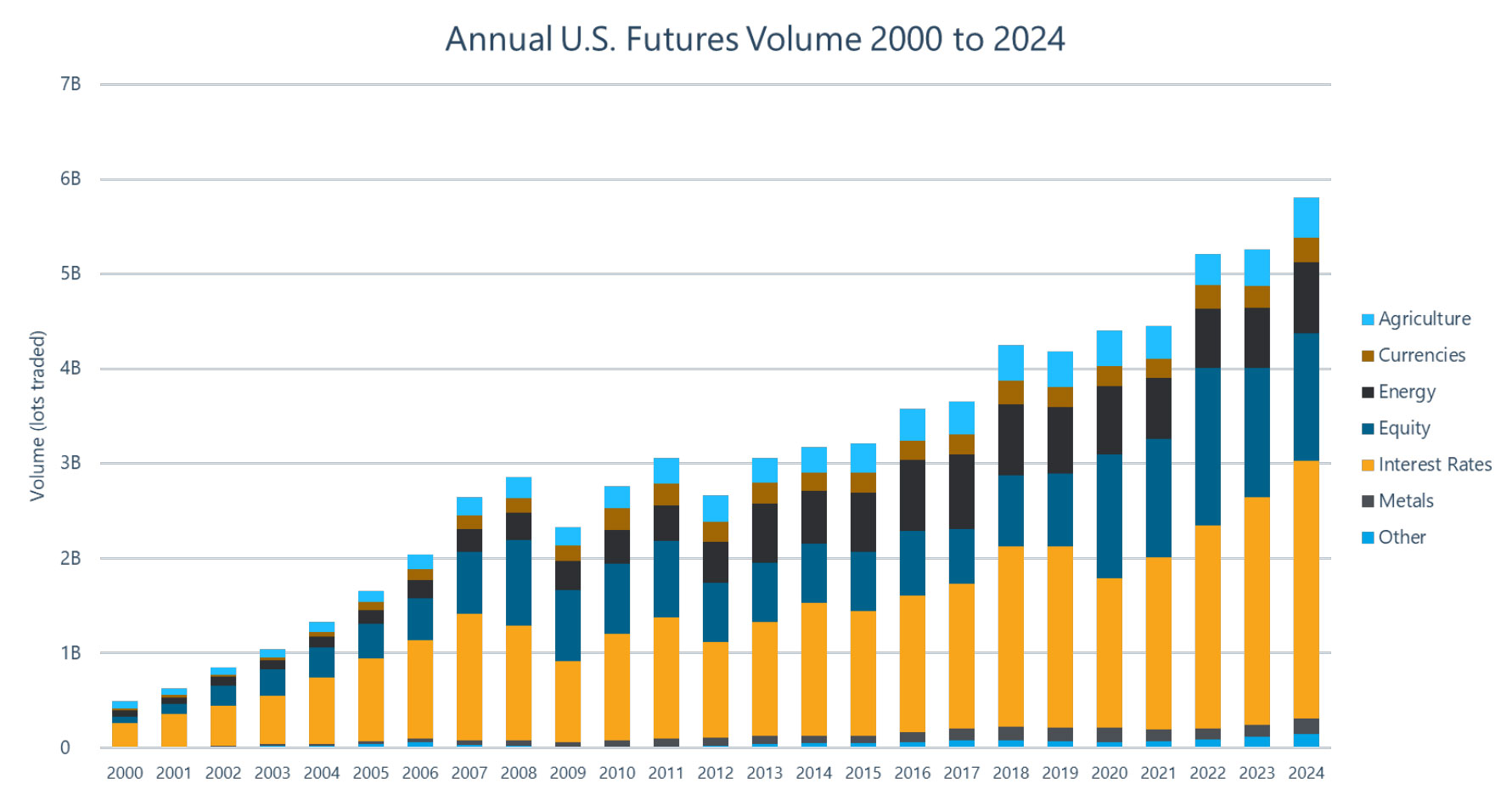

This flexible structure, in combination with the CEA’s broad definition of commodities, has enabled the futures industry to grow significantly through the introduction of new and innovative products. Since the enactment of principles-based regulation twenty-five years ago, the trading volume of futures on US exchanges has risen from 491 million contracts in 2000 to 5.809 billion in 2024, an increase of more than 1000%.

Principles-based regulation has unlocked significant growth in our traditional markets and is a well-suited framework for the evolving marketplace of digital commodities.

Innovation-forward mission

The CFTC also benefits from having innovation directly in its agency mission, which explicitly requires the Commission to promote “responsible innovation” in fulfilling its core tenants of protecting customers and upholding the financial integrity of the marketplace. The CFTC has balanced these duties, without sacrificing the safety of the markets, throughout its fifty years of existence by nurturing the development of new asset classes like interest rate futures, energy contracts, volatility indices, emission allowances, over-the-counter swaps, and most recently, crypto futures products.

The listing of futures on digital commodities has already provided the CFTC with significant experience regulating the cryptocurrency markets. In 2017, the CFTC first allowed exchanges to offer futures, options and swaps based on bitcoin. This decision brought these derivatives products into the CFTC regulatory framework for the first time. Since then, the range of products has expanded to include futures and options on Ether, Solana, Stellar, Avalanche, Hedera, Cardano and Ripple.

Today, more than 60 cryptocurrency futures and options contracts trade on seven CFTC-registered exchanges. Collectively these contracts make up the world's largest fully regulated market for derivatives on cryptocurrencies and one of the primary institutional gateways to this new asset class.

This experience, along with the CFTC’s innovation-forward regulatory approach, positions the agency well for assuming more responsibility in the regulation of cash digital commodities.

Robust customer protections

Another area worth highlighting is the CFTC’s customer protection regime, which has stood the test of time in protecting customer assets during various defaults in the futures markets. This regime consists of layers of protections around the segregation of customer funds. The CFTC requires that futures commission merchants (FCMs)—those brokers who serve as agents for customers—segregate, reconcile and confirm customer balances daily while providing a guaranty against shortfalls and losses should customers default.

The regime adds another layer of protection by requiring FCMs to contribute to a “rainy day” default fund should a single FCM not be able to cover its losses. The protections also empower clearinghouses to port – or transfer – segregated customer funds from a failing FCM to a healthy one to maintain the functioning of the markets. I experienced this firsthand with the Lehman Brothers crisis and its resolution that I helped oversee during my time at the CFTC.

These customer protections have held up as recently as the 2022 collapse of FTX, in which the only solvent part of that company was its CFTC-regulated derivatives clearing organization, LedgerX.

The CFTC’s customer protection regime would benefit the cash crypto markets and provide needed safeguards for end users should Congress provide this authority to the agency.

Strong enforcement

It is also worth highlighting the CFTC’s enforcement authorities that protect investors from fraud and manipulation and deter other market participants from wrongdoing. Over the years, the agency has used its enforcement authority effectively and aggressively.

For example, the agency utilized its enforcement authority to pursue firms that attempted to rig the Libor interest rate benchmark. This led to scrutiny of benchmarks across a range of other markets, as well as a transition to more rigorous methodologies for price calculations to avoid this manipulative conduct.

The CFTC has also used this enforcement authority to protect retail customers against highly-leveraged contracts based on currencies. The CFTC has effectively brought enforcement actions against those who prey on unsophisticated investors with get-rich-quick schemes. These actions have significantly reduced the amount of foreign currency fraud in our industry and deterred others from engaging in this corrupt activity.

The CFTC has aggressively punished firms that have attempted to manipulate our energy markets. For example, during my time leading the CFTC, the agency charged several energy companies with attempting to manipulate prices for natural gas, sending strong deterrence signals to other energy firms in that space.

Given this track record, I believe the CFTC would be an effective cop on the beat for this industry.

Effective cross border approach

Lastly, I want to highlight the CFTC’s approach to cross border trading, which has allowed customers access to global risk management products without endangering the integrity of U.S. markets.

Futures markets have operated internationally for decades, with market participants in the U.S. accessing overseas markets for a wide range of commodity futures. With the global nature of commodity markets, the CFTC has developed a framework for allowing access if the overseas markets are subject to comparable regulation and supervision in their home countries.

This framework has struck the right balance between protecting US entities and customers from fraud and manipulation while providing them with access to a wide range of markets around the world. As Congress considers regulating this new asset class, it should consider the benefits of this cross border approach, given the global nature of digital commodities.

Beyond emphasizing these regulatory strengths, I would like to turn to specific stakeholder issues that would bring needed capacity and clarity for these new products.

The important role of futures commission merchants

As you consider the various models for regulating digital commodity markets, we urge you to carefully weigh the important role of intermediaries.

In the US futures markets, these are known as futures commission merchants, or FCMs. Under the futures model for regulation, they have a set of responsibilities critical to the integrity of futures markets.

Those responsibilities include preventing misconduct by their customers and assisting regulators in maintaining orderly markets and preventing fraud, abuse and market manipulation.

FCMs also are critically important to the financial stability of the clearing system as a whole. They provide the vast majority of the capital in the default funds maintained by the clearinghouses to absorb losses in case of a member default.

As of the fourth quarter of 2024, FCMs contributed 98.4% of the $34.2 billion held by the top five US clearinghouses registered with the CFTC. Without this contribution from intermediaries, I question who would provide the buffer in the event of another FTX-style collapse.

Cross product margining and cross product netting

The first issue involves the treatment of risk-reducing trades for margin and capital purposes. Like traditional markets, FIA supports digital securities supervised by the SEC and digital commodities supervised by the CFTC. These markets are highly interconnected; however, each agency has distinct margin and custody requirements for the products they regulate. Regulatory differences in margin regimes have complicated the ability to provide risk offsets that are usually available when one clearinghouse clears the same products.

Providing margin offsets when offsetting transactions are risk-reducing incentivizes prudent risk management and hedging activity in both digital and traditional markets. It also allows for margin efficiencies for participants. We support statutory language that instructs the CFTC and SEC to allow for cross margining between offsetting positions in their markets.

Additionally, we support legislative language that instructs prudential regulators to address their bank capital rules to recognize these offsetting risk positions through cross product netting. These related changes will bring important capacity to FCMs that provide client access to digital products and beyond, and it will help ensure the success of these markets.

Avoiding conflicts of interest

Another area worth highlighting is the need for clear rules around managing the conflicts of interest that arise when a single entity takes on multiple registration categories.

Traditionally, the CFTC has regulated its markets by functional registration category. Exchanges that bring together buyers and sellers must register as designated contract markets (DCMs). Clearinghouses, with their obligations to protect the financial integrity of the system, must register as designated clearing organizations (DCOs). Clearing members, those firms that guarantee and safeguard customer funds, must register as FCMs.

Given these targeted responsibilities, registrants have historically been housed in independent legal entities. Increasingly, however, we see more entities creating a “vertical stack.” In other words, these entities are combining exchanges, clearinghouses, FCMs and trading arms all within the same legal structure.

This is particularly true for entities in digital asset markets. In our May 2022 comment letter about the FTX US Derivatives application before the CFTC, FIA expressed concern that collapsing the existing multi-tiered ecosystem—with its inherent checks and balances and customer protections—could undo the strong foundation of the listed derivatives markets and, ultimately, put customers at risk.

As such, we support legislative language that requires the CFTC to conduct a rulemaking on managing conflicts of interest when these various registration categories exist in the same firm. We believe the development of consistent rules around conflicts will ensure that customers are not faced with differing customer protections due to market structure design.

Conclusion

In closing, this committee has an opportunity to ensure these important markets continue to develop in a safe and innovative way – and one that protects customers and their funds.

The time has come to enact a regulatory framework for digital assets that allow the US to lead in this asset class. I look forward to working with this committee on the best approach to reaching this important goal.

Thank you for this opportunity to testify.

[1] FIA recently published a white paper on how blockchain technology could modernize the settlement and infrastructure of the post trade derivatives markets.