The transition away from LIBOR passed a key milestone on 11 May when trading in futures based on SONIA, the interest rate benchmark tapped as its successor in the UK, hit a new high relative to traditional short-term interest rate futures.

Three-month sterling futures, more commonly known as short sterling futures, have been the primary mechanism for trading short term rates in the sterling interest rate market for many years. That contract is based on LIBOR, however, and will be phased out at year end.

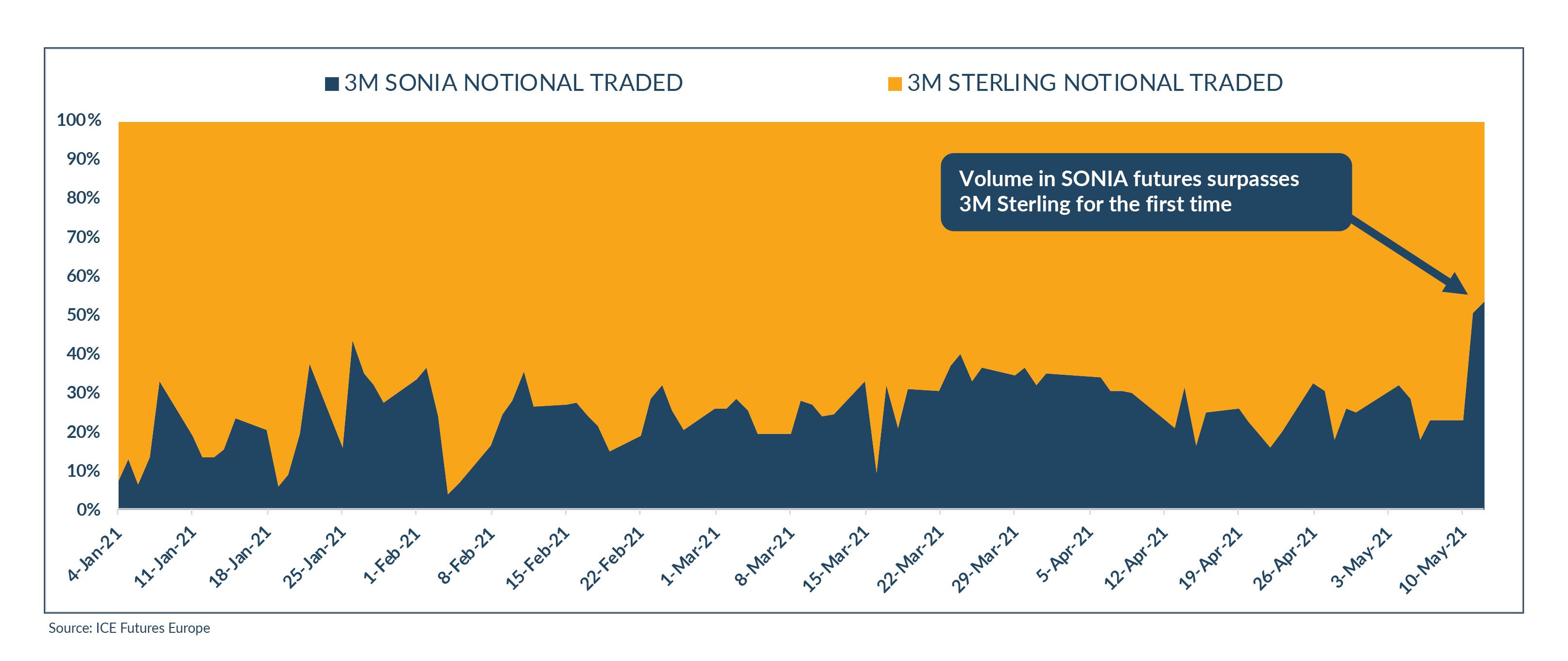

Until recently, trading in SONIA futures lagged significantly behind trading in short sterling futures, but that changed on 11 May. According to data published by ICE Futures Europe, the leading venue for short term interest futures in the UK, the value of trading in SONIA futures slightly exceeded short sterling futures that day. That was the first time that has happened, and it indicates that the interest rate market is gradually increasing its adoption of the new benchmark.

SONIA futures also trade on CurveGlobal, the derivatives exchange operated by the London Stock Exchange Group, and on CME Group, the US futures exchange operator. But the ICE market is more important for measuring the transition, partly because it has the largest share of the SONIA futures market, but more importantly because it is the dominant venue for short sterling futures.

The total number of SONIA and short sterling futures traded that day on ICE Futures Europe was 201,351 and 394,402 contracts, respectively. Although short sterling had higher volume, the value of the trading in SONIA futures was higher because the contract size is twice as large.

Each SONIA contract is based on the amount of interest paid on a three-month deposit of £1 million, so the notional value of trading that day was £201.351 million. Each short sterling contract is based on the amount of interest paid on a three-month deposit of £500,000, so the notional value of trading that day was £197,201 million.

The trend continued the following day. The notional value of trading in SONIA futures on ICE Futures Europe was £371 million on 12 May, versus £318.5 million for short sterling futures. Put another way, if the two contracts were combined into a single market, 53% of the value of trading on 12 May came from SONIA and 47% from short sterling.

On the last trading day of the week, however, the trend reversed, and the value of SONIA futures trading fell below short sterling once again. Many market participants continue to prefer the more established contract, and the short sterling market continues to be much larger in terms of open interest. As of 13 May, the number of outstanding short sterling contracts on ICE Futures Europe was roughly 10 times as large as the number of outstanding three-month SONIA futures. This indicates that market participants are holding a much larger position in short sterling futures.

That will change soon, however. UK regulators are pressuring market participants to move away from Libor-based instruments well ahead of December, when the rate will officially cease. On 13 May, the Financial Conduct Authority and the Bank of England issued yet another reminder, urging market users and liquidity providers in the exchange-traded derivatives market to change their "standard trading conventions" to SONIA from 17 June.

In addition, ICE Futures Europe has announced that all outstanding positions in short sterling futures that are still on the books in December will be automatically converted into SONIA futures. Some market participants may decide to sit back and wait for the conversion to occur, rather than taking on the cost of trading out of one set of positions and entering into a new one. But now that the amount of trading in the two markets is nearly equal, the cost of a switch may prove less of an obstacle.