Since 2018, CME Group has been the leader in offering a fully regulated marketplace for bitcoin futures. Its dominant position is now being challenged, however, with two large market operators stepping into the space through acquisitions. As a result, fund managers and other institutional investors who want exposure to cryptocurrencies—but only in a regulated environment—now have a growing range of choices.

When FTX announced the acquisition of LedgerX in August, the message was clear—one of the largest unregulated trading venues wanted to join the ranks of the futures exchanges regulated by the Commodity Futures Trading Commission, the primary overseer for derivatives markets in the US.

LedgerX was one of the first companies to get CFTC approval to offer bitcoin derivatives, and it launched trading in 2017, around the same time as CME. But it remained a niche market, with most of its trading activity concentrated in options.

FTX has grown extremely rapidly since it launched in 2019 and recently raised $900 million from investors eager to fund its next phase of growth. Following the acquisition, LedgerX has been rebranded FTX US and the exchange is poised to serve as the crypto company's gateway to the US market.

Two other players also joined the US market this year. In October Cboe Global Markets bought ErisX, a Chicago-based exchange with approvals to offer crypto futures but not much volume, as a way to re-enter the crypto market. Cboe made its first try in 2017, but it backed out after its products failed to gain enough traction. And Bitnomial, a startup formed several years ago with support from several crypto-oriented trading firms and venture funds, launched in mid-November with a set of futures that offer physical settlement in bitcoin.

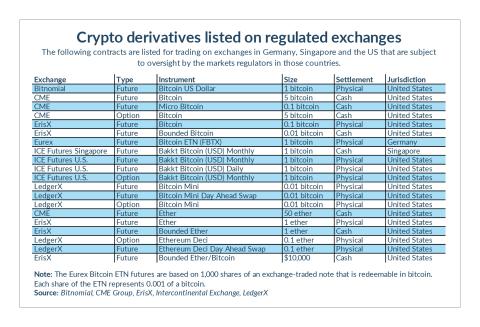

Using data collected from these and other exchanges, FIA assessed the current range of products listed on regulated derivatives exchanges around the world. All told, there were 16 futures and options on offer at the end of October. Eleven of these are linked to bitcoin, four are tied to ether and one is a hybrid product based on the price relationship between bitcoin and ether. Some are cash-settled, others feature settlement in the underlying cryptocurrency.

Most are listed in the US, but there are two other non-US exchanges that offer bitcoin futures. Germany's Eurex lists a futures contract based on an exchange-traded note that represents ownership in bitcoin, and ICE Futures Singapore offers a futures contract that tracks the price of a similar bitcoin futures contract traded on its sister company, ICE Futures US.

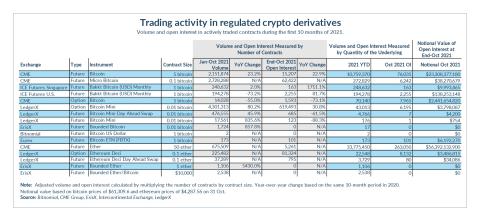

So who's the leader? In the table below are data on volume and open interest for each one of the 16 contracts available in October. Comparing markets is challenging because of differences in contract size. When CME listed its bitcoin futures in December 2017, it sized the contracts at five bitcoin in order to appeal to institutions. But retail traders are a major force in cryptocurrency markets, and more recently CME has introduced a micro contract that is 50 times smaller.

From January to October, CME's micro bitcoin futures tallied 2.7 contracts, while volume in its regular bitcoin futures was 2.1 million contracts. Both were eclipsed, however, by the bitcoin mini options listed on LedgerX, which had more than 4.3 million contracts traded as of October. In value terms, however, LedgerX is a long way behind. With a size of just 0.01 bitcoin per option, the LedgerX contract is effectively 10 times smaller than CME's micro contract and 500 times smaller than CME's original contract.

Using prices from the end of October, FIA estimated the dollar value of trading in these contracts. With volume data normalized for a rough value of $61,000 per bitcoin, the order is reversed. CME’s legacy bitcoin product is the runaway leader with more than $656 billion in notional value traded year-to-date compared with $16.6 billion for CME’s micro bitcoin and just $2.6 billion in notional value for LedgerX options.

Also worth noting: While CME’s ether futures “only” recorded 675,000 or so contracts traded in this period, it is sized at 50 ether. With volume data normalized at a rough value of $4,400 per ether, the dollar value of trading in the ether contract from January through October was $148 billion – larger than any other cryptocurrency contract on a regulated exchange, save CME’s legacy BTC offering.

LedgerX offers an option on ether, and as with its bitcoin contract, the contract size is 500 times smaller at 0.1 ether. The volume in the LedgerX ether option is about three times smaller than the CME contract in terms of the number of contracts traded and just a tiny fraction in terms of dollar value.

Beyond the small but growing number of regulated exchanges, there are a host of unregulated trading venue around the world that boast significant volume in a much wider array of digital assets. These include derivatives offering exposure to a wide array of cryptocurrencies beyond bitcoin and ether. Not all of that volume is real, however. The trading venues are not subject to the same rules as regulated exchanges and there are few if any barriers to wash sales, pump-and-dump schemes, and other forms of market manipulation.

Nevertheless, some of these trading venues have had great success in building large markets for crypto derivatives. For example, Binance, one of the largest venues, had $1.7 trillion in derivatives volume in September, according to a Reuters report, even though the company has been banned from offering its products in several countries.

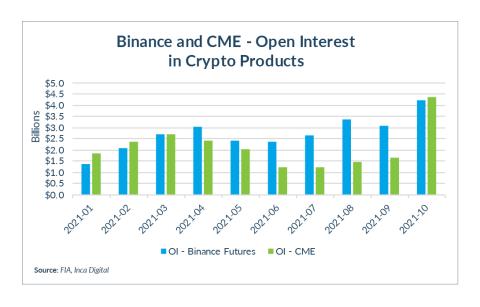

To get a sense for how large the unregulated crypto derivatives market is compared to the regulated market, FIA partnered with Inca Digital, a data analytics company that specializes in crypto markets, to compare CME and Binance.

Using data collected from Binance, Inca estimates that the trading in bitcoin futures on Binance, measured in US dollars, was about $886 billion during the month of October. Most of that trading volume was in "perpetual swaps," a type of contract that is similar to a futures contract except that it has no expiration. During that same month, the value of trading in CME's bitcoin futures was roughly $7.3 billion. In other words, the market for bitcoin on Binance was more than 100 times larger than the comparable market on CME in the month of October.

The two markets appear to be roughly the same size, however, in terms of open interest. Using data for the month of October, Inca estimates that Binance and CME had roughly $4.2 billion and $4.4 billion in open interest in bitcoin futures. In other words, even though Binance had much higher turnover, the amount of risk being held in each market was roughly the same.