CME Group is expanding its equity index lineup with the launch of Adjusted Interest Rate Total Return Futures on 21 September. The new contract is based on the S&P 500 index, the leading benchmark for the US equity market. Unlike the existing S&P 500 futures, this contract is designed to replicate the economic characteristics of total return swaps, a type of over-the-counter derivative widely used by institutional investors, but with the margin efficiency of listed futures.

CME's launch of the AIR futures marks the latest example of efforts by derivatives exchanges to capture more business from the OTC markets. The exchanges are betting that long-term futures contracts will increasingly supplant total return swaps as margin requirements for non-centrally cleared derivatives begin to apply to institutional investors from September next year.

These requirements, known as UMR, will bring an estimated 1,100 asset managers, hedge funds and other investors in scope over the next two years. That is spurring exchanges to design products that function in much the same way as their OTC equivalents for participants keen to avoid the steep margin associated with uncleared trades.

Margin Savings

"AIR TRFs are designed with the aim of providing market participants an effective and cost-efficient alternative to the OTC equivalent, while meeting many of the uncleared margin rule requirements," said Tim McCourt, global head of equity products at CME. "This means that not only will AIR TRFs have inherent margin offsets against other equity index contracts, they will also be futures-margin based and not subject to the UMR initial margin requirements of 15% for uncleared equity swaps."

The uncleared margin rules phase-in period was recently extended by a year due to Covid-19, and firms will now be considered in scope for the regulation when they hold aggregate notional amounts of non-cleared derivatives that exceed €50 billion beginning September 2021, and €8 billion in September 2022.

According to derivatives strategists at J.P. Morgan, the AIR futures will have a significant advantage in terms of margin costs. While the standard initial margin required for an uncleared equity swap will be 15% of notional exposure, the initial margin on total return futures is currently about 6% of notional. That means dealers will have to post about two-and-a-half times as much capital on a swap as on the future, the bank said in a recent note on the new contract.

Interest Rate Exposure

The key challenge for exchanges is that their standard equity index futures do not deliver the same return as total return swaps. The swaps include not only the return from changes in the price of the underlying index, but also the income from dividends on the stocks that comprise the index.

To compensate for this difference, several exchanges have introduced a type of equity index futures called "total return futures." These futures include the dividend component, and they are designed to appeal to investors that want to replicate the entire return they would get from owning the stocks in the index.

What makes the AIR futures different is that they have a built-in floating rate to accommodate the financing costs associated with funding an equity index exposure. The built-in floating rate is linked to the Overnight Effective Federal Funds Rate (EFFR) published by the New York Federal Reserve.

Essentially, with the AIR total return futures investors can lock in a financing spread to floating overnight rates at inception rather than locking in a fixed term financing rate as with ordinary futures. That means they more closely replicate the economics of an OTC total return equity index swap.

In a total return swap, one counterparty agrees to pay index performance to the other in exchange for an agreed financing payment. The counterparty that is long equity performance (the "receiver") receives the positive index performance inclusive of dividends, and pays the financing costs and any negative index performance to the counterparty who is short (the "payer") to compensate them for the financing and funding costs associated with purchasing the underlying equity position.

The financing payment of the swap is based upon the equity index notional amount and the interest rate, which is quoted as a spread to a benchmark reference rate, such as Libor or EFFR.

CME's new contract works in a similar way. The AIR TRF has a maturity at a known date and its valuation has three components: an equity index component, a benchmark financing component that accrues daily, and a financing spread adjustment component. The valuation is calculated as: AIR TRF = (Equity Index - Accrued Financing) + Financing Spread Adjustment.

As in a swap. the equity index component is an agreement between two counterparties to pass equity performance from one counterparty to the other. Accrued financing is calculated daily based upon the benchmark reference rate – the EFFR – and the sum is incorporated into the daily settlement of the product. This accrued amount is netted with the equity index performance.

The final component of the AIR TRF valuation is the financing spread adjustment. When trading an AIR TRF contract, counterparties will agree to a trade price in terms of an annualized spread, in basis points, that will be added or subtracted to the overnight EFFR – called the TRF Spread. This spread is equivalent to the spread that would be charged above or below the reference rate in an equity index swap.

AIR TRFs will be tradeable through the basis trade at index close (BTIC) mechanism on CME Globex or via a BTIC block trade. Margin requirements for the AIR TRF futures are similar to the currently listed S&P 500 Total Return Futures. Initial margin will be $13,200 and maintenance margin $12,000.

Alternatives to OTC

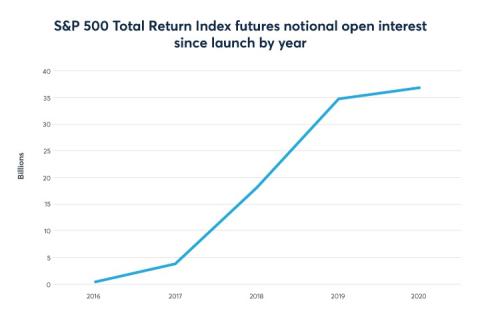

CME's latest contract continues a growing trend of exchanges launching functional equivalents for OTC instruments. CME launched total return futures on the S&P 500 in 2016 and added Nasdaq 100, Russell 1000, Russell 2000, and Dow Jones Indexes in 2018. The exchange says adoption in S&P 500 TRFs has gained traction as dealers transition from OTC to listed markets. Year-to-date, an average of more than 3,000 contracts have traded each day, up 48% compared to 2019. Average daily open interest in the product is about $37 billion in notional, up 4% compared to 2019.

Eurex, Europe's largest derivatives exchange, began offering total return futures on the Euro Stoxx 50 in 2016 and says the product has reached more than 15 million traded contracts since launch. It launched total return futures on single equities in 2019.

Other exchanges that have launched TRFs include Euronext, Hong Kong Exchanges and Clearing, ICE Futures Europe and the Singapore Exchange.