In August, CME Group and FTSE Russell struck a deal that will allow the Chicago-based exchange operator to list futures and options on futures on a broad range of FTSE and Russell indices. The licensing agreement will last 12 years and will give CME the exclusive rights to these products, meaning that no other exchange in the U.S. will be able to offer futures based on these indices.

The two companies have already set out a timetable for the listing of several products on CME’s Globex electronic trading platform this fall, starting with futures on the FTSE Emerging Markets, FTSE Developed Europe and the FTSE China 50 indices. The two companies also are making preparations for a two-stage migration of the Russell futures from their current home on ICE Futures US.

CME expects to list futures on several Russell 1000 indices by the end of the third quarter of this year and will have exclusive rights to those products starting in July 2017. For the Russell 2000 index futures, the most actively traded contract within the Russell complex, ICE has exclusive rights through June 2017. Once that expires, CME will take over that market and will retain exclusive rights to list the Russell futures through June 2027.

This is the second major index derivatives licensing deal announced by FTSE Russell this year. In February the company signed a licensing agreement with CBOE Holdings, under which the Chicago exchange will have exclusive rights to list index options on FTSE and Russell indices in the U.S. These two deals reflect the increasing clout of LSE Group in the index business following its acquisition of Russell Investments in 2014. That deal combined two of the largest index providers in the world, and today they estimate that more than $10 trillion assets under management are benchmarked to their indices (see our coverage of that deal in the September 2014 issue of Futures Industry).

ETF users will be “ a ready-made market” for the new CME products, which will allow them to manage their exposures to the indices in an efficient way.

Mark Makepeace, FTSE Russell

Mark Makepeace, chief executive officer of FTSE Russell, said that one goal of the new partnership with CME Group is to “concentrate liquidity” in the company’s indices. He explained that this will benefit not only the well-known benchmarks that are already established in the futures markets, namely the Russell products, but also the FTSE Russell indices that are actively used by exchange-traded funds but not available in the U.S. futures market. Makepeace said he expects ETF users looking to manage their exposures to the underlying indices will be “a ready market” for the new CME products.

Rounding Out

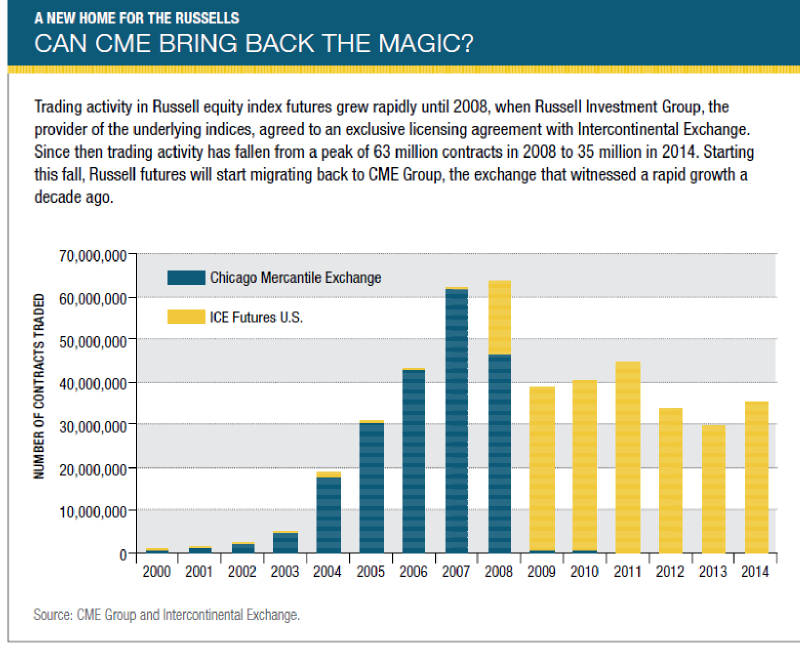

For CME Group, the deal has at least three drivers. First, the exchange will recapture trading in the Russell futures, which are traded on ICE Futures US under an exclusive license that dates back to 2008. Before that date, Russell index futures traded on both exchanges, and the Russell futures were an important part of the equity index complex at CME.

Tim McCourt, CME’s executive director of equity index products, explained that the deal will “round out” CME’s U.S. equity index offering and give customers the ability to trade multiple U.S. benchmarks on one platform.

Filling a Gap

Second, the deal will allow CME to add international benchmarks to its product line. FTSE indices are widely used by asset managers such as Vanguard to track the performance of equity markets in Europe and Asia. The group’s China indices are a particularly valuable addition. Many offshore investors use exchange-traded funds based on the FTSE indices to add China exposure to their portfolios.

McCourt added that offering futures based on the FTSE indices will fill a “noticeable gap” in the U.S. futures market. The ETFs based on these indices have attracted large amounts of investment, but there is no corresponding futures contract based on the same indices. CME believes that there is a “highly symbiotic” relationship between ETFs, cash equities and equity index futures, and making the futures available will lead to more efficient trading opportunities for all market participants.

Creating Synergies

Third, CME expects that the addition of these two sets of equity index contracts will create synergies with its existing products such as the E-mini S&P 500 futures. These synergies include the margin savings from offsets within a portfolio of related products as well as trading and operational efficiencies from having all of these products on the same electronic trading platform.

To make it easier for institutional investors to use the new FTSE and Russell index futures, CME plans to extend its “basis trade at index close” facility to these products. The BTIC facility currently covers some of the exchange operator’s more specialized index futures, including contracts on sector and real estate indices, and enables market participants to execute a trade as a basis trade relative to the official close for the underlying index. BTIC trades are executed as blocks and allow investors to lock in the closing price for their position independently of the underlying equity market closing auctions. That is a key consideration for fund managers that need to track the index value as closely as possible.