In recent years, venture capital funds have made sizeable investments in new and emerging companies that are aiming to transform financial services through the use of innovative technologies. According to estimates published by KPMG, $13.6 billion was invested in fintech companies worldwide in 2016, compared to $12.7 billion in 2015 and just $1.4 billion in 2011.

But fintech is a broad term that covers a wide range of financial services, including retail payments, mobile banking and wealth management. How much of this money is being deployed into the narrower sector of finance that includes derivatives? How many of these fintech companies are targeting the technological functions that support capital markets?

In July, CB Insights, a technology market research firm, released a report that sheds some light on this sector of fintech. Using data collected from a large number of private company financings and angel investments, CB Insights estimated that there are more than 145 fintech startups attacking various parts of the capital markets value chain, and the amount of venture capital funding flowing into these companies has been rising rapidly.

The report found that 2016 was a record for capital markets fintech deals globally, with 215 financings worth nearly $2.3 billion in funding. And 2017 is on track to surpass this level yet again. CB Insights predicts that this year will see 256 deals, representing a 19% increase from 2016, and total funding of $3.3 billion.

Increasing Interest

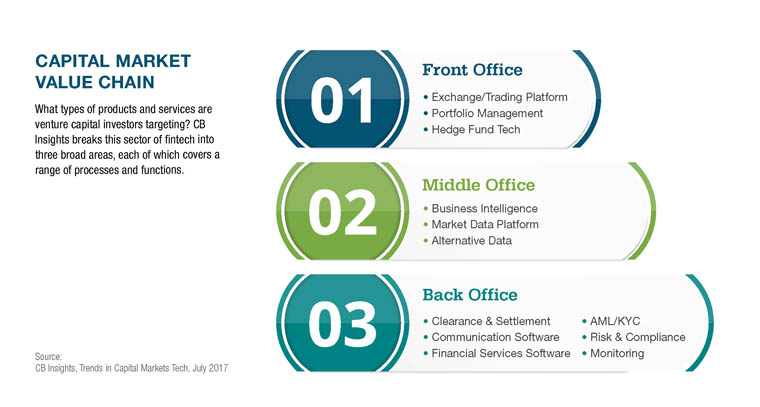

So what is capital markets fintech? CB Insights defines this category as a mix of software and services that “augments or replaces” the business model of financial institutions while facilitating the delivery and management of capital. Firms operating in this area can provide a wide range of tools and services—from alternative trading systems to financial modeling and analysis software—primarily aimed at asset managers, hedge funds, banks and exchanges.

There are of course plenty of mature firms that offer financial technologies. What is distinctive about the data collected by CB Insights is that it captures the flow of equity capital into new and emerging fintech companies that are specifically targeting capital markets. The data shows an increase in both the number of financings and the amounts being invested, which suggests that venture capital investors see real potential for outsized growth among these companies.

Illuminate Financial is an example of this trend. The London-based venture capital company was founded in 2014 to focus specifically on capital markets fintech. It now has investments in six startups. “The CB Insights report is particularly interesting because it starts to separate out capital markets fintech as an asset class in its own right,” said Mark Beeston, the firm's founder and managing partner.

Another example is Euclid Opportunities, the venture capital investment arm of NEX Group, the market infrastructure company that spun out of ICAP. “There is now an early stage financial technology business trying to address every single problem you can think of in the market,” said Michael McFadgen, managing director at Euclid Opportunities. “There are solutions for surveillance, communication, settlement and clearing, capital allocation, capital efficiencies—you name it.”

So where does the money come from? A large chunk comes from established venture capital firms like Andreessen Horowitz, the San Francisco firm famous for backing tech firms such as Twitter, Skype and Airbnb. Since 2012, it has invested in 10 companies that CB Insights defines as capital markets fintech, including Axoni, Quantopian, Ripple and Robinhood.

Another example is Spark Capital, a 10 year-old firm operating out of Boston, New York and San Francisco. Spark invests across a range of market sectors and is known for its early investments in Twitter, Tumblr, Foursquare and Oculus VR. According to CB Insights, Spark has invested in eight capital markets fintech companies, including Coinbase, eToro, Quantopian and Wealthfront.

Money is also flowing in from the financial services industry itself. Goldman Sachs has made venture investments in 15 capital markets fintech companies, according to CB Insights, and J.P. Morgan.

Chase has invested in nine. NEX Group has nine investments in this sector, both directly and through Euclid Opportunities. And CME Group currently has stakes in five capital markets fintech companies through CME Ventures, its venture capital investment arm.

In fact, corporate venture capital and financial services firms have proven to be some of the top investors in capital markets fintech in recent years, according to CB Insights. 2016 was a record year for this group, with investors participating in 71 deals worth approximately $1.1 billion. And this year is on track to go even higher; CB Insights projects that more than $1.7 billion will be invested by this category of investor by the end of 2017.

Strategic Value

Corporate venture capital is looking for more than just high returns. Ankur Kamalia, the head of DB1 Ventures, the venture capital arm of Deutsche Boerse, explained that these investments also can help established organizations tap into the latest technology trends and drive more internal innovation.

"At a global level, there is an increased recognition and focus on the part of incumbent financial services organizations to participate and collaborate with emerging and growing financial technology solution providers, as it is important to augment and complement internal innovation with that taking place externally," said Kamalia.

DB1 Ventures is focused on two broad areas of strategic interest to the group, he explained. The first consists of core technologies that "reshape the technology stack" for the financial markets, such as blockchain, security solutions, API technologies, cloud computing, machine learning and artificial intelligence. The second is the next layer above the technological base, where companies are using state-of-the-art technology to build applications for clearing, risk, collateral management, data analytics and other types of functions and processes relevant to capital markets.

Two recent investments illustrate this strategy. In July 2017, DB1 invested $10 million for a minority stake in Trumid, an electronic platform for all-to-all trading in the U.S. corporate bond market. DB1 now has a seat on the company's board and plans to work with Trumid to accelerate its entry into the European corporate bond market. In November 2016, DB1 participated in a Series B funding round for Figo, a provider of banking API technologies. DB1 plans to leverage the relationship to jointly develop infrastructure technology solutions for the banking sector, especially in the context of the revised Payment Services Directive regulations that will come into force in 2018.

The Unicorns Arrive

Another indicator of the surge of interest in capital markets fintech is the rise in the value of these startups. In fact, two recent fundraisings were so successful that the companies have achieved the rarified status of "unicorns," the term used for privately held companies that have a value of more than $1 billion.

One of these companies is Coinbase, a digital currency wallet and trading platform based in San Francisco. What makes Coinbase particularly interesting is the unique mix of investors that it has attracted. According to investment tracking platform Crunchbase, the cryptocurrency exchange was founded in September 2012 with $600,000 in seed money. The company had its first big funding round in late 2013, raising $25 million from Andreessen Horowitz and three other venture capital firms as well as a music industry executive named Anthony Saleh.

Then, from 2015 onwards, a number of major corporate investors also became involved in successive capital raising rounds. Those investors included Intercontinental Exchange through its subsidiary the New York Stock Exchange, Banco Bilbao Vizcaya through its investment arm BBVA Ventures, and Bank of Tokyo Mitsubishi.

The latest, and largest, round of funding this past August raised $100 million. Institutional Venture Partners led the funding with participation by five other VC firms: Spark Capital, Greylock Partners, Battery Ventures, Section 32 and Draper Associates. In total, the cryptocurrency startup has attracted 34 investors over six funding rounds, and the five-year-old company's total value is now estimated at $1.6 billion.

The other unicorn in capital markets fintech that emerged this year is Symphony. In contrast to Coinbase, Symphony has received the vast majority of its funding from the banking industry. BNP Paribas led the most recent funding round, which raised $63 million and pushed the value of the company over $1 billion. Of the 13 other participants in that funding round, nine were banks, and one was BlackRock, an institutional investor.

Exit Ramp

Beeston cautioned that anything related to cryptocurrencies or blockchain tends to have a different valuation than the rest of the capital markets fintech space. “These companies seem to have a very different pricing dynamic behind them, in many cases led by either crypto-focused investors or by the banks themselves investing at high valuations for relatively early stage businesses,” he explained.

McFadgen agreed, saying that the more likely outcome for most startups in the capital markets fintech space is to be acquired by a larger, more established company. “The exit route for founders of capital markets businesses tends to be with a consolidator in the M&A market as a trade sale,” he said. As a result, these businesses tend not to mature to unicorn status or go to an initial public offering. “This is because something big happens before that stage is reached,” he explained. “It’s not that the businesses are not as valuable as in other markets, it is just that the dynamics are different.”

What really matters, according to Beeston, is whether or not there is a real market problem. “Have they got an effective and adoptable solution? Can we help the entrepreneurs bring those solutions to market? Can we deploy capital into an investment at the right valuation and make a decent return?”

“I established Illuminate itself because I believe that we are at a moment of generational change in financial markets, driven by the post-crisis industry de-leveraging and the massive multi-jurisdictional regulation we’ve seen—of which Mifid II is just one part,” he concluded. “That broad set of global regulatory drivers will mean a decade-plus journey. I don’t see an end to regulation driving new challenges and opportunities.