The recent explosion of volatility in financial markets is accelerating the growth of the American Financial Exchange, a four-year-old electronic marketplace for overnight borrowing among banks, insurance companies, broker-dealers and other institutions in the U.S.

On April 1, AFX announced that transactions on its platform rose to $55.8 billion in March, setting a new monthly record. Total first quarter volume also set a record of $140.4 billion, up 13% from the previous quarter. AFX also announced that another 15 institutions had joined the marketplace since the beginning of the year, bringing total membership to 185.

"We are pleased that our volume continues to grow, but more importantly, that we are able to be a source of liquidity in these turbulent times," said Richard Sandor, the founder of AFX and its chairman and chief executive officer.

The rapid growth highlights the potential for Ameribor, the interest rate published by AFX, to emerge as a substitute for Libor, the interest rate benchmark that the Federal Reserve and other regulators would like to see phased out by the end of 2021. Although it has not attracted much attention on Wall Street, Ameribor is gaining support from a growing number of regional, mid-sized and community banks that have joined AFX. They say it is a better match for their funding costs than other alternatives to Libor, and some are starting to use it as a reference rate for their corporate loans.

Alternative to SOFR

For derivatives markets participants, the key question is whether the development of this new benchmark will create a ripple effect in the interest rate derivatives markets. So far most of the attention has been focused on the Secured Overnight Funding Rate, or SOFR, which is based on transactions in the repo market for U.S. Treasuries.

The Alternative Reference Rate Committee, a quasi-official group of financial institutions convened by the Federal Reserve, has recommended SOFR as the replacement for Libor in the dollar-denominated interest rate markets. A small but growing number of corporate borrowers have begun referencing SOFR in their debt issuance, and trading activity is picking up rapidly in the SOFR futures listed on CME Group and ICE Futures U.S.

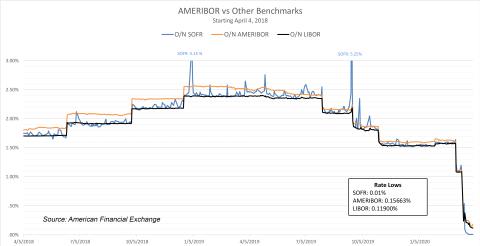

The spread of the Coronavirus has complicated the outlook, however. The dramatic slowdown of economic activity and the resulting turmoil in financial markets have caused stresses in the repo markets, increasing the volatility of SOFR and making it less effective as a hedge for the interest rate risk in corporate loans.

More importantly, SOFR is based on transactions secured by U.S. Treasury securities. That removes the credit risk component embedded in rates like Libor that are based on interbank borrowing, making it a better measure for pure interest rate risk. But it exposes the rate to other kinds of market dynamics, such as the "flight to quality" phenomenon seen during the current market turmoil. That makes SOFR problematic as a reference rate for corporate loans, because the rate tends to fall at the very moment when most lenders face higher borrowing costs.

In contrast, Ameribor is based on unsecured transactions, which means it includes the credit risk of the banks and other lenders participating in the AFX marketplace. That makes it better suited than SOFR to the needs of medium and small banks that need a benchmark for their funding costs.

"Credible and Robust Rate"

This advantage was highlighted in February, well before the chaotic conditions of March, by a group of 10 mid-sized banks that sent a letter to U.S. banking regulators expressing their concerns with SOFR. They explained that Ameribor is a better fit for their asset and liability profile, and they expect it to gain traction with other banks over time.

"We believe SOFR is an appropriate benchmark for larger financial institutions that have access to collateral and the ability to broadly operate on secured markets. But we also strongly believe that markets must have choice to be efficient, with multiple new reference rates paving the way for a smooth transition away from Libor," they told the regulators.

The banks signing the letter included Flagstar Bancorp, a $23 billion asset savings and loan holding company based in Michigan; First Merchants Corporation, a $12 billion asset bank based in Indiana; Cullen/Frost Bankers, a $34 billion asset bank based in Texas; and PacWest Bancorp, a $26 billion asset bank based in California.

The 10 banks added that they are using AFX as a source for overnight funding and they have begun pricing loans using the Ameribor benchmark. "We find it not only representative of our asset structure and risk profile, but it also is a credible and robust rate which is easy to explain to customers, regulators and other market participants. Given its unsecured nature, Ameribor is gaining greater traction and we encourage other banks to take note," the banks wrote in the letter.

For Sandor, who began developing AFX eight years ago, the recent turmoil has vindicated the creation of this marketplace. The platform launched in December 2015 with just four banks on board, and it has steadily gained in popularity as problems with Libor have become more evident.

In an interview with MarketVoice, he explained that the last several weeks of March have functioned as a "proof of concept" demonstrating the viability of the platform and strengthening its appeal to thousands of regional, mid-sized and community banks across the U.S.

"The question we were asked in the early days, in 2012 and 2013 when we proposed AFX, was 'what happens when you get a crisis? Your liquidity will dry up, it will never work.' Quite the contrary, this time has been a total proof of concept," said Sandor. "Not only didn't it dry up, we were a source of liquidity when others dried up. So the notion of peer-to-peer fintech lending was totally viable."

"Beginning of the Food Chain for Derivatives"

Despite the surge in trading on AFX, trading in derivatives based on Ameribor is still at a nascent stage. Last August, the Cboe Futures Exchange listed futures on Ameribor, but activity has been very low to date. Sandor said he thinks several key components need to be in place before that contract takes off.

First, the greater use of AFX for overnight funding is encouraging banks to use Ameribor as the reference rate for their corporate lending. The first Ameribor loan was issued in September 2018 by ServisFirst Bank, a small commercial bank based in Alabama. As of early 2020, there were a dozen institutions that have issued loans tied to Ameribor or are preparing to use Ameribor as a reference rate for their loans, according to AFX.

The next step is for this lending activity to generate demand for Ameribor derivatives. Banks use derivatives to hedge the interest rate risk in their loan portfolios, and if those loans are tied to Ameribor, then they will need derivatives based on Ameribor to hedge that risk.

The last step is for the growth of Ameribor derivatives to reach a point where the dealers need a wholesale market where they can lay off their risk. That market today is the Eurodollar futures market, which provides a central market with standardized contracts for managing Libor-based interest rate risk.

"We are starting to build up more banks using Ameribor as a benchmark for commercial loans," Sandor said. "Once they do that, that will create demand for swaps. And that swap demand will result in futures. So we are at the beginning of the food chain for derivatives."