A message from Walt Lukken, President and CEO, FIA

Welcome to the first issue of MarketVoice magazine and the new Insight column. As part of the expanded industry coverage in MarketVoice, I’ve set aside this column to explore key topics that are affecting our industry and membership.

Our industry is driven by numbers and figures, and FIA is uniquely positioned to analyze this data to identify trends, educate our members and inform policy-making.

In each edition of MarketVoice, Insight will address critical issues for discussion and scrutiny. My goal is to write an informed, thought-provoking column that provides a unique perspective on our industry, our association and the challenges we face.

For this inaugural column, I chose a topic that has been at the top of the agenda at nearly every industry meeting I’ve attended recently: cross-border recognition and coordination by regulators. At issue is the fundamental concept of how the global futures and swaps markets will function and survive as nations adopt and finalize differing, and sometimes conflicting, regulatory requirements.

“My goal is to write an informed, thought-provoking column that provides a unique perspective on our industry, our association and the challenges we face.”

Dating back to my days at the CFTC, I have been a strong proponent of mutual recognition and substituted compliance as a means to allow global markets to grow and function in a safe manner. The CFTC was a pioneer in the development of the global recognition framework in the nineties, developing a regime for foreign intermediaries offering foreign futures and options to U.S. customers and allowing direct market access for U.S. customers through foreign exchange terminals.

The rationale behind recognition is simple: why rebuild the wheel at taxpayers’ expense when home-country regulators already have authority, knowledge and proximity to the regulated activity?

This deference is contingent, of course, on ensuring the foreign regulators have “comparable” rules and regulations. At times, regulators imposed additional conditions on the recognition to ensure similar standards were in place in both countries and that the rules were being enforced. But mutual recognition and substituted compliance were never meant to require identical rules on a line-by-line basis; rather, the goal was to ensure equivalent regulatory outcomes.

With the scars of the financial crisis still fresh, regulators are finding it difficult to adhere to this tradition of mutual recognition and defer to foreign authorities for fear of importing another crisis. The CFTC, for example, has the authority to recognize foreign clearinghouses that are regulated in a way that is comprehensive and comparable to our regime. However, the CFTC has yet to develop such a recognition regime and has opted to directly register foreign clearinghouses that clear for U.S. customers.

While the desire to require home-country rules is understandable, this lack of deference is having real consequences in the markets.

Case in Point: The U.S. and Europe have been in negotiations for well over a year on whether U.S. laws are equivalent to European requirements. EMIR requires the European Commission to recognize foreign CCPs as equivalent in order for foreign clearinghouses to retain their qualified CCP (QCCP) status among European banks. Recently, the European Commission granted equivalency to CCPs within the jurisdictions of Hong Kong, Japan, Singapore and Australia. Unfortunately, there has not yet been an agreement to recognize the U.S.

The lack of recognition could increase the capital requirements on European clearing member banks by as much as 30 to 60 times, according to the International Banking Federation. Such a punitive increase would likely force these banks out of the U.S. clearing business and possibly the European clearing business as well.

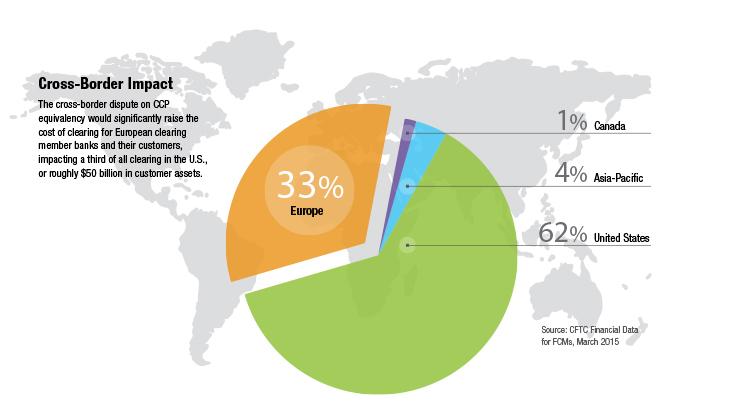

This could have a dramatic impact on liquidity on U.S. exchanges and beyond. According to CFTC data, one-third of clearing in the U.S. is done through foreign clearing members. European brokers account for most of that activity. All told, European brokers handle one-third of U.S. clearing, holding more than $50 billion in customer segregated funds. That is what’s at stake in these discussions.

I am encouraged by positive statements by EU Commissioner Jonathan Hill and CFTC Chairman Tim Massad regarding these negotiations. There does not appear to be a lack of commitment to getting this over the finish line. But regardless of the final outcome, the time it has taken to reach this point and the uncertainty that this has brought to the marketplace should encourage us to find a more predictable way for jurisdictions to find comity among their fellow regulators.

This will take enhanced global regulatory standards, more verifiable metrics to gauge these standards and of course trust... the latter of which is sometimes the hardest to come by. With more products coming onto clearinghouses, global standard setters should be continuing to update and refine how global clearinghouses are designed, governed and managed. These enhanced standards provide the benchmarks on which recognition can be granted and relied on by regulators.

That said, FIA Global has recently published a whitepaper recommending ways to improve and enhance the management of central clearing risk, including improved global standards on transparency, risk management andgovernance. Starting a public dialogue and finding common ground is imperative if we want to avoid these regulatory bottlenecks in the future.

This is not the first border dispute between regulators and it certainly won’t be the last. But increasing cross-border access to our markets through a predictable recognition program is a proven way to strengthen international ties, build regulatory trust and grow our markets for the benefit of its users and the economy as a whole.I am confident that we will find a way to resolution. The stakes are too high for any other conclusion.