Greifeld shares his thoughts on blockchain, artificial intelligence, the acquisition of ISE, and the outlook for NFX, the energy futures exchange it recently launched in the U.S.

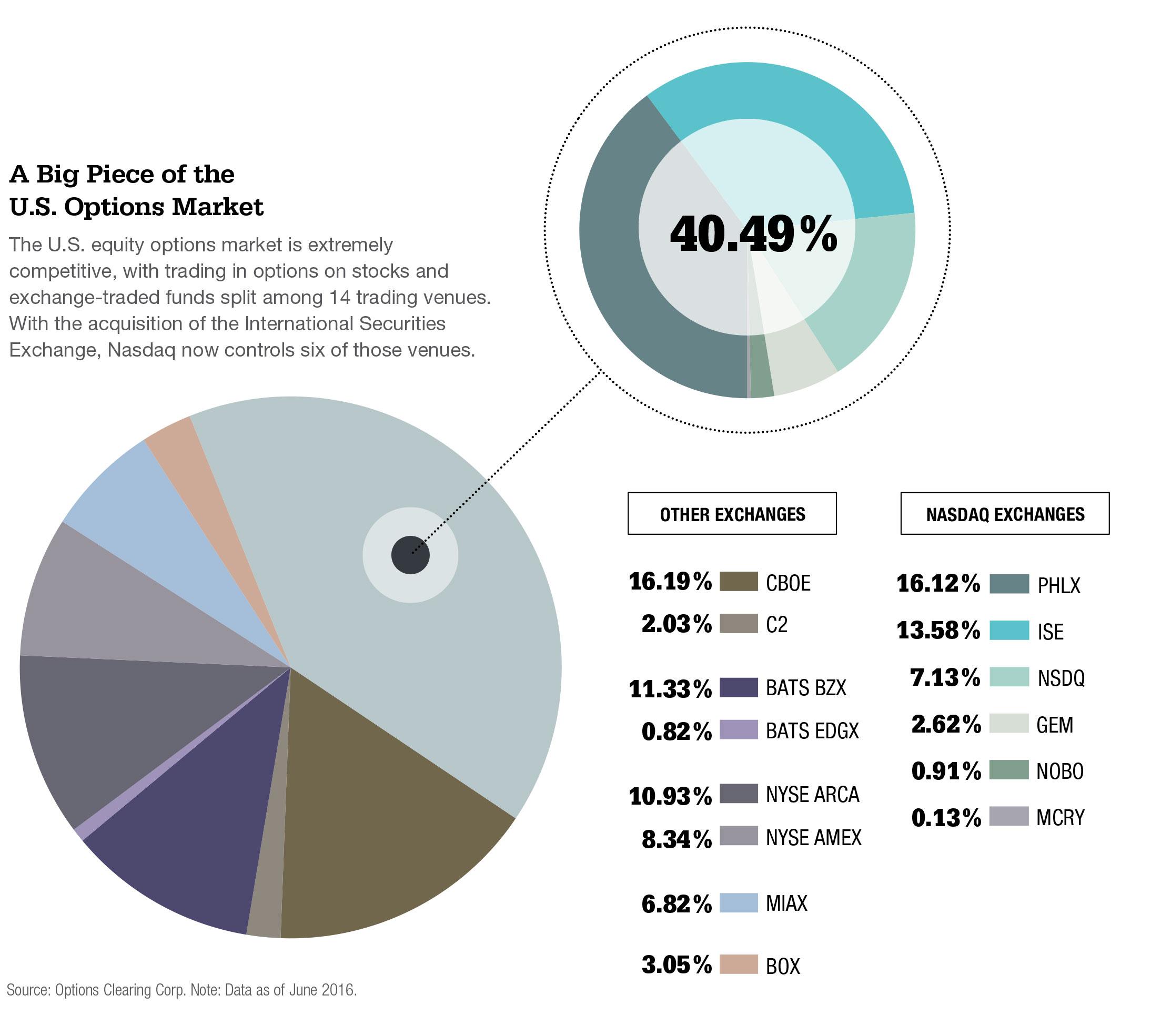

Bob Greifeld is looking for ways to make Nasdaq a bigger player in the derivatives markets. In June, Nasdaq closed a deal to buy the International Securities Exchange from Deutsche Boerse, a move that gives Nasdaq roughly 40% of the U.S. equity options market. In July, Nasdaq Futures Market, its one-year-old energy futures exchange, announced open interest of more than one million contracts, an important milestone in its battle for market share with CME Group and Intercontinental Exchange.

The two initiatives share a common strategy – open access to clearing. That’s a given in the U.S. equity options market, where all the exchanges clear through the Options Clearing Corp. But it’s something different for the U.S. futures market, where the vertical structure predominates. In a wide-ranging interview with MarketVoice, Greifeld says relying on OCC to clear NFX allows his exchange to offer trading and clearing fees that are less than half the fees charged by CME and ICE. The jury is still out on whether NFX can capture a meaningful share of the market, but there is no doubt that Greifeld is willing to challenge the status quo.

The other dimension of his strategy is technology. Buying ISE brings in ISE’s expertise in handling complex orders. That is especially important in the options market, given that many trading strategies require executing combinations of puts and calls at multiple strike prices. Greifeld told MarketVoice that he sees ISE’s complex order book functionality as an important advantage in his competition with other exchange operators such as NYSE and BATS.

Greifeld has been running Nasdaq since 2003, and he has consistently sought to be at the forefront of innovation. From buying Instinet in 2005, OMX in 2007 and now ISE in 2016, Greifeld has looked to use acquisitions to accelerate his company’s technological evolution. Next on the horizon is blockchain. Nasdaq has already begun experimenting with this new technology in two areas: Nasdaq Private Market, a marketplace for trading equity in private companies, and the Estonian stock exchange, where Nasdaq is providing a blockchain-based system for recording shareholder votes. Greifeld told MarketVoice that he is wary of the hype surrounding the technology, but predicts that it will transform the clearing of trades in the long-term.

MarketVoice caught up with Greifeld in early August, a few days after he returned from the Olympic track and field time trials. An avid runner himself, Greifeld helped found the U.S. Track and Field Foundation, an organization that raises funding to support youth athletics, emerging elite athletes and distance training centers. Many of the runners have found their way to the Olympics – over 30 athletes from the foundation sponsorship roster qualified to compete in the Olympics this summer in Rio de Janeiro.

Like the runners that the foundation sponsors, Greifeld gets up every day ready to compete at the highest level. In the following article, Greifeld shares his thoughts on technology, options markets and his ambitions for NFX.

Bob Greifeld: A View From the Top

On the leading edge with technology

MARKETVOICE: Let’s talk about technology, and blockchain in particular. Nasdaq has started using it in Nasdaq Private Market, for example. What is the next step?

BOB GREIFELD: I’d like to give you the context. I came to Nasdaq in 2003. I always saw us as a technology company. The fact that we have regulatory licenses, that we run exchanges, clouds the fact that the beating heart of this company is technology. Half of our employees are technologists. The exchange itself is really in many ways financial technology applied to the cloud, in that people are connecting to us as if they were connected to the cloud.

When we saw the development of bitcoin, we spent time studying it and understanding what it could mean for us. The first year or so we were focused on the bitcoin aspect of it. It wasn’t until some time had passed that we said, well, the fundamental building block for us is the blockchain. We were early with investigating it, then early with getting on with the blockchain.

Blockchain has the ability to change the world as we know it. But almost everything you’re going to try to do with the blockchain will require a vast change in the ecosystem. That will happen, but it will take time. So our focus now is on what can we do that’s actually actionable today that doesn’t necessarily take a village to create.

Blockchain has the ability to change the world as we know it. But almost everything you’re going to try to do with the blockchain will require a vast change in the ecosystem.

With Nasdaq Private Market, we control the whole vertical stack and every aspect of that operation. That gave us a clear path for actionability. We’re able to have internal meetings to decide how to use blockchain in Nasdaq Private Market, and it’s all up to us to make happen. Right now, we are expanding out what the blockchain can do for us. We want to do the cap table management in addition to the transactional activity of the Nasdaq Private Market. So, that’s what we’re working on today.

Is blockchain a type of technology that is acquired or is it something that you build in-house?

It’s a bit of a combination. As much as we’re a believer that blockchain will change everything, we have to realize that it’s just core system technology. If anything, I would relate it to database technology. It’s a new way of storing information on a communal basis. Blockchain by itself sitting there doesn’t solve anything. When Satoshi wrote the paper, it didn’t have a clear path to solve anything in the world that we’re trying to do. But it gives us the building block to go from. The successful implementation of blockchain will be those companies understanding the domain knowledge necessary to deliver solutions there. Blockchain becomes just one of the building blocks of the eventual customer solving solution.

Will we be in a situation where there are multiple versions of this type of technology?

I would have to say yes. But I think the application logic that’s built around blockchain is really going to be the differentiating factor. We work with different, smaller, technology-focused companies, in which application logic is their value-add – to understand the real innards of the blockchain and how to engineer it to handle volume and make sure you have resiliency with it. And then our job is to then apply that to our chosen mission.

There is too much hype about blockchain just being a panacea in and of itself. It’s a piece of a puzzle. It’s a major enabling piece for us to think communally across ecosystems. But you’ve still got to then develop the solution aspect of it.

At Nasdaq, we don’t develop fundamental technology unless we have to. I want to be the fast adopter of fundamental technology, applying it to the financial services industry where we choose to compete.

People have speculated that blockchain is especially well-suited to clearing. What are your thoughts on that? Do you think we’re going to have some sort of disruptive change to the way things are cleared?

Yes, I do. I think blockchain changes the clearing paradigm in major ways. I just would caution you that it doesn’t happen overnight, and it has to happen as part and parcel of the ecosystem. It’s not like clearing, as we know it, disappears tomorrow. But if you put your head down and lift it up 10 years from now, it will do that.

Turning to artificial intelligence, where do you see this technology being applied?

The term we like is machine intelligence. It’s not artificial; it’s just machine intelligence, as compared to human intelligence. Certainly pattern recognition is something that machine intelligence can do very well. We have a product called Smarts for real-time post-trade surveillance. We’ve built up tremendous IP [intellectual property] through the years developing these algorithms, these patterns that recognize bad behavior in marketplaces, whether it’s derivatives, equities or fixed income. We’d like to accomplish two things with machine intelligence. First is to eliminate the false positives. Second is to make pattern recognition more dynamic.

There are many other applications for it. We’re looking at machine intelligence for what we call our shareholder advisory business, where we’re there to advise companies who’ve been accumulating or selling their stock. Machine intelligence can advance that quite dramatically.

A major player in U.S. options

The acquisition of International Securities Exchange was a substantial move. You already had three options exchanges and now you have six. How many do you need?

With ISE we have a clear advantage in complex orders, and we think complex orders are a growing percentage of the options marketplace.

I think we have enough. But, with respect to ISE, we clearly have a belief in the options market being a good space to be in. Options volume has been relatively flat, and not everybody is optimistic about the options space. That provides us with an opportunity. Buying ISE gives us the scale to be quite an effective player in the space. We have right around 40% market share. Our big belief in the options marketplace is that we have some growth opportunities there, and with ISE we have a clear advantage in complex orders, and we think complex orders are a growing percentage of the options marketplace.

Where do you see most of the volume growth coming from?

I think you see more and more investors, especially on the retail level, understanding that options markets are a great way for them to hedge some of their underlying equity exposure. We think a lot of people who are buying equities today are unnecessarily unhedged, or certainly exposed, where they can minimize some of the exposure there.

You have roughly a 40% stake in OCC. How does it benefit your shareholders to have a 40% stake in a utility like OCC?

We think OCC, in its current corporate form, is not optimized between who has equity ownership and who has economic ownership. We think over time that will be addressed. As a 40% owner today, we have some interest in the economics of OCC. We don’t have any management ownership, but we have board representation there.

OCC is the lowest cost, highest quality, clearinghouse that exists on the planet today. On the planet. When we started NFX, our futures exchange, we looked at different places to clear. To me it was remarkable the competitive advantage that OCC had. They had ventured from the options world into the futures world, they had developed capability in futures and then we were the beneficiaries of them being able to do that [offer clearing] at their cost basis.

You mentioned you don’t see OCC being where it needs to be in terms of its corporate structure. What type of structure is needed? Do we need a privatized OCC?

Well, it is privatized today. I see it staying in a private context. It’s not a public company. But it should have an independent board to look after the assets. There’s increased independence on the board. I think that needs to continue. And I think the ownership versus the economic interest needs to get aligned over time.

How do you continue to compete in this current options landscape?

Being a 40% market share player, the question really is flipped. Other people have to worry about competing with us. We have the scale. We have to make sure we maintain our focus on our efficiency. We have to keep the technology at the cutting edge. We have to be as efficient as any player in the space, get the benefits of scale and then have those benefits of scale be represented to the customers, in addition to our investors. So, through this acquisition, our customers have to benefit.

One of the things we’re doing, which I think is interesting, is the regulatory fee. We'll be helping to normalize expenses for our customers, and in some cases passing savings over to our customers.

A year after launching NFX

It's been one year since Nasdaq launched NFX, competing in the U.S. energy futures markets. How is that going?

We hit 5% of the market. Now, I think we’re in the high threes. But understand that we haven’t rolled out all of our products yet. We have a number of products that are double-digit market share. So, that’s good, it’s impressive, it’s further along than we would have thought. But we have a long way to go, and we’re working on it.

How is open interest, at this point?

It's certainly a lot higher than we would have guessed. We’ve gone over one million contracts and we have a fair representation on the long-dated side. So it’s been exceptional. We’re ecstatic for where we are today. But we’re also recognizing that we have a long way to go. We had a great first inning. Now let’s focus on the second inning.

Past attempts to compete with ICE and CME have not been very successful. What’s different now?

Well, you will only be successful if you are representing the true will of the customer. Before we started NFX, we had to meet with the customers, understand their willingness and ascertain whether they really meant it or not. We put in a structure where the customers had financial obligations in order to participate, or financial penalties if they did not. NFX is an expression of the customers’ will to create a more competitive dynamic in the commodities sector. Now we can screw it up by having bad technology, bad customer support, that type of thing. But if we do all those things right, but don’t have the will of the customer, we won’t get anywhere. So far, we’ve had all the legs of the stool and we have to continue to do that.

Some analysts have said that a lot of the volume is generated from the incentives and that it’s largely a market maker environment. Is that an accurate statement?

Well, if you look at the open interest, you obviously will see that there’s some natural buying and selling going on. As I said, the open interest is the most impressive thing we have. That speaks to us making great progress there. But, I also want to recognize that we don’t get where we are without market maker support.

I want to make it clear that ICE and CME have market maker incentive plans. They’re a permanent fact of life, right? There’s always going to be, regardless of the market, a need for market maker support. In equities, it’s in the form of maker taker pricing, in the derivatives world it’s a little different. But the common theme is that you have to have market makers.

Oftentimes, in an exchange environment, the clearing ends up being the most profitable piece of the picture. You’re not in a vertical silo. You don’t control your clearing. Do you envision changing that, or are you going to be able to compete without that clearing piece?

Definitely. What we say to our customers is that we believe in open access. If OCC wanted to have another competitor come in, they should do that. That would look and sound more like the equity world we’re very familiar with. We’re comfortable in that environment.

On the trading side, we have the ability to deliver great value to the customer and still be profitable ourselves. If you look at our capture rate in equity options, it’s about 15, 16 or 17 cents per contract. In the commodities space, our competitors are getting $1.38 to $1.40 a contract. We said that, publicly, we want to be all in with clearing around 60 cents. That is a 50% reduction relative to the current competition. So we’re quite comfortable with the economics.

We started charging fees in May and our market share has continued to grow. In the month of August we had our highest level of onboarding of new customers ever. So we’re ecstatic with the progress we’re making. We've got a long way to go, though.