Regulators outline reform agenda for U.S. Treasury Market

The U.S. Treasury market is one of the deepest and most liquid markets in the world, with significant trading in not only the benchmark securities such as the 10-year Treasury note but also the Treasury futures and options traded on the U.S. futures markets. The composition of this market has been changing however.

The Treasury futures and the cash Treasury market have always been closely linked. Now that relationship is set to get even tighter as U.S. regulators embark on a series of changes to the regulatory framework for the cash Treasury market.

While their primary goal is to improve their ability to oversee this market, one effect of the reforms now under discussion will be to encourage greater convergence in market structure. For example, regulators are pushing for greater transparency similar to what exists in other markets such as futures. Regulators also want to subject trading venues to exchange-style oversight and extend dealer-style regulation to principal trading firms.

All of these elements came into view at a day-long public event held at the Federal Reserve Bank of New York on Oct. 24. The SEC is taking the lead in terms of registration requirements and trading venue regulation. The Commodity Futures Trading Commission is providing a model for the regulation of automated trading. The Federal Reserve is lending its weight to the efforts to improve data collection. The Treasury Department is setting the agenda and coordinating the various elements. Of course, all of these initiatives were begun under President Obama and the next administration is expected to have a much more skeptical view of new regulations.

On the other hand, senior staff at both Treasury and the Fed are worried about the fragility of liquidity in the cash Treasury market. Ensuring that this market functions properly is likely to be a top priority, given its importance to government borrowing and market stability.

Data collection and public transparency

The key to understanding this newfound desire to overhaul the regulation of the cash Treasury market was the so-called "flash rally" in October 2014. During a brief 12-minute period on Oct. 15, prices for Treasury securities and Treasury futures suddenly surged on a frenzy of buying and then just as suddenly plunged back down. Officials in Washington and New York were caught by surprise, and even after a year of analysis and the publication of a 72-page report, they were unable to explain the event. One big finding was that there were huge gaps in their ability to analyze the Treasury market, partly because they could not obtain sufficient data, and partly because they had not come to terms with changes in how the market operates.

At the Oct. 24 conference, Antonio Weiss, a senior adviser to the Treasury Department, explained that the government is now determined to change this state of affairs. Weiss, a former investment banker at Lazard Freres who joined Treasury in January 2015, is one of the main architects of the reform agenda. Under his leadership an inter-agency team of government officials embarked on a comprehensive review of the evolution of the Treasury market, focusing not only on the events of October 2014 but also more broadly on the rise of electronic trading, the role played by principal trading firms, changes in risk management practices and the benefits and risks of increased public disclosure of trading activity.

Weiss discussed the government's plans to improve data collection, the first step to better oversight. He started by pointing to a recently approved initiative by the Financial Industry Regulatory Authority, the self-regulatory organization for the U.S. securities industry. FINRA plans to leverage its expertise in operating Trace, its reporting system for corporate bonds, to build an engine for collecting data on trading in the secondary market for U.S. Treasury securities. Broker-dealers that are FINRA members would be required to report their trades directly to FINRA, and banks that are not FINRA members will submit their data via the Federal Reserve.

Weiss discussed the government's plans to improve data collection, the first step to better oversight. He started by pointing to a recently approved initiative by the Financial Industry Regulatory Authority, the self-regulatory organization for the U.S. securities industry. FINRA plans to leverage its expertise in operating Trace, its reporting system for corporate bonds, to build an engine for collecting data on trading in the secondary market for U.S. Treasury securities. Broker-dealers that are FINRA members would be required to report their trades directly to FINRA, and banks that are not FINRA members will submit their data via the Federal Reserve.

Weiss noted that this initiative will take effect next July, and said it will capture "roughly 90%" of Treasury market transactions. Weiss then set out the arguments for mandating greater transparency for market participants and the public. He acknowledged that some market participants have warned that greater transparency could impair liquidity and increase the costs of market-making. But he emphasized that Treasury is committed to improving public access to trading data, asserting that regulators see "compelling benefits" in terms of lower transaction costs, greater competition, a more diverse set of market participants and a more resilient market structure. Weiss also pointed out that a move towards greater transparency in cash Treasury trading would be consistent with practices in Treasury futures, interest rate swaps and other related markets.

"We believe the debate should shift from whether to seek increased transparency to how, when, and on what basis."

"We believe the debate should shift from whether to seek increased transparency to how, when, and on what basis," Weiss said. He added that the requirements will be carefully tailored to address the concerns raised by market participants. For example, transparency will be limited to post-trade reporting, rather than pre-trade market data, and will be implemented in phases to allow for adjustments along the way. Trade sizes will be "capped" to protect information on block trades, and reporting of trades in some market segments will be delayed to protect liquidity providers from being exposed before they can hedge their side of the trade.

Greater regulation of trading firms

Another key element of the reform agenda is to require principal trading firms that transact in Treasury securities to register with the regulatory authorities. This reflects a recognition that these firms, which trade for themselves and do not hold customer assets or bank deposits, have emerged in recent years as major players on the inter-dealer platforms that serve as the main source for price discovery in the cash Treasury market. The current framework is designed primarily for banks, broker-dealers and asset managers, and the regulators are looking for ways to extend their oversight to these firms.

Weiss said Treasury strongly supports such a registration requirement, and Mary Jo White, the chair of the SEC, spelled out the details in her speech to the conference. Principal trading firms should be required to register with the SEC and become subject to SEC oversight, she explained, because they represent more than 50% of the trading volume on interdealer platforms such as Nasdaq's eSpeed and ICAP's Brokertec. Equally important, their trading activity indicates that they are "acting as dealers," she said.

The SEC has not yet issued a formal proposal for this registration requirement, but White offered some indications as to what the SEC has in mind. The goal is to subject these trading firms to net capital requirements, anti-manipulation and anti-fraud provisions, market conduct rules and various other elements of dealer regulation, she said. She added that this regulatory regime also includes the SEC's market access rule, which requires dealers that have direct market access to implement certain types of risk controls.

The big question is whether the SEC's ideas for greater regulation will be carried forward under new leadership. Shortly after the election of Donald Trump as president, White announced plans to step down from the chairmanship in January when the new administration takes office. The expectation is that President Trump will nominate a new chairman with a more free-market approach to regulation, and at this stage there is no way to know where Treasury market oversight will fit into that person's list of priorities.

Regulation of automated trading

Another consequence of the October 2014 turmoil is that U.S. officials have become more aware of the role of automated trading in the Treasury market and more interested in understanding how to manage the risks of automated trading. That in turn has led to a focus on the CFTC, which is now in the process of developing a regulatory framework for automated trading in the futures markets.

CFTC Chairman Tim Massad explained at the Oct. 24 conference that the purpose of Reg AT is to reduce the risk of disruption and other operational problems that could be caused by automated trading. He outlined the key elements of the proposed rule, including requirements for certain types of risk controls and a registration regime for the small number of firms that account for a large percentage of trading volume.

Massad put the rule into a broader context, explaining that regulators need to modernize their methods for market surveillance to take into account the increase in complexity, speed, and interconnections. He gave several examples to show how the CFTC uses extremely precise market data from the futures market to reconstruct market events, and called for better data on the cash side of the market so that regulators can compare activity across markets.

"This is especially true for markets like ours, where the major derivatives participants are often some of the major participants on the cash side as well," Massad said. "Given the interconnected nature of our markets, such gaps hinder our ability to understand trading activity and liquidity." Although Reg AT, as this framework is called, is limited to the futures markets, some officials suggested that it could become a model for how to manage the risks of automated trading in other markets.

Treasury's Weiss called Reg AT "an essential new rule" and commented that it will be a "leap forward" in terms of dealing with the "new reality of trading practices." And the SEC's White signaled that her agency is also moving in this direction, telling the audience that the SEC is gearing up for a "thorough and data-driven public dialogue" on how to respond to "potentially disruptive trading strategies." At the same time, however, the tone of the official remarks suggested that principal trading firms are now viewed as a valuable part of this market, rather than dangerous interlopers. In fact, several speakers commented that capital requirements are constraining the ability of banks to provide liquidity in the Treasury market, and pointed to the PTFs as a welcome alternative source of liquidity.

Daleep Singh, the Treasury Department's head of debt management, talked about the importance of encouraging liquidity in the Treasury market. The presence of principal trading firms supports this objective, he said, by providing an additional source of liquidity that complements the role traditionally held by the banks.

"We, in coordination with regulatory agencies, are focused on the growing importance of PTFs as liquidity providers," said Singh. "We need a diverse and reliable set of institutions that can be pillars of strength in times of stress."

Treasury Futures and Treasury Securities: two markets intertwined

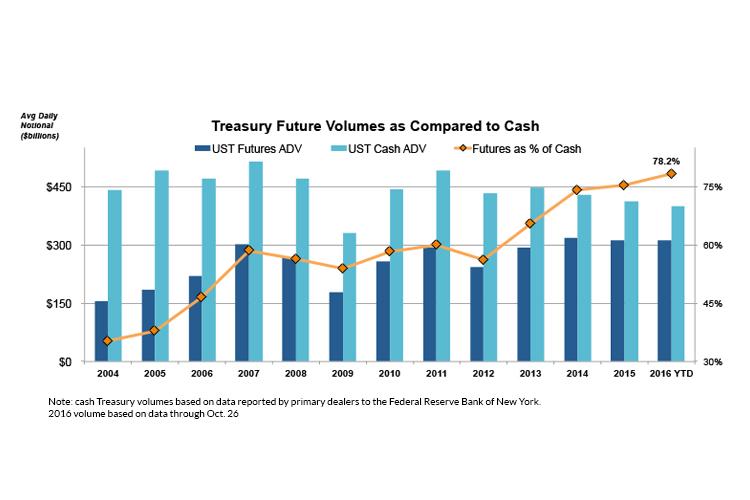

Statistics published by CME Group and the Federal Reserve Bank of New York show that since 2010 trading activity in Treasury futures has risen by more than 20% while the trading of cash Treasuries has declined. Average daily volume in Treasury futures has risen from $257.3 billion in 2010 to $312.5 billion in 2016, while average daily volume in cash Treasuries reported by primary dealers to the New York Fed has fallen from $442.4 billion in 2010 to $399.6 billion.

Put another way, the Treasury futures market continues to be smaller than the cash Treasury market in notional value terms, but its relative size has risen from 58% of the cash market in 2010 to 78% in 2016. Statistics published by CME Group and the Federal Reserve Bank of New York show that since 2010 trading activity in Treasury futures has risen by more than 20% while the trading of cash Treasuries has declined. Average daily volume in Treasury futures has risen from $257.3 billion in 2010 to $312.5 billion in 2016, while average daily volume in cash Treasuries reported by primary dealers to the New York Fed has fallen from $442.4 billion in 2010 to $399.6 billion. Put another way, the Treasury futures market continues to be smaller than the cash Treasury market in notional value terms, but its relative size has risen from 58% of the cash market in 2010 to 78% in 2016.

A research paper published by CME in June cited several factors for the trend towards higher futures volume, including changes in banking regulations that have increased demand for off-balance sheet Treasury exposure, the increasing amount of liquidity available in the Treasury futures market during non-U.S. hours, and the rising number of settlement fails in off-the-run Treasury securities. Separately, the New York Fed has published several research papers on the relationship between Treasury futures and cash Treasuries. Those papers document the tight links between the two markets, as shown by a substantial increase in cross-market trading, and the importance of both markets for price discovery.