Four Leaders Who Will Shape Financial Markets Policy in Washington

When Donald Trump stunned the world last fall with his victory in the U.S. presidential election, financial markets rallied on a wave of enthusiasm for a dramatic change in Washington. Market participants looked forward to a new administration that would pivot away from the post-crisis push for stronger regulation and focus instead on faster economic growth and fewer restrictions on capital formation and business activity.

Now comes the hard part: turning words into action. In this article we profile four key members of the new administration who will have the greatest influence on the listed and cleared derivatives markets. These four officials will redefine U.S. policy on financial market regulation, determine how much of Dodd Frank will be revised or rescinded, and decide how to fulfill the demand for growth and innovation in the financial markets.

Gary Cohn, director of the National Economic Council, and Steven Mnuchin, secretary of the Treasury, will set the overall direction of the new administration's policy on financial market regulation. Meanwhile, Jay Clayton and Chris Giancarlo are preparing to lead the Securities and Exchange Commission and the Commodity Futures Trading Commission, the two agencies that oversee the day-to-day regulation of derivatives markets. As this issue went to press, Clayton was awaiting Senate confirmation on his nomination as SEC chairman, and Giancarlo was serving as the acting chairman of the CFTC and the agency's thought leader on the need for a more market-friendly approach to regulation.

There are many other officials in the Trump administration who will also have tremendous influence on the derivatives markets. The members of the Federal Reserve, for example, will have a leading role in deciding whether capital requirements on the banking industry need to be revised. And of course the members of Congress who sit on the committees that oversee financial and commodity markets will be extremely important, since their support will be essential for any change to the law. But these four officials – Cohn, Mnuchin, Clayton and Giancarlo – are the members of the Trump team who matter the most to the derivatives markets.

Although their familiarity with the political process in Washington is limited, all four have many years of success in the kind of deal making that Trump understands and appreciates. Cohn, who was the president of Goldman Sachs before joining the White House, comes from the upper echelons of finance and has direct access to many of the most important decision makers in the business world. Mnuchin brings an unusual blend of experience from working in Wall Street and Hollywood, and he can lean on a relationship with Trump that grew out of two hotel projects that they worked on together. Clayton, a partner in the law firm of Sullivan and Cromwell, worked on some of the biggest mergers and acquisitions on Wall Street as well as the largest initial public offering of shares in U.S. history. Giancarlo brings an intimate knowledge of the swaps market, hands-on experience with managing an IPO, and a keen appreciation for the benefits of technological innovation in financial markets. All four have achieved exceptional success in the private sector, and they are now poised to bring their experience to bear on the challenges of promoting growth and innovation through regulatory reform.

Gary Cohn

Gary Cohn

NEC Director

Gary Cohn has quickly emerged as an influential voice on economic policy in the Trump administration. As the head of the National Economic Council, his role is to coordinate the policymaking process across the administration and provide economic policy advice to the president. The post of NEC director does not require congressional approval, so Cohn got off to a fast start while other cabinet nominees were waiting for Senate confirmation.

Soon after setting up shop in the White House, Cohn took charge of policy on financial regulation. On Feb. 3, he stood next to the President as Trump announced the administration's plan to conduct a 120-day review of financial regulation, and it was Cohn who explained the plan in meetings with Congressional leaders and interviews with the media. "We are not anti-regulation. We want smart regulation that allows our financial services to be the envy of the world," he said on Bloomberg television.

Cohn came to the White House after 26 years at Goldman Sachs, including 10 years as the company's second ranking executive. He started his career trading options on the floor of the New York Mercantile Exchange and ran the company's fixed income, currencies and commodities division before moving up to president and chief operating officer.

Cohn, who is registered as a Democrat but has made campaign contributions to both parties, is viewed as a voice for pragmatism in the White House and as the chief liaison to the business community. In addition to shaping the administration's plans to overhaul Dodd-Frank, he is also leading the charge on tax reform, infrastructure spending and the replacement of the Affordable Care Act. Although Steven Mnuchin will have a big say on economic issues as the head of the Treasury Department, the NEC is likely to remain extremely influential, given its policy coordination role within the White House. Just look at the history. When President Bill Clinton created the NEC in 1993, he appointed as its first director another executive from Goldman Sachs who had great success in Washington – Robert Rubin.

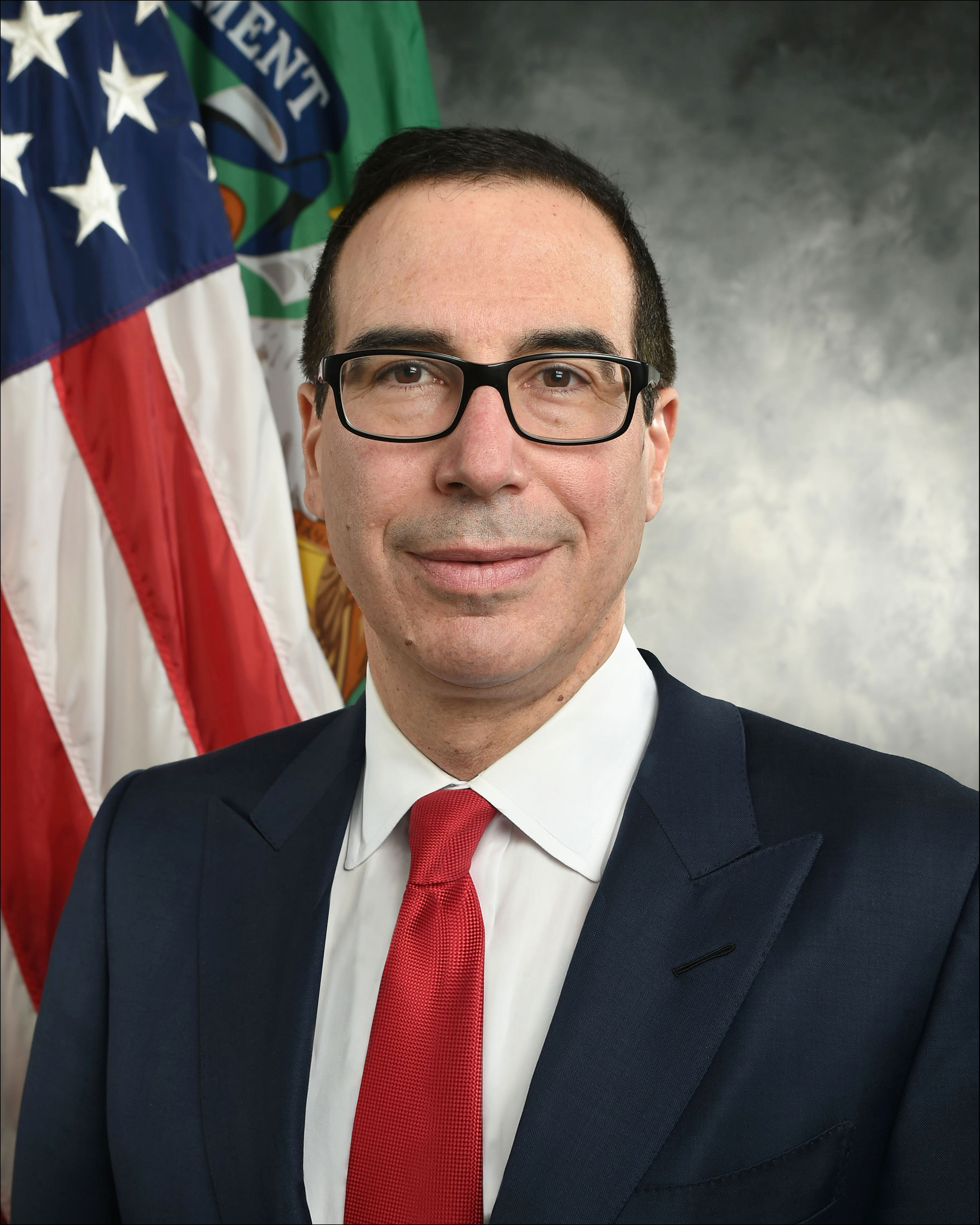

Steven Mnuchin

Steven Mnuchin

Treasury Secretary

After serving as finance chairman for President Trump's campaign, Steven Mnuchin was one of the first people that the newly elected president named to his cabinet. The former Goldman Sachs executive, movie financier and real estate lender will now serve as Treasury Secretary, the president's principal economic advisor on domestic and international financial, economic and tax issues. "He has spent his entire career making money in the private sector, and that's okay," President Trump said on Feb. 13 as Mnuchin, 54, was sworn into office.

Mnuchin has deep roots in Wall Street, most notably a 17-year stint as a senior executive at Goldman Sachs. He ran the bank's mortgage division for several years and served briefly as chief information officer. After leaving the bank in 2002, he moved to Los Angeles and started a new career in the financial side of the movie industry. The movies that he helped finance include such hits as Avatar, Gravity and American Sniper . He also got involved in the commercial banking sector, leading an investor group that bought the bankrupt residential lender IndyMac and turned it into OneWest Bank. Under Mnuchin's leadership, OneWest became the largest bank in southern California and in 2015 it was bought by CIT Group for $3.4 billion.

In his role as Treasury Secretary, Mnuchin will serve as chairman of the Financial Stability Oversight Council, the panel charged by President Trump to undertake a 120-day review of financial regulation. During his confirmation hearing before the Senate Finance Committee, Mnuchin pledged to carry out that mission. He highlighted concerns over the Volcker Rule, a provision in the Dodd-Frank Act that requires banks to fully separate their proprietary trading. He said he supported the rule in principle, but criticized it for being overly complex and for limiting liquidity. "That's something I would absolutely want to look at," he told lawmakers.

One immediate challenge is averting a debt ceiling crisis. On March 15, Congress's latest suspension to the U.S. borrowing limit expires. "I would like us to raise the debt ceiling, sooner rather than later," Mnuchin told lawmakers in his confirmation hearing.

Mnuchin joins the ranks of other former Goldman executives who served as Treasury Secretary: Robert Rubin, who served during President Clinton's administration and Hank Paulson, who served under President George W. Bush. Although this is Mnuchin's first ever role in public service, his ties to Trump go back well before the campaign. His hedge fund, Dune Capital Management, helped finance the construction of a Trump hotel and condominium tower in Chicago, and he worked with Trump on a hotel project in Hawaii. Those deals helped cement a personal relationship with Trump that led to his fundraising role in the campaign and to his new role in the Trump administration.

Christopher Giancarlo

Christopher Giancarlo

Acting CFTC Chairman

Important things to know about Christopher Giancarlo: he plays the banjo, he is the owner of a mint condition '73 Buick convertible and he thinks there are many things about financial reform that need to be fixed. Now he is in position to make those changes. In January, he was designated the acting chairman of the Commodity Futures Trading Commission, putting him into position to take the agency in a new direction.

Since joining the CFTC as a commissioner in the summer of 2014, Giancarlo has emerged as a thoughtful critic of the CFTC's rulemakings and a strong advocate for a more "forward-looking" approach to market regulation. He maintains that he supports the core reforms of Dodd-Frank, namely data reporting, central clearing and registration of swap dealers, but he has been critical of the CFTC's implementation of the law. In his view, the agency should take a more principles-based approach to regulation to reduce unnecessary burdens on market participants and encourage innovation.

Before entering public service, Giancarlo was an executive vice president of GFI Group, an inter-dealer broker in financial and commodity markets. He was responsible for strategic relationships and transactions, including mergers and acquisitions, strategy development and government relations. He directed GFI's initial public offering in 2005 and led the acquisition of Trayport, an energy trading platform, in 2008.

Giancarlo has highlighted the need for the CFTC to embrace innovation and encourage the adoption of new technologies such as blockchain.

Shortly after joining the CFTC, Giancarlo wrote a white paper that analyzed the flaws in the CFTC's implementation of the swaps rules in Dodd-Frank. He called for a more flexible trading requirement for swaps, stating that the CFTC's approach was highly over-engineered and disproportionately modeled on U.S. futures markets. Now that he is the acting chairman, Giancarlo has vowed to move forward with an alternative regulatory framework that allows for more flexibility in the way swaps are traded. "It will help to attract, rather than repel, global capital to U.S. trading markets," he recently told members of the swaps trading community.

Right now there are three vacancies on the commission, with Democrat Sharon Bowen being the only other commissioner. That hampers Giancarlo's ability to draft new rules, but even so he is already putting his mark on the agency. On Feb. 13, he gave swap market participants more time to comply with the variation margin requirements due to take effect on March 1. The CFTC staff issued a letter providing a six-month "grace period" for market participants to come into compliance. Giancarlo noted that as many as 90% of the industry's customers were not ready to meet the new requirements, and said this action "foams the runway to ensure a safe landing."

Giancarlo has highlighted the need for the CFTC to embrace innovation rather than stymie the advancements of new technologies such as blockchain. In a speech last year he asserted that regulators should "listen and learn" from financial technology firms and give them more "breathing room" to grow. He also has been outspoken about protecting the intellectual property of market participants and has criticized the agency's efforts to gain access to proprietary source code without a subpoena. "Market regulators must stand up for intellectual property," Giancarlo said in a recent podcast.

Jay Clayton

Jay Clayton

SEC Chairman

For the derivatives markets, the new head of the Securities and Exchange Commission could prove to be a change of direction in both policy and perspective. In contrast to the previous two chairs, Jay Clayton, a partner at Sullivan and Cromwell, is neither a prosecutor nor a rule-writer. He brings to the agency years of experience advising financial corporate executives on how to raise capital and engage in mergers, acquisitions and spin-offs.

During the financial crisis, he advised Bear Stearns on its sale to J.P. Morgan, Barclays in its purchase of the core U.S. business of Lehman Brothers shortly after that firm's bankruptcy, and Goldman Sachs in its negotiations with Warren Buffett on a $5 billion infusion of capital. More recently, he advised Alibaba, the Chinese ecommerce company, on its initial public offering in 2014. That offering raised $25 billion, making it the largest IPO in U.S. history. He also has experience with commodity trading firms. In 2012 he advised a group of investors that formed Castleton Commodities through the purchase of the energy trading joint venture backed by Louis Dreyfus and Highbridge Capital. Three years later he advised Castleton on its acquisition of Morgan Stanley's oil merchant business. In a nutshell, he is the kind of lawyer who knows the "art of the deal."

As this issue went to press, the Senate had not yet confirmed the nomination, but Senate Republicans such as Mike Crapo (R-Idaho), the chairman of the Senate Banking Committee, expressed strong support for Clayton. If and when confirmed, he will join Republican Michael Piwowar and Democrat Kara Stein on the commission. Two other seats remain vacant, giving President Trump the opportunity to make a decisive change in the SEC's composition.

The new chairman will face a challenging agenda. Many senior staff left the agency during the transition to the new administration, including the heads of the enforcement division, the trading and markets division, and the economic and risk analysis division. One of his first tasks will be to fill these vacancies. More importantly, he will set to work on fulfilling the mandate set by President Trump, namely, to reorient the SEC to promoting capital formation.

"Jay Clayton is a highly talented expert on many aspects of financial and regulatory law, and he will ensure our financial institutions can thrive and create jobs while playing by the rules at the same time," Trump said when he announced the nomination on Jan. 5. "We need to undo many regulations which have stifled investment in American businesses, and restore oversight of the financial industry in a way that does not harm American workers.”