Disclosing the results of stress tests can help clearing members make meaningful comparisons among central counterparties.

In the paper “Stress This House,” LCH proposed a stress testing regime for central counterparties that would enable members to draw meaningful comparisons among CCPs, regardless of the variations due to product portfolio, margin models, confidence levels, default fund structure, assessments levels, etc. While there has been much discussion on this topic, it is fair to say that there has not been much agreement on how best to proceed.

The CPMI-IOSCO Quantitative Disclosure requirement is a good start on which to base the CCP comparison, but members have been continually asking for more detailed information.

Key Questions Answered in the Stress Test Report

In the experience of LCH, member concerns boil down to two basic questions:

- How safe are my margins, and by extension, my default fund contribution?

- What is the maximum assessment that I could be asked to provide, and in what circumstances?

The approach taken here to answering these questions is to leverage the fact that a CCP is required to meet the cover two standard, and that the stress scenarios implicit in the default fund sizing have been signed off by regulators. This means that a member knows that at least three clearing member defaults will have to occur simultaneously before the default fund contributions of non-defaulted clearing members will need replenishment and the CCP will need to make a further assessment.

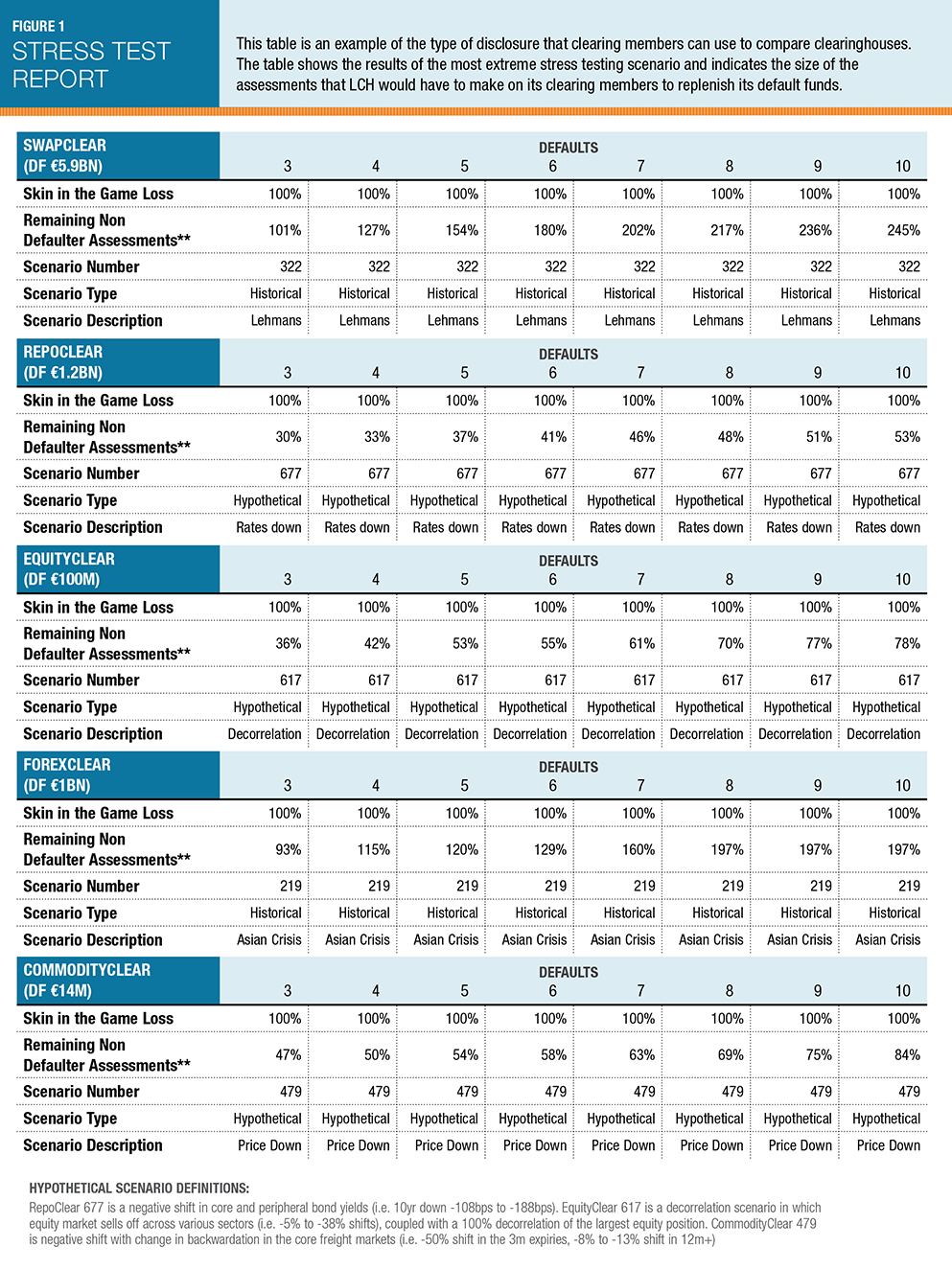

The stress test report shows how the assessments grow (as a percentage of surviving member default fund contribution) as more and more members default. These are the maximum assessments, given a specified number of defaults, which would be called under the most adverse market scenario among all those scenarios that drive the default fund. At LCH, the ceiling on assessments is one assessment per default up to and including three defaults within six months.

The report also indicates the prevailing market stress scenarios that would drive these assessments, in answer to question two. Question one is also addressed since default fund contributions of non-defaulting members are at risk only after bilateral margins of the defaulting member(s) have been exhausted.

Perhaps the most surprising aspect of the information provided to members is that even after the simultaneous default of 10 member groups, there will only have been two assessments in the SwapClear default fund and less than a full assessment in the RepoClear default fund, under the most adverse stress scenario governing the default fund.

Description of Stress Test Report

Each default fund listed is segregated by clearing service. This means that the collapse of any one clearing service will have no impact on the waterfall of the other four clearing services offered by LCH. This removes any misleading benefit driven by inadvertent correlations, as described in the "Stress This House" paper.

For each default fund in the CCP, the table sets out the following information:

1. Size of the Default Fund

2. Skin in the Game Loss

- Skin in the Game refers to the portion of a CCP’s own resources incorporated in the default waterfall. The Skin in the Game Loss is the percentage used in the particular default fund if a specified number of member groups were to default. It assumes the members who generate the maximum losses have simultaneously defaulted under the most adverse market scenario driving the default fund.

3. Remaining Non Defaulter Assessments

- This is the worst assessment (expressed as a percentage of a surviving member’s default fund contribution) that would be called in a default scenario if a specified number of member groups were to default under the most adverse market scenario driving the default fund.

- For example, in SwapClear, if five member groups were to default simultaneously under the most adverse market scenario, the surviving members would be assessed and required to provide 154% of their previous default fund contribution. Upon completion of this assessment, the default fund would be back to the prefunded level of surviving members.

4. Scenario ID

- This identifies the governing market scenario, which may or may not vary depending on the number of defaults that have occurred.

- The description of the market scenario corresponding to each ID is detailed in the footnotes.

5. Scenario Type

- This describes whether the governing market scenario is Historical or Hypothetical (Antithetic, De-Correlation); these scenarios are constructed under the standardized rules described in the “Stress This House” paper.

6. Scenario Description

- If the scenario is a historical event, the time of such an event is indicated so that clearing members can reconstruct the associated market parameters from their own systems.

- If the scenario is antithetical, that is the “opposite” market move to an actual historic event, and the time of that event is then specified so that the members can construct the associated market parameters from their own system.

- If the scenario is labelled “De-Correlation,” the paper “Stress This House” indicates how to reconstruct the details. For example, for rates products, the Principal Component Analysis (PCA) is used. For products with specific risk, such as equities, the process is to identify the name that provides the most beneficial hedge among all scenarios governing the default fund, and then to apply a 100% de-correlation from the governing scenario to that name.