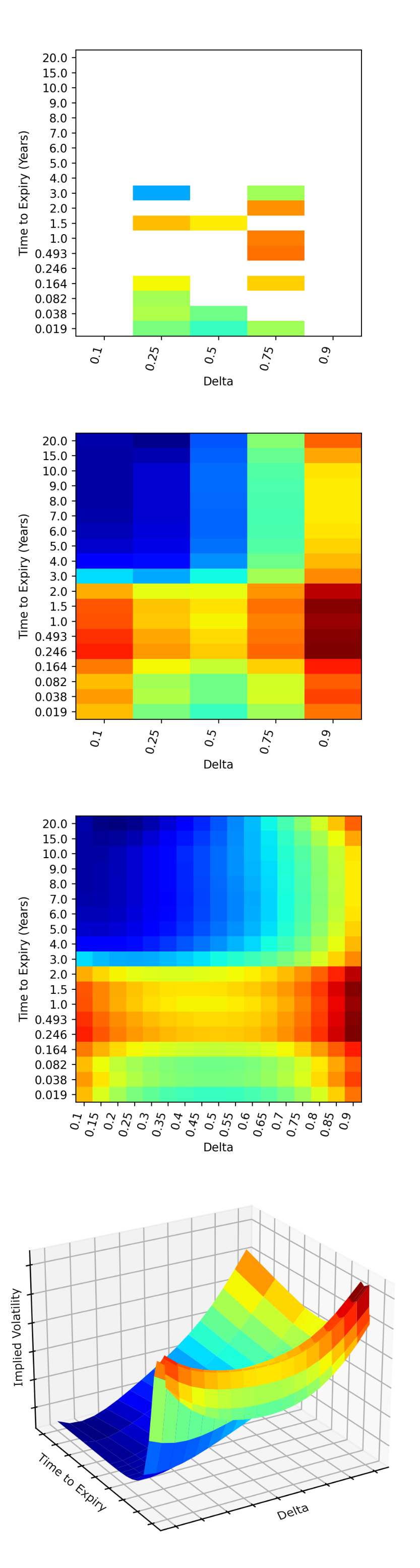

Riskfuel volatility surfacesThe following figures show the progression (from top to bottom) of a partially observed heatmap, to the completed heatmap, to the finely-interpolated heatmap constructed using a trained variational autoencoder. The fourth image is a 3D representation of the finely-interpolated heatmap. |

This article was contributed to MarketVoice by Riskfuel, a Canadian startup that won FIA's Innovator of the Year award in 2020.

Option traders like to think and communicate in terms of implied volatilities. An implied volatility is the volatility that, when plugged into the Black-Scholes equation, gives the observed price of the option. Implied volatilities are then useful for comparing options of different terms or strikes.

By arranging listed options in a matrix by term and strike, we can construct a surface of these implied volatilities. A quick glance at a surface can give an option trader a very meaningful understanding of the entirety of the options trading on an underlying in an instant.

By fitting a surface through the traded points, traders can also use the surface to interpolate or extrapolate implied volatilities for OTC products.

How do traders build a volatility surface?

In practice, building a volatility surface is quite challenging. Often only a few points are available to define the entire surface and gap-filling techniques are needed to get the full market’s view of the underlying asset. Current approaches are based on assumptions about the shapes of surfaces, and therefore only good while those assumptions hold. Second, generating surfaces is quite manual with practitioners having to hand-tune surfaces slice-by-slice and patching them together to get a good fit. This is particularly difficult when some of the terms and strikes are infrequently traded and the current best estimate of a tradable price is very uncertain.

Fortunately, traders no longer need to settle for the status quo! Riskfuel has developed a technology to automatically complete volatility surfaces for even the most illiquid assets. The technology is purely data-driven and makes no assumptions about the process driving the underlying asset, nor about the shape of the surface. By completely removing human bias from the equation, new insights into volatility dynamics are now possible.

Riskfuel uses a type of deep neural network called a variational autoencoder to learn the space of all possible volatility surfaces for a particular asset class. Once trained, a variational autoencoder provides a fast, robust, and interpretable method that can complete volatility surfaces from partial information in real time.

A technical paper discussing the intricacies of the technique is available here: Variational Autoencoders: A Hands-Off Approach to Volatility.

Fast and accurate volatility surface completion opens the door to new game changing applications. It allows market participants to monitor data for outliers and trading opportunities. Variational autoencoders can also be used to perform realistic stress testing by creating realistic synthetic volatility surfaces. Improbable parallel shifted volatility surfaces can finally be relegated to history books.

Learn more about Riskfuel at Riskfuel.com

About Maxime Bergeron, Director of Research and Development at Riskfuel

Maxime conducts cutting edge research in applied machine learning and the topology of high dimensional data. Prior to joining Riskfuel, Maxime was a faculty member in the Department of Mathematics at the University of Chicago where his research program focused on understanding the shape of high dimensional parameter spaces. He has a PhD in Mathematics from the University of British Columbia and a BSc/MSc in Mathematics from McGill University.