Welcome to Future Industry’s annual volume issue. Like many of you, I love data and find it fascinating to look at volume numbers across various asset classes, exchanges and regions. These numbers reveal certain emerging trends in our industry.

Last year’s data reveal some positive indicators going forward. I’m glad to see that futures exchange trading in the U.S. is up 6% from 2013 and it’s exciting to see the explosion of trading on Chinese exchanges. Unfortunately, we are still struggling globally to recover the type of growth we saw before the financial crisis. In 2014, the total number of futures and options traded on exchanges worldwide rose by only 1.5%.

It’s clear that—beyond the forces of supply and demand—regulation continues to be a heavy drag on growth. Since the financial crisis, we’ve done a good job of making our markets safer. But not at the expense of their ability to exist. We must make the rules proportional, predictable and cost effective so that our industry can innovate and thrive.

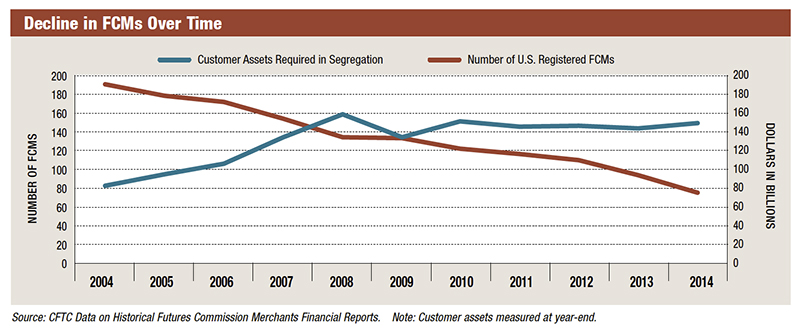

One of the most critical obstacles to growth is the considerable rise in the costs of clearing. Today, there are fewer than 80 clearing members registered with the Commodity Futures Trading Commission and that number is less than half what we had 10 years ago.

Clearing firms are the foundation of the clearing system on which we all rely. They provide access to clearing and the lion’s share of the capital that backstops clearinghouses.

One significant cost is derived from the new Basel capital rules, which will require clearing members for the first time to hold capital against safeguarded customer funds, despite these assets being segregated under client protection rules. These new capital rules will make it more expensive for end-users to hedge and clients to access the markets. That’s a troubling pattern that runs against the goals from the financial crisis of pushing unregulated products onto clearinghouses.

We also need to find ways to encourage innovation. There are plenty of people in our industry who are eager to invest in new markets, but if the cost and uncertainty of compliance with the new regulatory framework are too high, there are plenty of other sectors in the global economy where opportunities beckon. We need to think about how to incentivize innovation.

Consider swap execution facilities, a new type of trading venue designed to bring more transparency to over the counter derivatives. The first year of data shows that the notional value of swaps traded on SEFs was actually lower in the second half of the year than in the first half. It is too soon to write an obituary for the SEFs. Nonetheless, I can’t help but think that the rules governing SEFs may need some adjustment if we want more than a handful to succeed.

I encourage regulators to think about our markets as an ecosystem. Having a healthy clearing community with a wide range of business models and a steady drive for innovation isn’t just good for business, it’s a source of strength for the financial system as a whole.