Q&A with Matthias Graulich of Eurex Clearing

Capital efficiency is now at the top of the agenda for clearing firms and their clients as a result of Basel III and other changes in the regulatory environment. How is Eurex Clearing responding to this need?

Capital efficiency is now at the top of the agenda for clearing firms and their clients as a result of Basel III and other changes in the regulatory environment. How is Eurex Clearing responding to this need?

Our industry is facing many challenges. There is increasing regulatory pressure and uncertainty on client clearing on multiple fronts, from Basel III to the European Market Infrastructure Regulation (EMIR) and MiFID II. Overall we are seeing an increase in capital requirements and the demand for collateral, while at the same time the supply of collateral is tightening and the need for clearing is rising.

Eurex Clearing’s objective is to help clients address these challenges by offering solutions and services to mitigate these regulatory impacts. Our integrated CCP model allows for capital, margin and collateral efficiencies while at the same time offering superior client protection and a solid default management process. By offering solutions like cross margining through Eurex Clearing Prisma across listed and OTC derivatives, we provide the tools for our clients to optimise their margin requirements.

Our latest solution is ISA Direct, which provides direct access to the CCP for buy-side clients. It allows for higher capital efficiencies with both derivatives and securities financing transactions while at the same time it increases the safety and integrity of the market by reducing concentration risks, increasing asset protection, and improving likelihood for portability. We are currently working with clients in a pilot phase and the full service will launch this summer.

The clearing mandate for the European swaps market will start taking effect in June 2016. What steps are you taking to prepare for this?

We launched our EurexOTC Clear service for interest rate swaps a few years ago, talking with clients to meet the market needs for the clearing of OTC transactions by reducing counterparty risk, margin and collateral requirements and at the same time providing client asset segregation and legal certainty.

For instance, we were the first CCP to launch an EMIR compliant Individual Segregated Clearing Model. Our Individual Segregated Account (ISA) model offers full physical segregation of a disclosed client’s positions and collateral. This differs from value-based models where only a value equivalent is protected instead of the client’s actual assets.

On-boarding and business activity has made good progress over the last 18 months. Today, we have 50 clearing members and 105 registered customers, with many more in the on-boarding process. Over 70% of our registered customers have on-boarded under the ISA model.

With mandatory clearing of interest rate swaps for category 1 firms starting in June, we are seeing a significant increase in volume in cleared notional outstanding as well as monthly cleared notional. In April alone, we cleared an average daily volume of EUR 6.2 billion with a notional amount outstanding of EUR 451.8 billion at the end of April, and we are confident that we will continue to build critical mass.

Eurex Clearing now offers portfolio margining for interest rate futures and swaps through Eurex Clearing Prisma. What types of members and clients are most likely to benefit from this service?

Sell-side and buy-side clients alike can benefit from cross margining at Eurex Clearing. Eurex Clearing Prisma permits cross margining between products as well as across markets. Prisma calculates risk and margin on a portfolio basis segmented by pre-defined Liquidation Groups each comprising closely correlated products. Our default management process, by the way, is also aligned to these product groups.

Since February, our Italian and Spanish interest rate derivatives (FBTS, FBTM, FBTP and FBON) are part of the cross margining optimizer, giving our members a broader ETD product range in order to offset OTC exposure to reduce their initial margin requirements.

Of course clients with offsetting positions in listed and OTC derivatives, such as firms running relative value strategies or firms using futures to hedge or warehouse their OTC exposures, benefit the most. However all clients benefit from a single risk management approach across all derivatives products, with payment netting across all cleared products.

Overall I believe that the full potential for cross-product margining—including listed, OTC and hybrid products like the deliverable swap future—will unfold in the coming 12-24 months as banks become more accustomed to using the full suite of derivatives products more flexibly to manage their risks.

Eurex Clearing is introducing a new account structure called ISA Direct. How does this differ from existing models for clearinghouse membership?

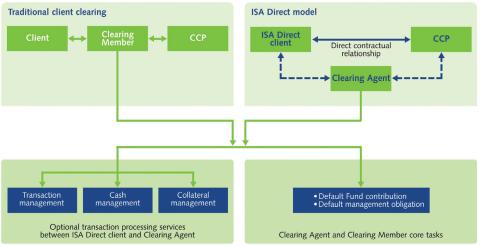

This type of account structure combines elements of a direct clearing membership and the traditional service relationship in client clearing. Our regular clearing members will continue to act as a clearing agent, providing a variety of mandatory and optional service functions, but the client becomes a direct member of the clearinghouse. We think this will reduce the impact of the Basel III capital requirements on the cost of clearing and expand access to clearing for buy-side firms such as fund managers and insurance companies.

What are the main benefits for clients?

One important benefit is that this model will enhance portability. In other words, it will be easier for clients to move their positions and assets from one clearing to another. This is especially important given the declining number of firms that are willing to provide clearing services. Another important benefit is cost. We expect that this account structure will reduce the capital requirements for banks to offer better terms to their clients. There is also a benefit in collateral management. Once a client becomes a member of Eurex Clearing, it will be able to take advantage of the integration between our clearinghouse and Clearstream. For example, an asset manager with an ISA Direct account will be able to use our Repo and GC pooling services.

What types of products will be clearable through ISA Direct accounts, and what types of clients do you expect to use this type of account?

When we launch this summer, we will limit the product range to interest rate swaps and repo transactions. Our view is that this is where the potential demand for direct access is especially urgent. But we plan to extend the new account structure over time to all asset classes that we clear, including listed futures and options.

We mainly expect insurance companies, pension funds, investment funds and other financial institutions to show the most interest. Another group of potential clients would be banks that are not clearing members and need to clear their derivatives trades. I should caution that firms must be domiciled in the European Union or Switzerland in order to become an ISA Direct client.

What responsibilities will clients have if they become direct members of Eurex Clearing?

They will be responsible for meeting margin requirements by posting collateral under the same conditions and deadlines as with our other account structures. They can opt to do this themselves, or rely on their clearing member to handle this on their behalf. That is up to each ISA Direct client to decide in negotiation with its clearing firm. They will not be responsible, however, for contributions to the Eurex Clearing default fund or any of the functions that clearing members must undertake whenever there is a default. For example, an ISA Direct client will not be required to participate in an auction for the assets of a defaulted member.

What will be the role of the clearing member in this type of account structure?

In some ways, the role is not that different from the traditional role. The clearing member covers the default fund contribution and the default management obligation for its clients. The clearing member also handles certain operational and financing functions for its clients, such as cash management and the movement of collateral, if the client decides to delegate those functions to its clearing firm. What is different is that the client has a direct contractual relationship with Eurex Clearing and maintains legal and beneficial ownership of all collateral.