Osaka Exchange launched their new derivatives trading platform in July that delivers faster performance, greater capacity, and the ability to support new types of derivatives contracts. Matthias Rietig, Senior Officer at the exchange, puts the technology strategy into historical context.

Osaka Exchange, the derivatives arm of Japan Exchange Group, is now in the second phase of an ambitious technological transformation. When Osaka Exchange and Tokyo Stock Exchange merged in 2013, the two companies decided to combine their futures and options contracts into a single market based on OSE's J-Gate. This platform was introduced in 2011 and was based on the Click technology originally developed by OMX (currently Nasdaq).

While the consolidation provided significant benefits to local and international traders, the exchange almost immediately began exploring the potential for an upgrade. After several years of preparation, the exchange launched a new platform in July that offers tremendous improvements in speed and capacity. Just as important, especially for the clearing firms that support the exchange, the new platform offers a suite of risk controls designed to prevent error trades before they even reach the matching engine.

The introduction of a more advanced trading platform is part of a broader effort to modernize the listed derivatives markets and make them more accessible to international investors and hedgers. At the same time, the new platform is tailored to the unique characteristics of the Japanese market, one of the oldest futures markets in the world.

Origins in Osaka

The history of exchanges in Japan goes back to the 18th century. At that time, Samurai lords all over the country built warehouses in Osaka to transfer and store rice, which at that time was used to pay taxes. They sold the rice to merchants through auctions at an exchange in Osaka called Dojima Rice Exchange. The merchants traded rice stamps instead of heavy and bulky bales of rice. This trading was called Sho-mai trading. In anticipation of price fluctuations, the merchants traded rice at a certain time and settled the trade by offsetting buying and selling at a future point in time. These trades were recorded and settled in books of accounts and called Cho-ai-mai (rice futures) trading. The Dojima Rice Exchange operated Sho-mai trading market and Cho-ai-mai trading market, and Cho-ai-mai (the futures) was their main trade.

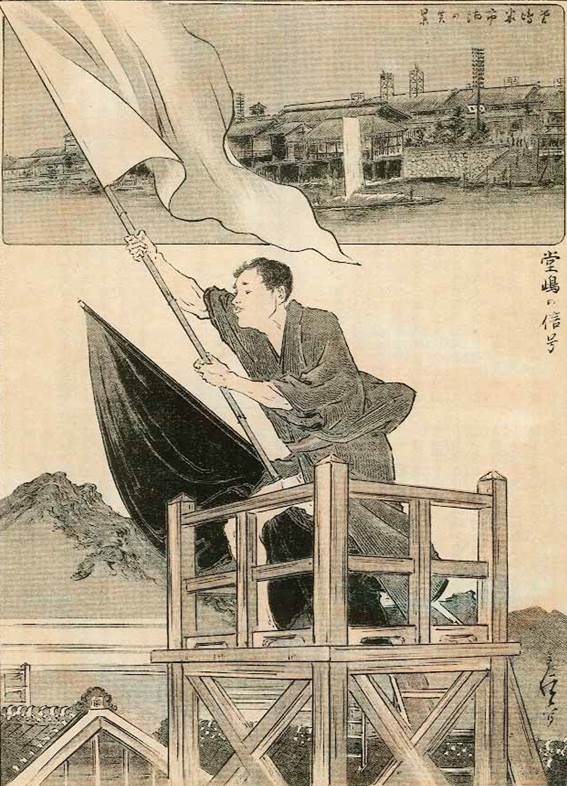

The Dojima Rice Exchange separated the market into three distinct functions: exchange operations, administrative works, and clearing operations. The exchange also had several other features associated with modern futures exchanges: contract-months, margin, leveraged trading, and a circuit breaker system. Moreover, it had a market data distribution system. The prices determined in Dojima Rice Exchange were carried across Japan via networks of express messengers between Osaka and the main rice producing regions. It took six days to transmit the rice price information from Osaka to Edo (today named Tokyo), 400 kilometers / 250 miles away. Later a flag-signal system was started. Market information was passed from one mountain to another by waving flags. The systems were coded; for example, two waves from right to left meant a bull market. Thanks to the combination of the flag signals and the express messenger networks, the transmission time between Osaka and Edo was reduced to eight hours. This method was used until the telephone became a common form of communication.

The Modern Era

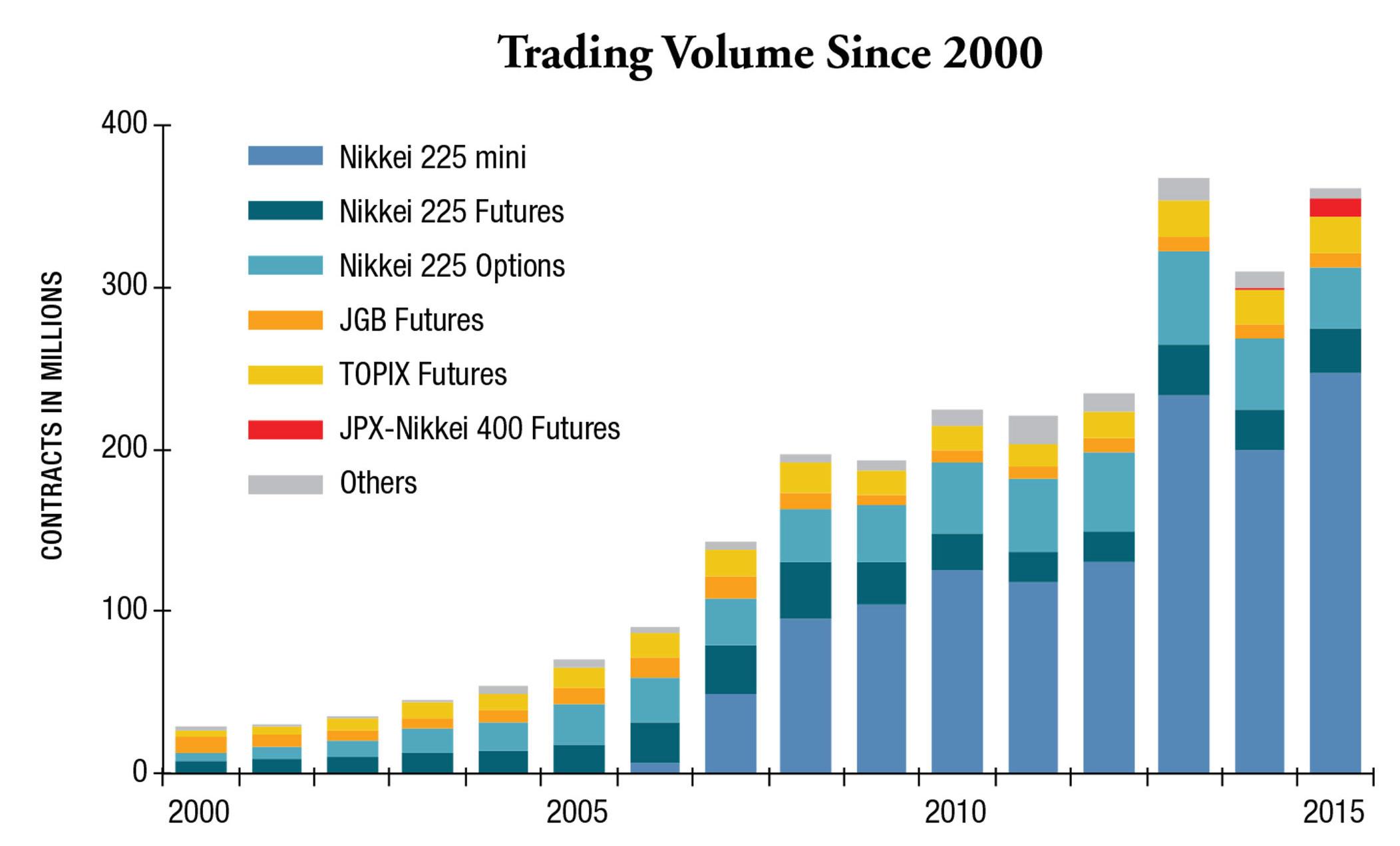

Although commodity futures have been traded in Japan for more than two centuries, financial futures were not introduced until relatively recently. Futures on Japanese government bonds were introduced in 1985, and the two main stock index futures—the Nikkei 225 and the Topix—were introduced in 1988.

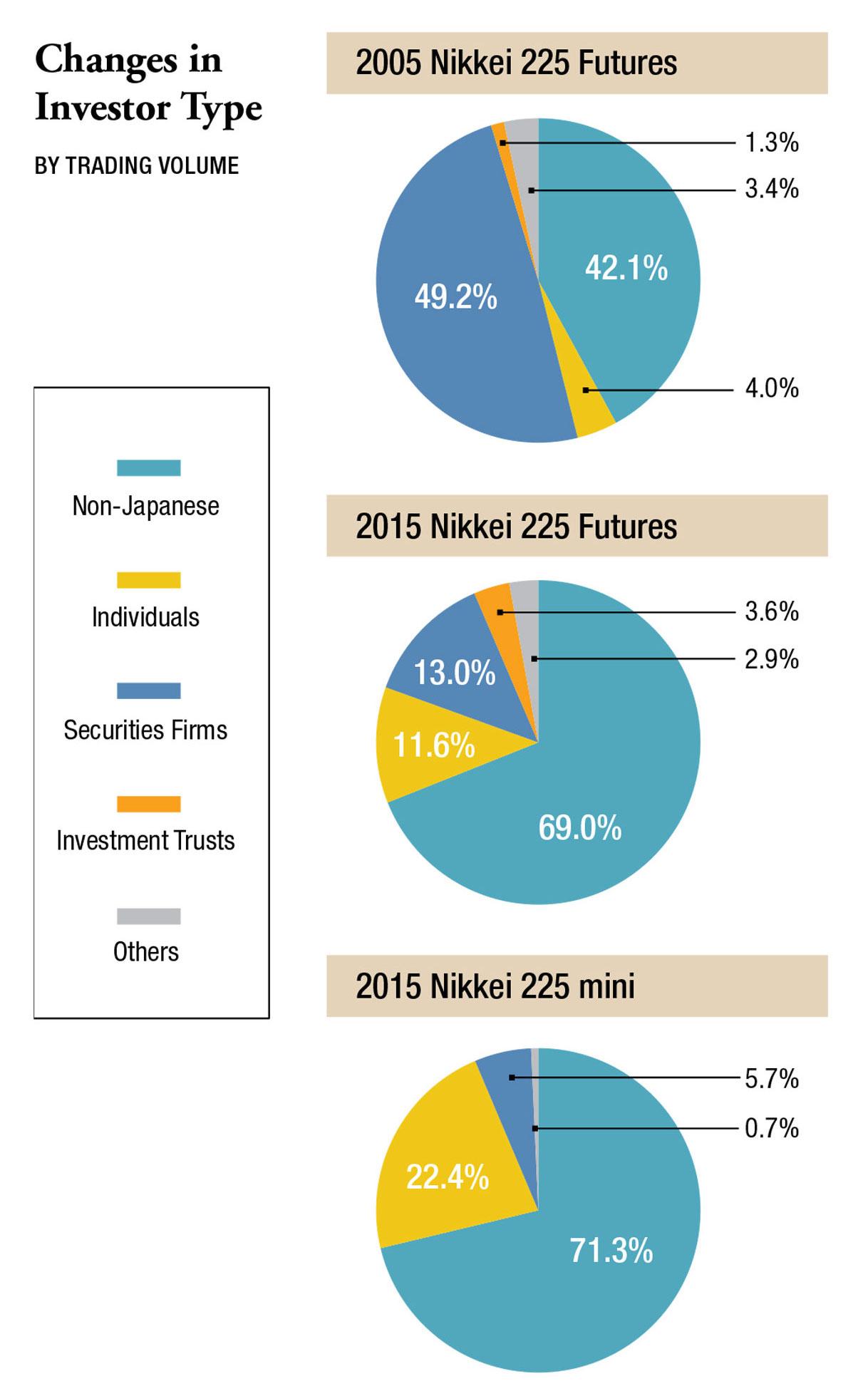

Initially the market was dominated by securities firms and other institutions, but that began to change after the introduction of the Nikkei 225 mini contract in July 2006. The smaller contract size attracted retail investors, and by 2007 retail trading had risen to 10% of overall trading. The Nikkei 225 mini today is the most heavily traded derivatives contract on Osaka Exchange, accounting for nearly two thirds of the exchange's volume.

The exchange has long recognized the importance of technology. One of the main reasons for the decision to adopt OMX technology in 2011 was to take advantage of what was then the state of the art in international derivatives markets.

Today the new J-Gate platform brings the exchange to the forefront in technology. For example, the old platform took two milliseconds to process an order message. The new platform takes less than 100 microseconds (average response), which is 20 times faster. The old platform could process up to 12,000 orders per second. The new platform can process as many as 100,000 orders per second, which means order processing capacity has risen by eight times.

The new platform offers not only improved capacity and lower latency but also new functions: ITCH protocol for multicast market data distribution and an enhanced risk management system called TradeGuard. This system allows controls to be set at the exchange level, and all trades sent to the exchange pass through these controls.

Along with the launch of the new platform, we expanded our product line by adding four equity index products: TSE Mothers Index Futures, TAIEX Futures, FTSE China 50 Index Futures, and JPX-Nikkei 400 Index Options. The TSE Mothers Index Futures track the startup companies market in Japan. As companies listed on TSE Mothers are not eligible to be dually listed on TSE 1st section, constituents of TSE Mothers Index are completely different from those of Nikkei 225 or Topix. Hence TSE Mothers Index moves in a unique way. The TSE Mothers Index Futures started with trade by Japanese retail investors, and gradually trade by non-Japanese is growing.

Additionally, in September 2016, Tokyo Commodities Exchange, one of the major commodities derivatives exchange in Japan, started using our trading platform. Now, investors can trade even commodity futures and options on our new J-GATE.

The new decade has just begun. We continue to challenge ourselves and constantly seek innovation to create and build an attractive marketplace.