Sponsored content by Kemet Trading, a provider of institutional-grade infrastructure for digital asset derivatives trading. Kemet Trading won the People’s Choice award at FIA’s Innovators Pavilion in 2022.

At Kemet Trading, we believe that digital asset derivatives are the next frontier of institutional trading. To put things in perspective, the trading volume for US equity options is around 3500% larger than the spot market. In the digital assets market, that same comparison is 2%. Although there is a massive opportunity for growth in the digital asset derivatives market, the market is currently extremely inefficient.

In this article, we will dive deeper into:

- Why institutions prefer derivatives over spot instruments.

- The complexity of trading, as an institution, in a fragmented digital asset derivatives market.

- How Kemet Trading is solving for the fragmentation and changing the landscape of the digital derivatives market for institutions.

Why institutions prefer derivatives over spot instruments

Derivatives provide institutions more benefits over their spot counterpart:

- Leverage: The ability to leverage positions is fundamentally enticing for higher “CAGR”; leverage allows for a substantially higher alpha overall.

- Reduced Operational Risk: Derivatives allow institutions to gain synthetic exposure without the need for custody of any underlying asset. Custody is a friction-heavy process.

- Efficient Hedging: Derivatives help mitigate various risk exposures. Every major institution utilizes derivatives in some form or another for hedging market volatilities.

- Deep Liquidity: Almost every digital asset derivative is cash settled. This drives a more capital efficient market-making operation; translating to deeper liquidity across the market.

Trading Digital Asset Derivatives: A Complex Landscape

Digital assets lack the infrastructure necessary to execute elaborate derivative strategies adjacent to traditional markets. Institutions struggle to maneuver a market that is fragmented across liquidity, data and execution.

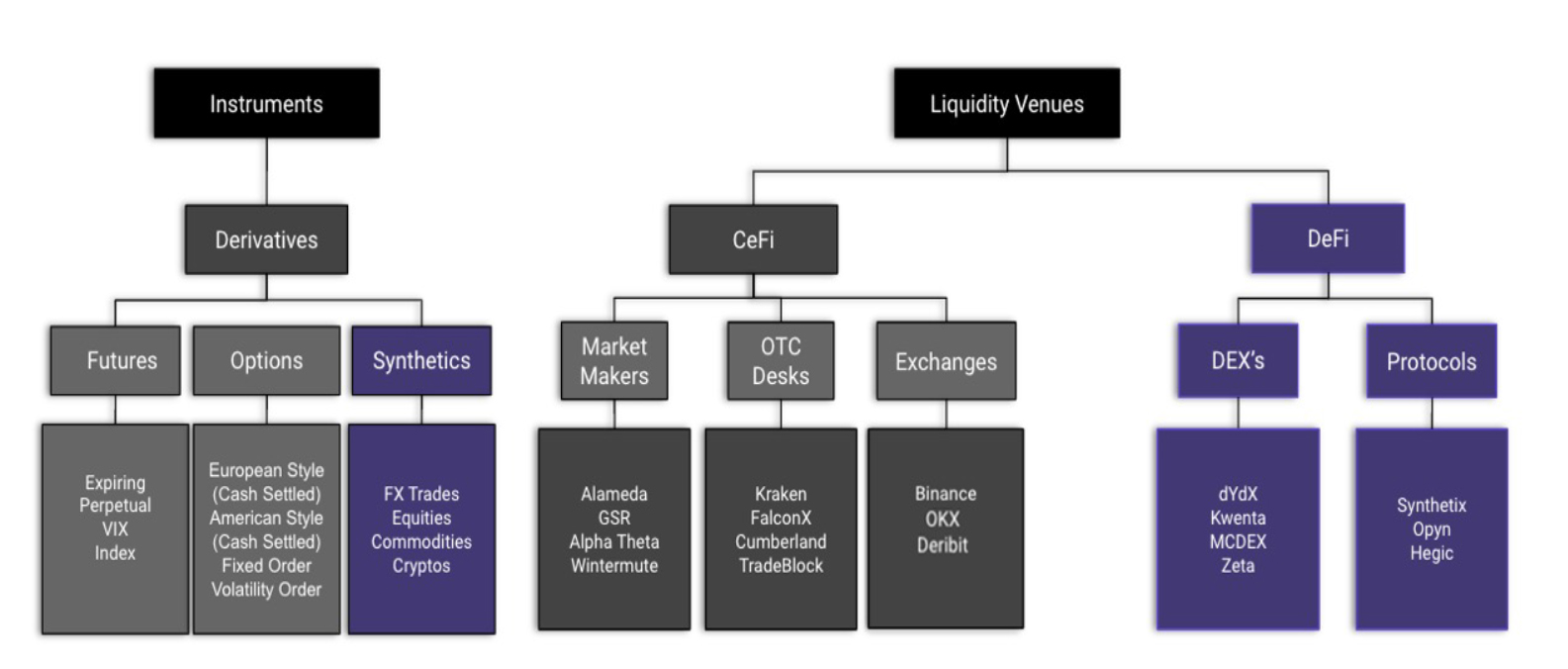

The following diagram depicts the current state of the digital asset derivative market as it stands:

Running a digital asset derivatives trading desk in this state is cumbersome:

- Multiple traders executing hundreds of trades a day using various instruments across multiple liquidity venues means that there is no central trade blotter. This risks desk performance and results in an increased margin of error throughout trading sessions.

- Fragmented liquidity venues make desk management and the trade lifecycle overly complex.

- Fund admins struggle to onboard multiple liquidity venues and track the desk’s outstanding positions.

- Risk managers lack necessary tooling for real-time tracking of positions, options Greeks and leverage ratios.

- Auditors deal with multiple exchanges, both domestic and global, in an unclear regulatory environment. This makes compliance difficult.

- DeFi trading is complicated. Running a DeFi trading desk across multiple supporting functions is even more complicated.

It’s a mess that needs fixing for this asset class to grow to a size on par with traditional markets. All of these moving parts make it difficult for institutions to find an efficient workflow to better their performance and maintain their edge across the market.

How Kemet Trading is changing the landscape of digital asset derivative trading for institutions

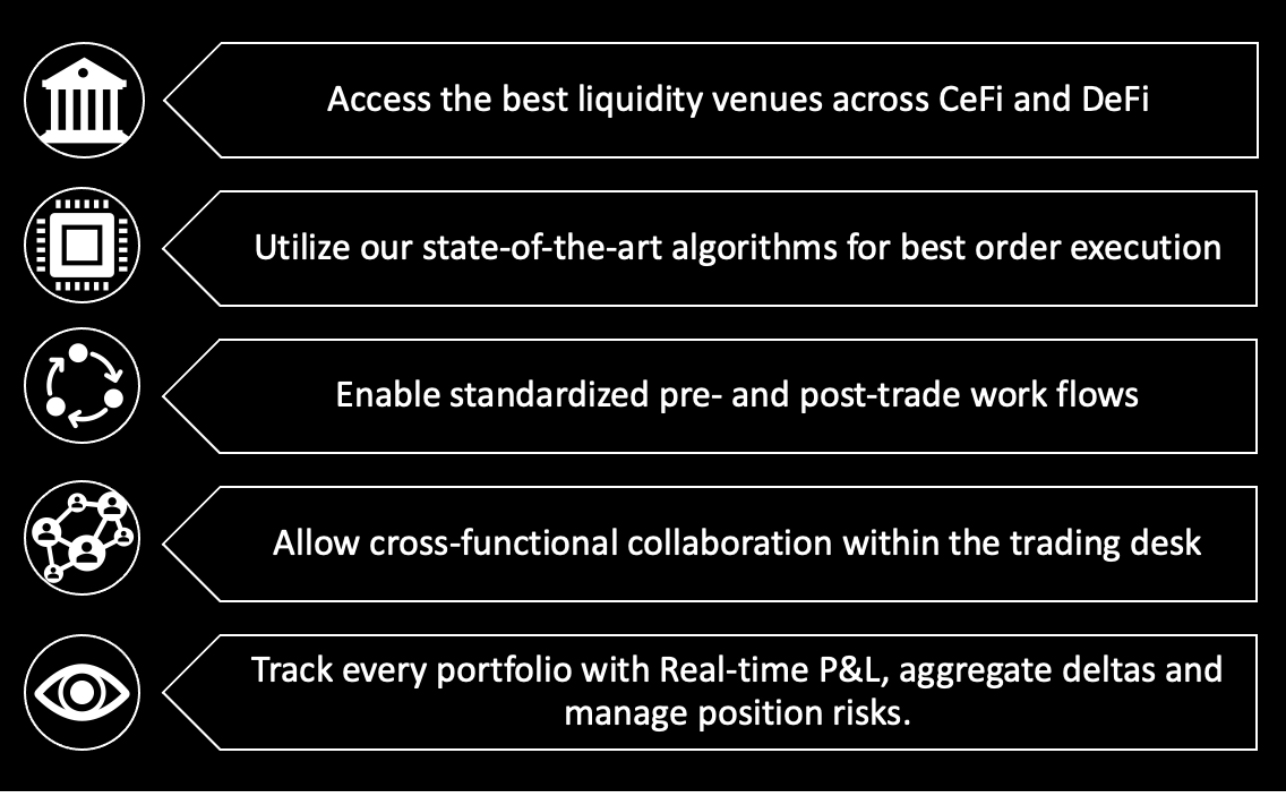

Kemet Trading is the streamlined solution to trade digital asset derivatives designed for institutional investors. Our offering allows firms to:

We provide institutions with the only platform necessary to access the entire digital asset derivatives market and all its fragmented touch points and manage the full-trade lifecycle in one institutional-grade, customizable solution.

Kemet Trading addresses the biggest pain point for any institutional investor looking to enter the digital asset derivatives space or advance their strategies. If you would like to a demo for the product, please reach out at info@kemettrading.com.