Euronext’s milling wheat derivatives market, the benchmark for the pricing of wheat in Europe, has seen a surge of activity in its options contracts this year, according to data on trading volume and open interest. The rise comes as war disrupts production in Ukraine, one of the largest wheat producers in Europe, and physical hedgers adjust to higher margin requirements.

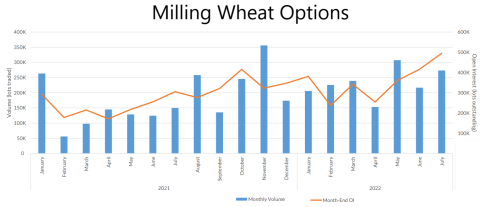

The number of milling wheat options traded on Euronext has exploded this year. In July, the volume of trading reached 273,405 contracts, a rise of 82.6% from 149,735 contracts in July 2021 and the highest monthly total in at least four years.

For the first seven months of the year, volume jumped by 68% to 1.62 million contracts, up from 965,049 contracts during the same period a year ago.

Open interest, which measures the number of outstanding positions, also has picked up dramatically, rising 62% to 494,754 contracts in July 2022 from 305,222 contracts in July 2021.

Euronext’s contracts refer to milling wheat from any EU origin, with France being the main producer. As 50% of French wheat is exported, the market has grown in significance globally over the years. So much so, the contracts are also used as a benchmark to set the price on other cereals, such as feed barley, malting barley and oat, due to the liquidity of the market.

The market is also dominated by producers and merchants rather than speculators. According to Euronext, around 55% of participants are physical users of the market, which could go some way in explaining the rise in options trading this year.

With conflict still raging in Ukraine leading to supply disruptions, extreme heat and drought crimping crop yields in France and other parts of wheat-producing Europe, and high energy prices affecting the cost of running farm equipment and transporting product to market, wheat prices have shot up significantly this year.

At Euronext, milling wheat has historically traded at around €200 per tonne. In mid-May, the December 2022 price climbed to €433 per tonne and is now trading at around the €320 mark. As Europe is primarily a producing region, commercials account for the majority of short positions.

The sharp price rise has triggered a steep increase in the margin requirements for these contracts. This creates problems for grain producers and other commercial market participants that use derivatives to hedge their price risks. Since they are long the physical commodity, they tend to take short positions in derivatives, and as the price rises, they are required to post more collateral to meet the margin requirements.

Nick Kennedy, the head of commodities at Euronext, explained that the increase in margin requirements is leading to a shift in hedging practices towards options.

“This causes a huge problem to our short position physical holders because margin requirements are choking them,” said Kennedy.

"One way around that is to use options – for example, simple bull call strategies by which they are long a lower price and short a higher price, thereby locking in their range. By taking a directional view, they are limiting their loss to the price of what they have paid for the option and it's a much cheaper alternative because it requires much less margin.”

He added that futures prices have not risen as much as they have in the US, where more participants are speculators. “What we are seeing here is a natural market of hedgers, which is the true sign of a real market,” Kennedy said.

FIA's Data Spotlight series is based on data collected by FIA from exchanges, clearinghouses and government agencies and published through its website. For more information about FIA's data services, contact data@FIA.org.