At the end of 2017, CME Group and Cboe Global Markets received regulatory approval to list futures on bitcoin. A lot has happened in the intervening years, including the so-called "crypto winter" of 2022.

But an FIA data analysis shows that, despite recent challenges, crypto derivatives markets are going strong.

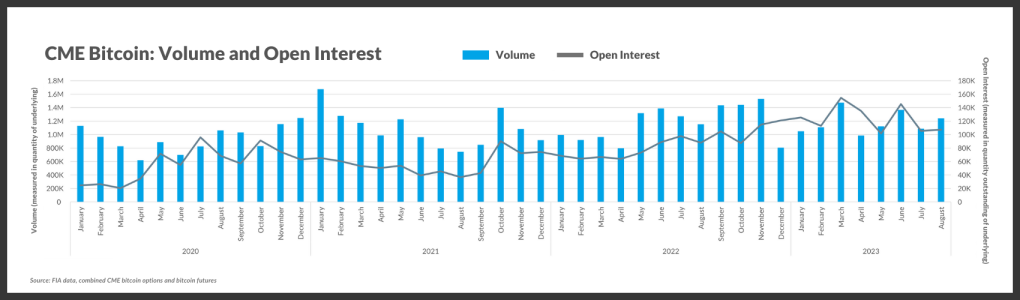

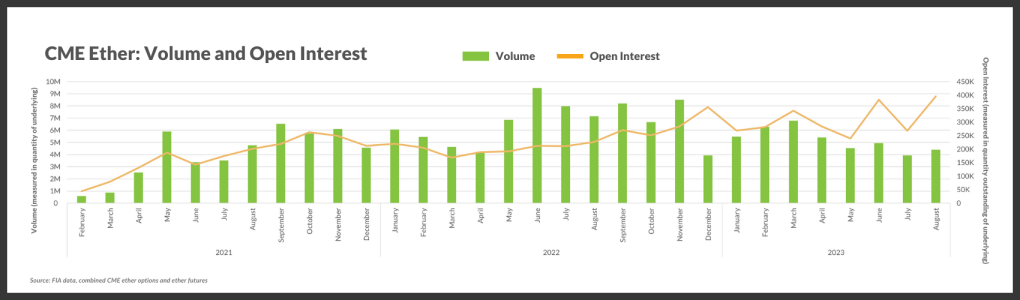

Looking at CME's dominant bitcoin and ether products, the Chicago-based exchange saw an impressive 154% jump year-over-year in volume across its bitcoin futures and options as a group across the January-to-August timeframe, and an 87% rise in open interest. Its ether futures and options also hit a record level of collective open interest when comparing the first eight months of 2022 to 2023.

Regulatory restrictions have limited US futures exchanges to offering contracts on only two cryptocurrencies, bitcoin and ether. Volume in those contracts grew rapidly and reached record levels in 2021 thanks to increased mainstream interest in the world of cryptocurrency and DeFi. That trend has persisted – and, in some cases, grown – across leading bitcoin and ether derivatives products.

FTX sought to enter the regulated US futures markets by acquiring a small startup called LedgerX in 2021. Although it had little volume, LedgerX had the necessary approvals that FTX needed to enter the business. Unfortunately, FTX became a cautionary tale for other firms pursuing crypto derivatives exchange contracts when it collapsed at the end of 2022. Many cryptocurrency prices cratered around the same time, with bitcoin falling as much as 75% from its 2021 highs.

However, market data shows that since January 2020, there has been strong open interest and volume in leading crypto derivatives contracts even through the recent challenges of "crypto winter." In fact, open interest in CME's ether futures and options just hit an all-time high in August – eclipsing the prior high recently set in June. CME's record OI across bitcoin futures and options came earlier this year in March, but still shows a long-term uptrend.

FIA examined the top four crypto derivatives contracts as of the end of August 2023, all belonging to CME: CME Bitcoin futures, CME Bitcoin options, CME Ether futures and CME Ether options. The vast majority of liquidity is in these contracts – and considering their large size at 5 ether and 50 bitcoin per contract, they are more representative of institutional interest vs. retail activity in crypto derivatives.

CME dominates crypto derivatives

|

Exchange |

Type |

Contract |

Size |

Notional Value (end Aug 2023) |

|

CME |

Future |

Bitcoin |

5 |

1,965,605,426 |

|

CME |

Option |

Bitcoin |

5 |

771,072,260 |

|

CME |

Future |

Ether |

50 |

361,464,826 |

|

CME |

Option |

Ether |

50 |

285,024,848 |

Volumes were indeed elevated at the end of 2022 around the collapse of FTX and crashing spot crypto prices. However, the sustained strength in open interest in CME's products – including a high for its combined bitcoin futures and options in March 2023, and a high for its combined ether futures and options in August 2023, shows that crypto derivatives continue to show their value to market participants.