Crude oil futures trading exploded in the first quarter of 2020 as price volatility reached record levels, but that was only the latest chapter in a long-term uptrend in the world’s most actively traded commodity futures.

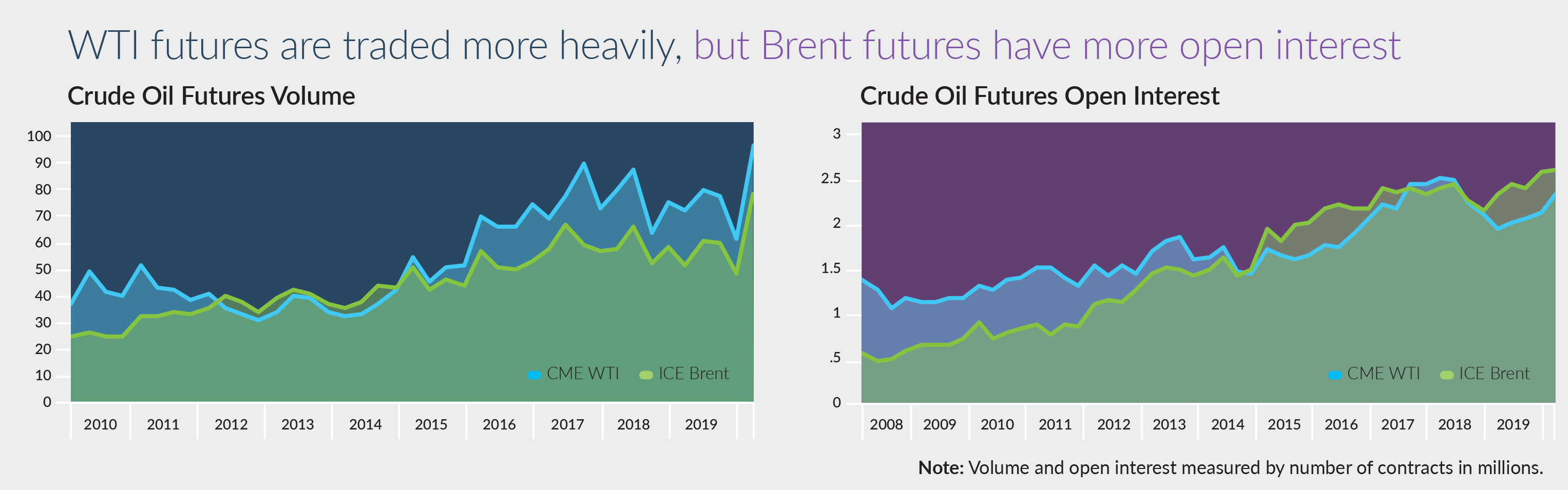

Looking back over the last decade, the trading of futures on WTI light sweet crude, the main benchmark for oil produced in North America, has risen by almost 200%. In the first quarter of 2008, volume in the WTI futures traded on the New York Mercantile Exchange was 33.5 million contracts. By the first quarter of 2019, it had risen to 95.1 million contracts.

Trading of the Brent crude oil futures, the main benchmark for oil produced in the North Sea, grew even more rapidly. Volume in the Brent futures traded on ICE Futures Europe rose from 16.7 million contracts in the first quarter of 2008 to 78.5 million in the first quarter of 2019, an increase of 370%.

There are many other oil futures traded on derivatives exchanges around the world, but these two contracts are the most important benchmarks for the industry, with the deepest liquidity and the greatest impact on price discovery.

Open interest, which measures the number of outstanding positions, has been on a long-term growth trajectory as well, with both contracts benefiting from greater use of these contracts to hedge risks in the oil market. But Brent has been more popular lately, with open interest running 10% to 20% higher than WTI since the beginning of 2019.

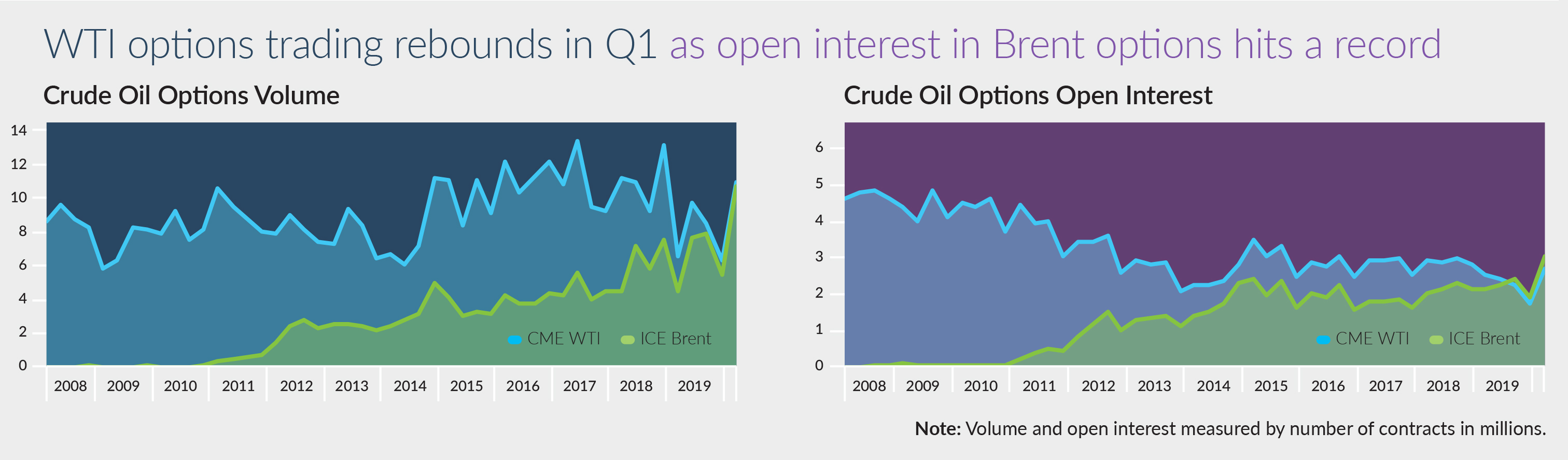

Brent is also gaining ground in the crude oil options market. Options on the ICE Brent futures began the decade with a tiny fraction of the market, but the contract’s popularity has grown by leaps and bounds ever since, and by the first quarter of 2020, volume had reached 10.7 million contracts, within shouting distance of the 11 million options on WTI futures traded at Nymex. The convergence was even more pronounced in the open interest trends. Options on WTI futures peaked in 2009 with 4.9 million contracts outstanding at the end of the second quarter, and have trended downward ever since. Options on Brent, on the other hand, have been steadily rising, and set a record of 3.1 million contracts in the first quarter of 2020.

The battle of the benchmarks is not a zero-sum game, however. The Brent contract has gained popularity for hedging the cost of oil shipped by sea to the rapidly growing economies of Asia-Pacific, making it the leading benchmark for the international market. The WTI contract, on the other hand, is the key benchmark for oil production in the U.S., which has exploded in recent years as producers have found new ways to extract oil from shale formations.

Both contracts also sit at the center of a complex web of futures and options based on other grades of crude oil and other delivery locations as well as refined products such as gasoline and jet fuel. That gives hedgers, speculators and market makers more ways to manage the changes in the price differentials between these two benchmarks and a wide range of related products, and creates even more liquidity for Brent and WTI.