Around the world, sustainable investing has been gaining prominence and popularity among investors of all sizes, with interest from retail investors growing in recent years. In Asia, few markets have been more proactive than Taiwan in supporting ESG (environmental, social and governance) investing. The island continues to move up the global ESG investment rankings, placing higher than other markets such as Japan and South Korea, according to the Asian Corporate Governance Association report. ESG-focused investments in Taiwan, including ESG ETFs and mutual funds, make up an industry worth tens of billions of TWD.

The expansion of ESG investment in Taiwan, coupled with greater availability of ESG-linked products, has created new hedging and trading demands. The Taiwan Futures Exchange (TAIFEX) rose to fill the gap with the launch on June 8 of a new equity index futures contract based on an ESG index. This contract, the FTSE4Good TIP Taiwan ESG Index Futures, is the first ESG-linked futures contract in Asia and it adds a key component to the ecosystem of Taiwan’s ESG investment products.

The new product is based on the FTSE4Good TIP Taiwan ESG index developed by Taiwan Index Plus (TIP) Corporation in partnership with FTSE Russell, the global index provider that is part of the London Stock Exchange Group. It measures the performance of companies listed on the Taiwan Stock Exchange that meet the globally recognized ESG standards used by the FTSE4Good Index Series. Additionally, companies with negative trailing twelve-month return on equity are excluded as financial performance selection criteria. This index has been designated as a benchmark for the discretionary investment plan of Taiwan’s Labor Pension Fund and it has been used by asset management companies for issuing various financial products.

TAIFEX’s ESG futures is introduced in response to the substantial increase in ESG investment led by institutional investors, such as ETF issuers and asset managers. In addition, with a small-sized contract design, it offers a low trading threshold for retail investors engaged in futures trading, and at the same time, attracts potential retail participants active in Taiwan’s ESG ETF market.

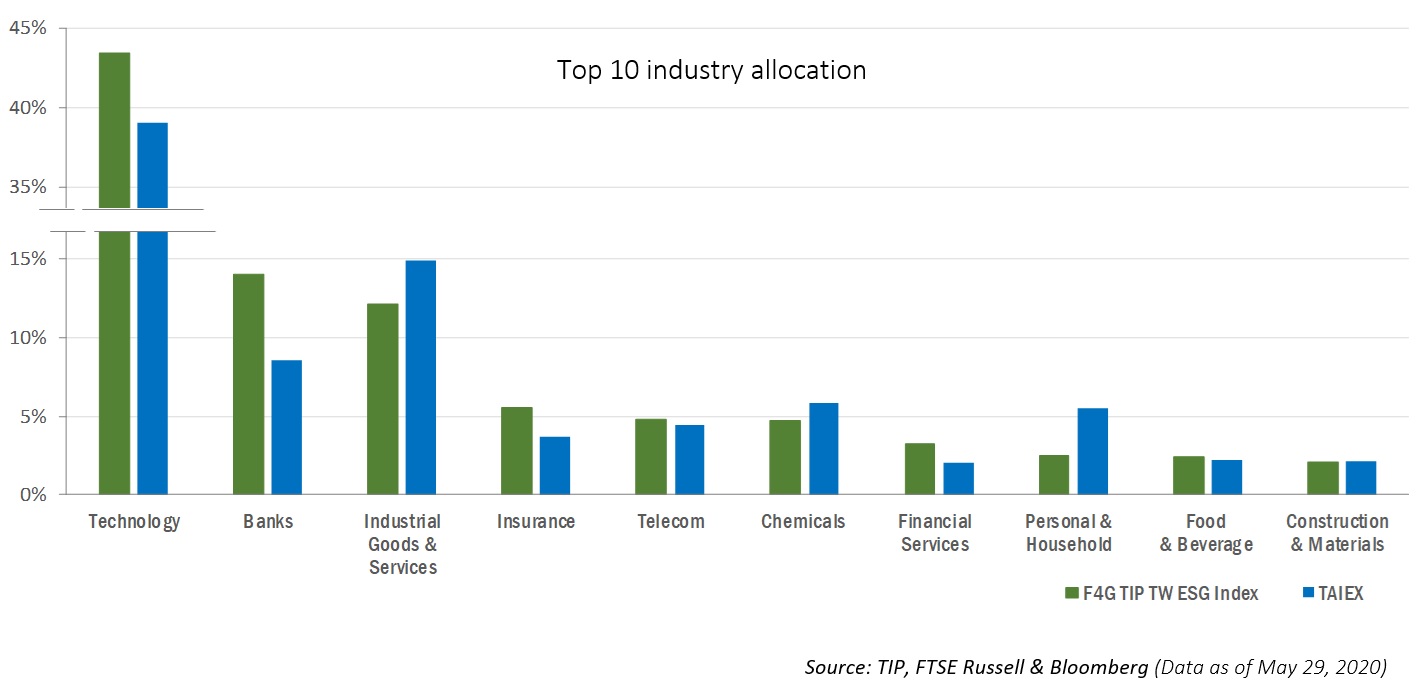

The ESG index has similar overall industry group weights as the TAIEX index, the benchmark for Taiwan stock market, with higher weightings in technology, banks, insurance and finance, but lower in chemicals. Having fewer underlying index constituents than the TAIEX Futures (TX), TAIFEX’s new ESG futures makes it more feasible for investors to monitor stocks that may have more impact on index movement. With a meaningful boost in ESG and a connection to Taiwan’s internationally competitive technology sector, TAIFEX’s new product allows investors to comfortably incorporate ESG into the center of their portfolio, and to stay in line with their investment values while achieving their goals.

To date, nearly a dozen ESG futures have been listed in Europe and the US. According to UBS, trading of these contracts hit a new high in March 2020, with average notional value of USD 290 million per day. As one of the leading regional exchanges, TAIFEX’s launch of F4G TIP TW ESG Futures not only complements its equity index product suite, which includes core products such as TAIEX Options (TXO), TX and Mini-TAIEX Futures (MTX), but also extends its product offering into ESG, provides an exchange-listed ESG derivative instrument for investors to effectively hedge their exposure in sustainable investing, and delivers an indispensable risk management tool for Taiwan’s growing ESG industry.