OCC, the world's largest clearinghouse for equity derivatives, has announced that it plans to seek regulatory approval in the US to increase the amount of capital that it contributes to the financial resources available to cover losses from a member default.

In a letter sent to members on 3 Aug., OCC said it decided to commit $62 million as a minimum amount for its "skin in the game" contribution to default protections. The Chicago-based clearinghouse currently allocates some of its capital to this purpose, but the amount is variable. It is now seeking approval from the US Securities and Exchange Commission to ensure that this amount never falls below $62 million.

The announcement is the latest development in a long-running debate over how the risk of a default should be allocated between clearinghouses and their members. Large asset managers such as Blackrock and Vanguard have joined with clearing firms such as J.P. Morgan and Citi in arguing that clearinghouses should put more of their own money into the default funds so that their shareholders have a shared interest in minimizing the risk of default.

OCC gave two reasons for the shift in its approach: to align the interests of its management and market participants, and to support its efforts to achieve recognition from European regulators.

"Our goal in recommending a minimum amount of skin-in-the game is to increase alignment with our clearing firms and market participants and to strengthen our eventual consideration for European recognition," OCC said in the letter, which was signed by John Davidson, the OCC's chief executive officer, and Scot Warren, the chief operating officer.

Seeking EU Recognition

Under the European Market Infrastructure Regulation, a clearinghouse must have a minimum skin in the game that is equivalent to at least 25% of its regulatory capital requirement. In OCC's case, that works out to $62 million. By adopting a rule change that puts a $62 million floor on its skin in the game, OCC is hoping to improve its chances of achieving recognition from European regulators, a key strategic objective.

Other US clearinghouses such as CME Clearing, ICE Clear US and Nodal Clear have already achieved recognition, mainly because their regulator, the US Commodity Futures Trading Commission, has reached an agreement with its counterpart, the European Securities and Markets Authority, that their regulatory regimes for clearinghouses are equivalent. The SEC, however, has not reached a similar agreement with ESMA, and as a result, clearinghouses under SEC oversight such as OCC are facing a potentially severe shock next year when a new set of bank capital requirements take effect. Starting in June, European banks will have to set aside a much higher amount of capital for exposures to central counterparties that are not "qualified CCPs" in Europe. Non-EU clearinghouses become "qualified CCPs" once they are recognized under EU law. OCC is not yet a "qualified CCP", and its concern is that its European-based clearing members may have to reduce their participation at OCC or withdraw altogether if this issue is not resolved in time.

Davidson and Warren also cited recent calls from market participants for higher skin in the game at clearinghouses in general, and they pointed to a paper released in October 2019 that was signed by leading clearing firms and asset managers. One of that paper's recommendations called for clearinghouses to increase their contributions to default fund resources, saying that skin in the game is "the principal mechanism to align a CCP’s incentives and ensure effective risk management."

"We take seriously the interest of the industry and international regulators in seeing more significant SITG at CCPs," Davidson and Warren wrote in their letter. "Increasing the minimum amount of OCC’s SITG will further enhance our alignment with clearing firms, as well as reduce the likelihood of a draw on the clearing fund and the resulting cost borne by clearing firms."

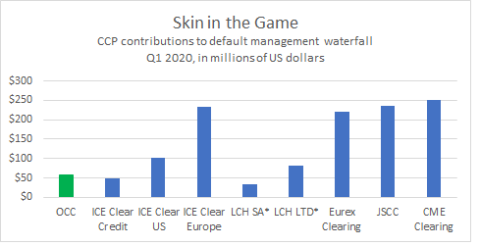

At the end of the first quarter, OCC had $57.8 million of its own funds committed to cover default losses. That included $54.7 million in excess capital and $3.1 million of money that came out of deferred compensation for OCC executives. In their letter, Davidson and Warren noted that the use of deferred compensation money gives OCC management a strong incentive to avoid losses, but they acknowledged that OCC's "persistent" skin in the game, i.e., the minimum amount, was "relatively low" compared to the amounts at other clearinghouses.

Comparison to Other Clearinghouses

According to the most recent quarterly disclosures available, skin in the game at other large clearinghouses is typically above $100 million.

For example, at the end of the first quarter, CME Group had contributed $100 million of its own capital to the default fund for its "base" futures and options markets, and another $150 million to the default fund that covers its clearing service for over-the-counter interest rate derivatives.

Eurex Clearing, the largest clearinghouse in Europe, had contributed $220.5 million to its default fund, which covers futures and options, repos and interest rate swaps.

Intercontinental Exchange had a combined total of $385.9 million in contributions to multiple default funds at its clearinghouses in Europe and the US. That amount included $183 million for futures and options cleared at ICE Clear Europe, $49.9 million for credit default swaps cleared at ICE Clear Europe, $50 million for credit default swaps at ICE Clear Credit in the US, $68 million for futures and options at ICE Clear US, and $35 million for the bitcoin futures cleared at that clearinghouse.

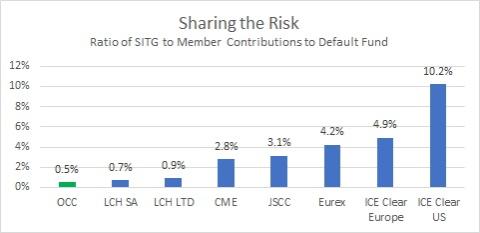

Another way of measuring skin in the game is to compare it to the amount of money contributed to the default fund by the clearing members. The size of the default fund is tied to the overall amount of risk in the clearinghouse, and a clearinghouse that clears a wide range of positions across many markets will tend to have a larger default fund than a clearinghouse that focuses on a smaller range of markets or that clears a lower number of positions.

The ratio of skin in the game to member contributions therefore provides a risk-adjusted measure of the clearinghouse's share of the potential losses in case of a member default.

By this measure, OCC falls near the low end compared to its peers. OCC's ratio of skin in the game to member contributions was 0.5% in the first quarter.

That was not far off from 0.7% and 0.9% ratios at the Paris and London-based clearinghouses in the LCH Group. But it was substantially lower than the ratios at CME, Eurex and Japan Securities Clearing Corp., which were 2.8%, 4.2% and 3.1% in the first quarter, respectively, and much lower than the 10.2% ratio at ICE Clear US.

Balancing Member Interests

The size of the default fund is not the only yardstick for measuring clearinghouse risk management, however. Clearinghouses have many other protections in place to absorb losses before calling on the resources in their default funds, including the initial margin collected on every position that is cleared and the defaulting member's own margin and default fund deposit.

Clearinghouses also take different approaches to how they balance the various components of their risk management frameworks. Some clearinghouses take a more conservative approach to calculating initial margin, which reduces the need for a large default fund but increases the cost of trading, while others rely more heavily on member contributions to the default fund.

In OCC's case, the decision to increase skin in the game marks an important shift not only in the management's approach to risk management but also in the priorities of its members. In contrast to most other major clearinghouses, OCC is not part of a public company that seeks to maximize profits for its shareholders. Instead it is run as an industry-controlled utility that provides clearing on an arm's length basis to nearly two dozen trading venues, and its board of directors consists primarily of people who represent the interests of clearing members, exchanges, trading firms and other market participants.

When OCC's revenues from clearing fees rise above the amount it needs to cover its costs, upgrade its technology, and sustain its capital, it refunds those revenues to its members and lowers its clearing fees. But in order to fund the $62 million that it plans to maintain in the default fund, OCC will have to draw from its operating cash flow. In other words, the funding for the skin in the game contribution will come out of the same pool of revenues that OCC uses for the refunds to its clearing members. In effect, OCC is attempting to balance two competing sets of member interests: maximizing refunds and fee reduction versus minimizing exposure to potential losses.

The good news for OCC and its members is that the clearinghouse's revenues have been boosted this year by a record amount of transactions in the US equity derivatives markets. In the first half of 2020, OCC cleared on average 26 million options per day, up 50% from the previous year, and in June it set an all-time record for the highest number of cleared contracts.

As a result, OCC should have no difficulty funding its contribution to the default fund. In fact, the clearinghouse projects that it will have sufficient earnings this year to provide its members with a refund of $80 million to $100 million, and it plans to reduce its clearing fees starting in September.