Bouts of extreme volatility, record volume, and market stress hit the market in early 2020 in the wake of the COVID-19 pandemic. However, participants at an FIA Expo panel on 11 November noted that this real-world stress test of the clearing industry provided an important opportunity to identify core areas of the model that need enhancement and modernization.

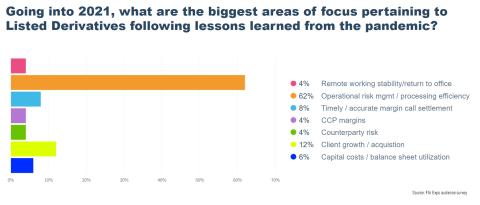

A survey of the Expo audience clearly identified operational risk management and processing efficiency as the biggest areas of future concern for market participants. More than 50 conference attendees responded to the live survey during the operations panel.

Some of the primary lessons learned, according to panelists, were a need to focus on transparency, standardization and a commitment to prioritizing same-day trade processing/give-up acceptance to prevent backlogs.

Scott Andersen, Americas Head of Listed Derivatives Clearing at Société Générale , said that the due to the record clearing volumes in the market, some firms were struggling to keep up with the post trade processing back-log that was building day on day, with give-up/trade acceptance processing causing much of the strain. “During the period between February and March, our firm experienced 12 unique days where our clearing volume surpassed our prior record volume day. While many firms have developed processes to automate post trade processing, there is a core dependency for coordination across counterparties, clients, brokers and FCMs, and often that communication is bi-lateral. If one firm was struggling, it can negatively impact the other counterparties involved in the trade life cycle, and we saw that during this period.”

Laurent Partouche, vice president of fixed income sales at Eurex, noted that five of his firm's top 10 volume days in history occurred during a period of three weeks in early 2020. Eurex made some changes to help its members handle this unprecedented volume, including extending its clearing window, but he noted that delaying clearing cycles is much different than resolving the underlying issues.

"It's a tricky business, because then we have to delay when we run the batch and delay when we send a report to members and then when they can reconcile transactions," Partouche said. "We would prefer to do everything when it's regularly scheduled."

Brian Sayers, Executive Director of Post-Trade Services and Risk at CME Group, said CME has focused on automation and efficiency giving the ability for the industry to accept all give-ups top day and we have gotten it to the point where roughly 95% of give-ups are accepted on top-day by clearing firms. However, "that 5% still involves a significant amount of manual work for the clearing firms when they get to T+, a period of high volume only compounds that further."

As an industry, Sayers said, "we can and should remove some of the manual nature when it gets to T+. Let's get to a place where the risk is getting to where it needs to be on top day as much as possible."

Admittedly, such standardization cannot happen overnight. As the industry addresses this concern in the long-term, transparency and communication will continue to be a top priority to ensure cleared derivatives markets remain resilient, said Diane Sherman, Director at BofA Securities.

"Balance sheet management became extremely important as margins were spiking" during the peak of market volatility in March, Sherman said. “Optimization and transparency were also extremely important. We had daily conversations with our risk partners to help determine what a client’s risk profile would result in at the end of the business day and the impact to funding."

While the industry came together in coordination with FIA to implement tactical solutions to get through this period, it’s imperative that the industry continue to look to the future of the clearing model. Andersen noted, “With exchange traded derivatives and clearing, market participants generally know what to expect with standardized contracts and daily margin settlement. But this period of heightened sensitivity showed us that we need to enhance the clearing model focusing on process optimization, standardization and transparency across counterparties and market participants. Now is the time to re-define and modernize post-trade processing, which will reduce risk and gain efficiency.”