Fall is slowly slipping into winter in the northern hemisphere, but at FIA there is no hibernation on the horizon. To us, the changing of clocks and the turning of leaves means that we double down on our mission to support this industry, and gear up for a busy 2020.

The approaching new year is a time of new starts, but there are lingering issues that are grabbing our attention. As I write this, we can see uncertainty all around us. Every day the news is filled with stories of political strife. In fact, three leading universities in the U.S. have produced an index measuring global levels of uncertainty. That index hit a record high in August and remained at very elevated levels through the fall. Between impeachment, Brexit, Hong Kong and flaring regional disturbances, I think it is fair to say that we are experiencing the highest level of political unrest in the last 50 years.

Like you, FIA closely monitors these political events with great interest. How will all this impact the economy? Which way will the markets move next? Where is this all heading? Truthfully, none of us know.

But it is exactly at these times that FIA plays a pivotal role in clarifying uncertainty for our industry. We do not wait for events to unfold. We proactively work with policymakers to help our member companies anticipate and adjust to this ever-changing world.

Brexit is a timely case in point. The process around Britain leaving the EU has been remarkably uncertain and we still don't know exactly what the post-Brexit environment will look like or when it will come into being. With that in mind, we recently went back to the EU to extend the relief granted last year so that firms in Europe can continue to access clearinghouses in the U.K. during this transition.

Brexit is an all-too-real reminder why cross-border recognition is so vital to our global marketplace. Many futures, options and swaps are global benchmarks that trade without regard to borders. Indeed, cross-border trading makes up a substantial share of the volume on all the leading exchanges. This centralization of liquidity is good for customers because they have access to a much larger range of products at better pricing than if they were limited to domestic markets.

Regulation, on the other hand, is administered at the local level without a consistent framework from one jurisdiction to the next. Thankfully, the international regulatory community has developed a "trust but verify" system that enables authorities to recognize foreign laws and regulations when they are deemed "equivalent" and avoid duplicative or even conflicting requirements on cross-border business.

This cooperation among regulators has worked remarkably well over the last 40 years. I was acting CFTC chair and commissioner during the financial crisis, and I can tell you that it worked even during a time of extreme distress.

However, we are now at a crossroads on whether regulators will reaffirm this approach or take a more direct regulatory path. Both the EU and the U.S. have proposals that will shape this debate in the coming months. It's extremely important we get this right because it could set a precedent for how our markets develop for years to come. We have urged regulators to reach a workable resolution that allows for cross-border recognition while ensuring their ability to guard against imported financial risk. This is the right approach to promote economic growth while at the same time preserving the ability of regulators to protect home-country customers and markets.

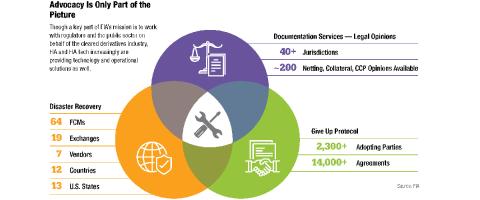

FIA's role is to act as the industry's voice, working with regulators to produce better, smarter regulation. But advocacy is only half the picture.

Much of FIA's work involves improving the efficiency and resilience of the markets through improved operations, best practice standards, enhanced technology and industry continuity exercises. In other words, FIA is a solutions organization with a growing toolbox at your disposal.

Some recent examples include:

Tag 1031 execution source codes: On Nov. 17, CME implemented a new requirement that all order messages include a tag identifying the method used to execute the trade. This tag is based on a standard set of codes developed by FIA and FIA Tech. This is a major milestone in the industry’s efforts to reduce issues in brokerage fee settlement and improve the efficiency of post-trade processing. FIA is working with other exchanges to implement the same set of tags across the industry.

Business continuity: FIA works with member companies to ensure that the industry can continue in the event of a disaster or cybersecurity intrusion that disrupts the workings of the markets. In October, we completed our annual industrywide disaster recovery exercise to practice resiliency by completing test transactions from backup systems and sites. FIA also conducted a cybersecurity exercise to explore how market participants should respond in case of a ransomware attack.

Standard documentation: FIA works with member firms to develop and maintain standard forms and agreements that address specific needs within the industry. This service provides documentation such as swap execution agreement templates, legal opinions on the enforceability of standard FIA netting provisions, CCP risk reviews, EMIR and MiFID II/R compliant terms of business and many more. To date, we have developed approximately 200 netting, collateral and CCP opinions that cover more than 40 jurisdictions.

Bulk transfers: In anticipation of Brexit, FIA developed a standard give-up protocol to allow for the bulk transfer of client accounts out of the U.K. This protocol, which is administered by FIA Tech, has been adopted by 2,300 parties that have used it to “re-paper” more than 14,400 agreements. More importantly, this solution saved significant costs by providing a standard approach that works for the industry.

FIA's network provides us an incredible platform to advocate for change—whether that's regulatory, operational or even generational. I am mindful of the power of this platform and am careful not to misuse it. But there are times when we must leverage this platform to advance an important topic for the betterment of the industry and society. FIA's Diversity Initiative, which was announced this past March at our Boca conference, is one of those topics.

Through this effort, FIA has begun an important conversation with the industry about how to provide an on-ramp for the next generation of talent. Our conferences will be addressing this issue going forward and we will look to make our programming more reflective of the diverse talent in the industry.

FIA has also created a program at our two main trade shows— IDX London and Expo Chicago—to recognize "rising stars" in our industry. This program aims to give these outstanding individuals the tools for successful careers as well as connect them with other "next gen" leaders. Change will not come overnight, but we are committed to advancing this important initiative.

Every one of us can look back on our careers and identify someone that gave us a break. Someone who took a chance on you and gave you your start. As we head into 2020, I hope you will remember those individuals and their impact on your life and consider giving a young person a similar chance. It's time for this wonderful industry to pay it forward and I guarantee that we will reap the benefits in years to come.