The Brazilian Stock Exchange (B3) has been experiencing exponential growth in various instruments such as interest rate futures, foreign exchange, stock indices, and individual stocks. B3 strongly believes that market makers are a key mechanism to increase the liquidity in these markets.

B3 regulates the activity of market makers within the exchange environment and provides programs for market makers to trade in the equity, interest rate, currency and commodity markets.

In its programs, B3 offers market makers incentives to provide liquidity. The incentives include discounts and exemptions from trading and post-trading fees, and the market makers’ obligations are essentially to maintain buy and sell orders in the order book for a certain period of time and with a maximum spread and minimum quantity.

In recent years, market maker activity has greatly helped drive the volumes of the equities market in Brazil, both in cash equities and stock options.

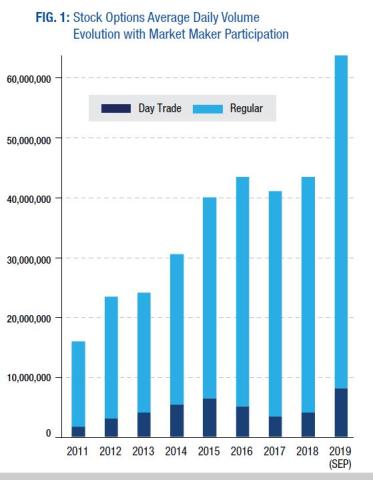

The Stock Options Market Maker Program was launched in 2011 to: (i) increase liquidity in this market and (ii) encourage the trading of a larger number of assets (market deconcentration). In doing so, market makers have facilitated trades and mitigated artificial fluctuations of asset prices.

Since the program was first launched, the traded volume of options with market makers’ presence has grown considerably (See FIG.1). This shows the importance of this type of market participant in providing greater liquidity to instruments with growth potential.

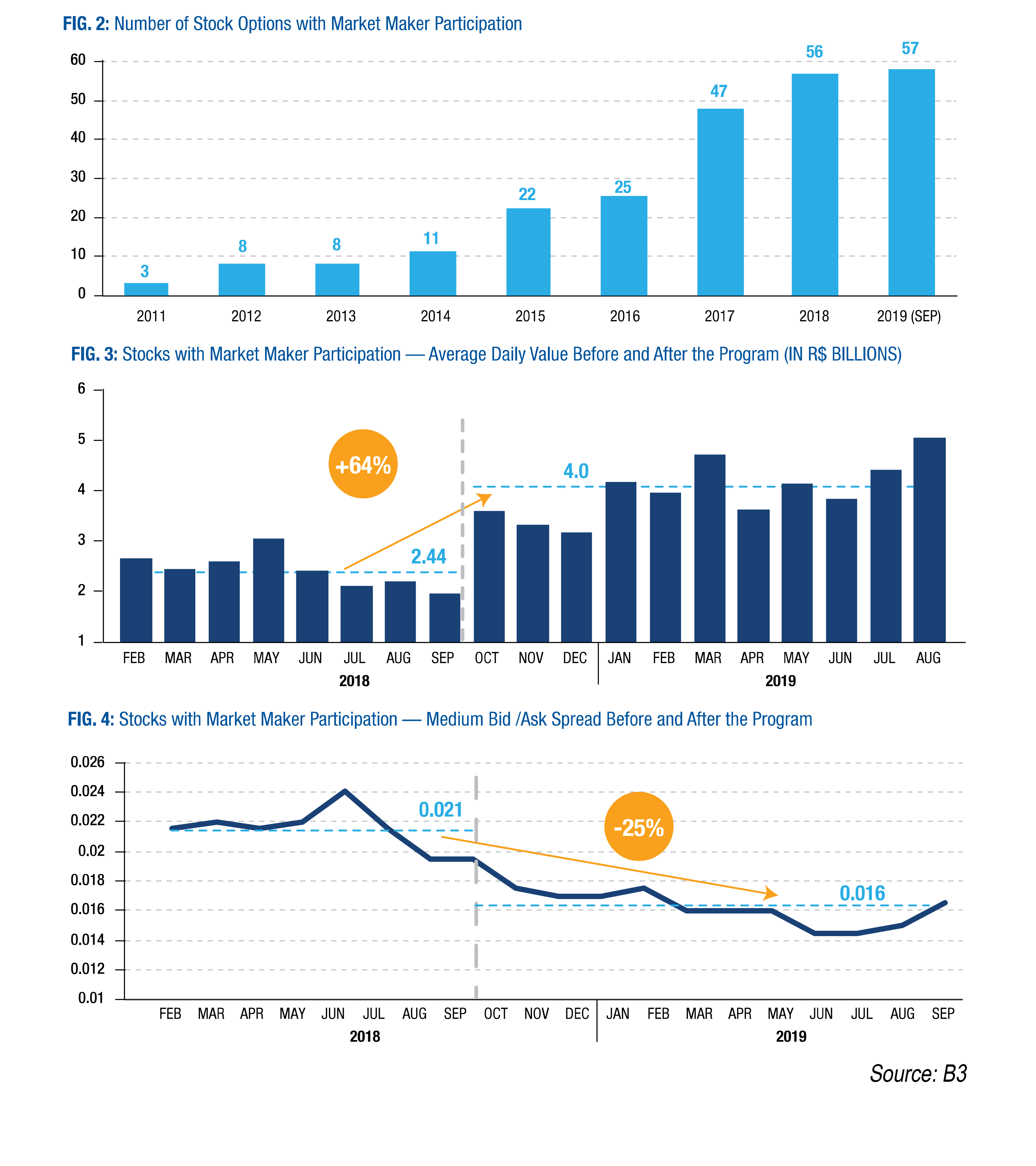

In October 2018, market maker activity was extended to the cash equities market with the launch of a program for 54 stocks, each with 3 open slots for market makers. The extension had very positive results; the program’s underlying assets benefited from a substantial increase in liquidity with volume growth (FIG.3) and improved transaction costs through greater depth in the order book and tighter spreads (FIG.4).

B3 believes in the potential of market makers for the development of the Brazilian capital markets and is therefore expanding these programs for the coming years by adding 37 new stocks to the program’s renewal in October 2019 and opening up to 5 slots for market makers in some of the instruments available.

To learn more about B3’s market maker programs, visit www.b3.com.