My former boss and mentor, Senator Richard Lugar of Indiana, was extremely proud of his grove of black walnut trees on his 604-acre farm southwest of Indianapolis. You might say he was obsessed with them. At his funeral last summer, his son Bob humorously recounted how his father would spend hours upon hours tending to these trees, which he registered in 2006 as the first Indiana tree farm to provide a carbon offset with the Chicago Climate Exchange. As a farmer, the pragmatic Lugar loved the idea that his walnut trees would help his stewardship of the earth, which he believed was a providence-directed responsibility that all of us should bear. And the notoriously frugal Senator didn’t mind that he got paid to do it. Lugar well understood that incentives and markets matter in our battle to make a more sustainable world.

This lesson is not lost on me as I was asked to join the Consultative Group of the Taskforce on Scaling Voluntary Carbon Markets. Not the catchiest of titles, but its work is critical. This Taskforce, initiated by Institute of International Finance and Mark Carney, UN Special Envoy for Climate Action and former Governor of the Bank of England, aims to develop a blueprint for how we improve the use and scale of voluntary carbon markets that will be critical to tackling climate change.

The Taskforce has just begun its work with the ambitious goal of publishing a final report by the end of January 2021. This comes on the heels of the subcommittee report of the CFTC Market Risk Advisory Committee on climate change that provides extensive recommendations on ways the financial markets will need to evolve to address climate risk, including setting a price on carbon.

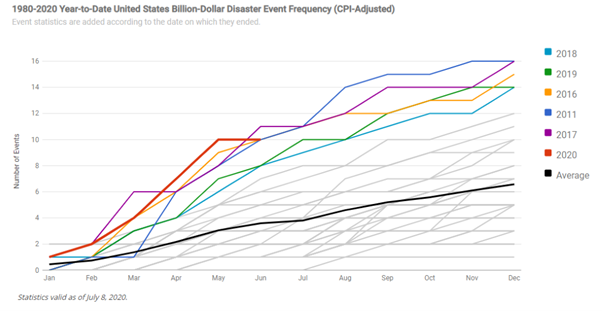

It is difficult to dispute that climate-related disasters are occurring on a more frequent basis. Just over the last two years, global losses caused by natural catastrophes amounted to over $640 billion annually, according to the Task Force on Climate-related Financial Disclosures. In just the United States alone, the National Oceanic and Atmospheric Administration estimates that the average number of billion-dollar-loss climate-related events increased from 6.6 annually over the last forty years to 13.8 events over the last five years. For an industry obsessed with data, these numbers, along with a whole body of evidence, clearly indicate enhanced climate risk to the global economy.

Market-based solutions are key to unlocking this problem. Since our industry’s beginnings, the listed and cleared derivatives markets have been utilized by farmers, manufacturers, and financial firms to manage risk and discover prices for commodities and financial products. Businesses need the ability to plan for their future as they purchase supplies for manufacturing, plant crops for forward sale or lock-in financing for long-term energy projects. Our markets provide a central forum to offset and manage risk over long time horizons and determine the value of a given commodity, interest rate, or financial instrument.

I have seen time and time again how this industry takes uncertainty and turns it into opportunity. It was our industry that created foreign currency and financial futures when the world went off the gold standard in the 1970s. It was our industry that came up with energy futures to help manage volatility during the oil embargoes of yesteryear. It was our industry that brought us electronic and cross-border trading that democratized trading around the globe. And yes, it was our industry that brought us markets to help clean up the acid rain disaster of middle America and that listed carbon for the first time on a trading platform.

In order to tackle the risks associated with climate change, markets must be part of the solution. FIA recently published a policy paper on climate-related risks for financial markets and the global economy, entitled, "How derivatives markets are helping the world fight climate change.” The paper highlights existing industry solutions and potential partnerships with the public sector to help build a more sustainable economy in the long term.

The principles of this paper will guide my involvement with the Taskforce. First, innovation and competition are key to making markets work. Exchanges, working in partnership with market participants, should continue to quickly identify new products that can assist in sustainability efforts. Second, standardization is key to allowing markets to succeed. Industry-developed best practices, protocols and standards are needed to make sure markets are speaking the same language and able to interface with market participants globally. Lastly, regulatory harmonization is imperative in these global markets. It is crucial for the public and private sectors to work together to ensure laws and regulations avoid unnecessary conflicts and incentivize market-driven solutions.

Climate change is a global problem and requires a global response. There is no silver bullet, and we need to be creative on ways to address the problem. Markets need to be at the center of any solution. I am proud to be a member of an industry that has stepped up to these kinds of challenges in the past and faced them head on, and I am confident we will do it again. The world may literally depend on it.