Possible evolution of MIFID II algorithmic trading rules

6 May 2021 • 2:00 PM - 3:00 PM BST • VirtualIn light of the recent ESMA consultation on MIFID II/MIFIR Review Report on Algorithmic Trading and the ongoing review of European financial market regulations, FIA will look at the evolution of algorithmic trading rules in Europe and their impact on cleared derivatives markets, including:

- Direct electronic access and the nuances around sub-delegation;

- Disorderly trading definition and the impact of a one-size-fits-all approach;

- The definition of algorithmic trading and the impact on different types of trading strategies; and

- The reality of conformance testing, its challenges and the validation of algorithms.

To what extent have regulators taken on board industry developments, what remains to be done, and what aspects cause the most concern? Speakers will share their views on the current and emerging landscape.

*This webinar is open to FIA members only.

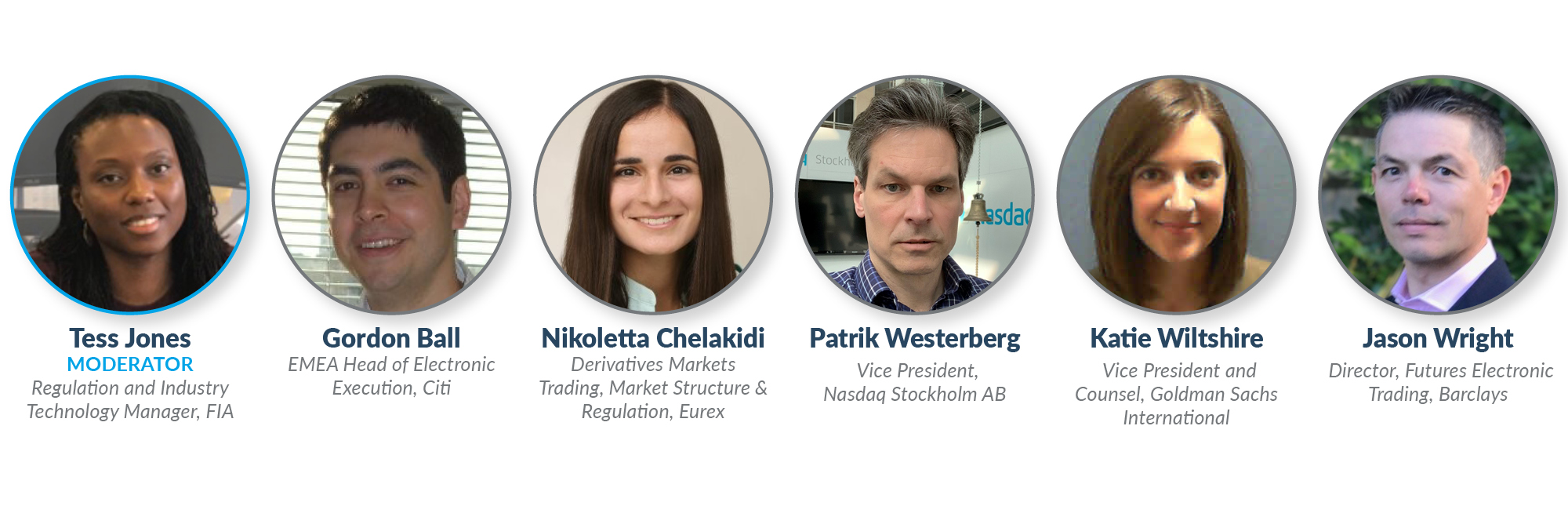

| Moderator: | Tess Jones, Regulation and Industry Technology Manager, FIA |

| Presenters: | Gordon Ball, EMEA Head of Electronic Execution, Citi Nikoletta Chelakidi, Derivatives Market Design, Market Structure & Regulation, Eurex Patrik Westerberg, Vice President, Nasdaq Stockholm AB Katie Wiltshire, Vice President and Counsel, Goldman Sachs Jason Wright, Director, Futures Electronic Trading, Barclays EU eTrading Committee Chairman |

| Date/Time: |

Thursday, 6 May 2021 | 2:00 p.m. – 3:00 p.m. BST |

This webinar is intended for informational purposes only and is not intended to provide investment, tax, business, legal or professional advice. Neither FIA nor its members endorse, approve, recommend, or certify any information, opinion, product, or service referenced in this webinar. FIA makes no representations, warranties, or guarantees as to the webinar’s content.