There are tales in literature and lore of protagonists who obsess over certain quests but who are never able to obtain their elusive capture. For King Arthur, it was the Holy Grail. For Ahab, it was Moby Dick. For Casey’s at Bat, it was the home-run. And for me, it’s portfolio margining of cash and futures in the US Treasury market.

Go ahead and laugh but it’s true!

With the recent mandate by the Securities and Exchange Commission to clear certain treasuries and repos, this goal is again coming into focus. Portfolio margining for treasuries has been a topic that has been discussed for years by our industry but whose promise has largely fallen short. But if we can get it right, it can return billions of dollars of idle capital back to asset managers and other market participants and make our markets more affordable for investors.

At a basic level, efficient capital markets are intended to deploy capital to the parts of our economy that are in most need of those investments. Commercial businesses and investors use cash instruments and derivatives to optimize the use of this capital.

Often, the trades in the cash and derivatives markets are offsetting hedges – a long position in the cash market hedged by a short position in futures. Farmers understand this concept – if the price of corn goes down, the farmers’ corn harvest loses value, but their short position in corn futures increases and they are made whole.

The same concept holds true for other markets, including one of the largest financial markets in the world – the US Treasury market. If only we could measure the risk of these cash trades together with the offsetting futures and derivatives contracts, the amount of margin needed to back this portfolio of positions would be reduced significantly without adding any risk to the system. I will say that again…without adding risk. Thus, the Holy Grail!

Once upon a time, I ran a futures clearinghouse by the name New York Portfolio Clearing or NYPC. With its owners DTCC and NYSE Euronext, its main differentiator was to use the same margin methodology to calculate the risk of the fixed income futures traded at NYSE LIFFE US together with the cash US government bonds held by DTCC. This “one-pot” portfolio margining was estimated, on average, to lower margin amounts by roughly 20 percent.

This idea was the right one at the wrong time and this venture never took off. Fast forward to today. The financial markets are now being mandated to clear certain US Treasury securities and repos. There is $27 trillion in outstanding Treasury securities today and that is expected to grow to $45 trillion in just ten years. It is one of the largest financial markets in the world, yet only a fifth of the trading volume is cleared through a central counterparty.

Significant amounts of capital and margin will be needed to clear these trades at a time when there are fewer clearing firms and less clearing capacity in the system. Finding efficiencies in how we clear these trades will be critical if this mandate is to succeed and that’s where portfolio margining comes into play. But it won’t be easy.

One of the key impediments to portfolio margining is the fact that the cash markets and the derivatives markets have different regulators, different customer protection regimes and different bankruptcy protections.

Treasury futures are regulated by the Commodity Futures Trading Commission that segregates customer funds to protect them from defaulting participants. The cash treasury market is regulated by the SEC, which uses an insurance system for making non-defaulting customers whole. And the over-the-counter interest rate swaps market – another correlated derivative instrument—is primarily regulated and cleared in London. Implementing a common approach to portfolio margining will require the regulators to find a way to work together to reconcile their different regimes. Not an easy task.

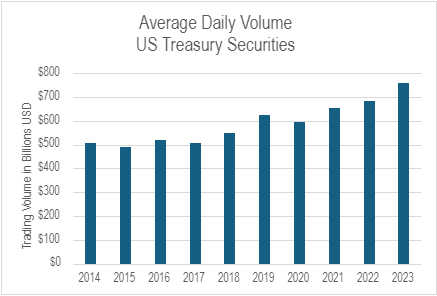

The second major impediment is the fact the liquidity for each of these products sits in three locations with three different institutions and three different margining models. DTCC’s FICC is the primary clearinghouse for cash treasuries in the US, with an average processing volume of $7 trillion per day. CME controls the treasury futures market in the US, with an average of $645 billion in notional value traded per day in 2023. And LCH clears a vast majority of US dollar-denominated interest rate swaps, with $140 trillion in notional value outstanding as of early April. Capturing all three of these markets under one margining model will be challenging so partnerships and alliances are needed.

CME and FICC already have a cross-margining arrangement for firms that are members of both clearinghouses. Cross margining is a form of portfolio margining between two independent clearinghouses and this agreement was updated in January. With the SEC’s new clearing mandate, they both see an opportunity to open this program up to customers and provide the whole market with the margin offset benefits of cross-margining. This seems like the horse to beat.

But the size of the Treasury clearing inflows is causing competitors to take a close look at how they might capture some of this business. During FIA’s recent Boca conference, both CME and ICE executives said they are exploring the cash treasury clearing market. ICE already has an SEC-regulated clearinghouse that could do this business, but this would be the first time the CME has considered having a major business line regulated by the SEC. That’s not insignificant.

The other interesting competitor in this space is BGC, which trades cash treasuries on its Fenics platform and is now preparing to list Treasury futures and other interest rate futures on FMX, its new futures exchange. FMX will clear its trades at LCH, which is the primary clearer of interest rate swaps.

FMX faces a stiff challenge in competing with CME, but if it succeeds in capturing a share of the interest rate futures market, LCH could offer portfolio margining of swaps and futures. And if LCH decides to enter the cash Treasury clearing business, it would have all three legs of the stool with cash, futures, and swaps under one roof. Interesting indeed.

The cash treasury and repo clearing mandate won’t come fully into effect until 2026 but it will be fascinating to see the strategic maneuvers and partnerships that develop over that time. Will we capture the elusive white whale of portfolio margining or will it escape us again? Only time will tell but I wouldn’t bet against the innovative minds of our industry.