Chairman Scott, Ranking Member Scott, and members of the Subcommittee, thank you for the opportunity to testify about Brexit and various cross-border matters that impact derivatives markets and market participants.

I am the President and Chief Executive Officer of FIA. FIA is the leading global trade organization for the futures, options and centrally cleared derivatives markets, with offices in London, Brussels, Singapore and Washington, D.C. FIA’s membership includes clearing firms, exchanges, clearinghouses, trading firms and commodities specialists from more than 48 countries as well as technology vendors, law firms and other professionals serving the industry.

FIA’s mission is to support open, transparent and competitive markets, protect and enhance the integrity of the financial system, and to promote high standards of professional conduct. As the principal members of derivatives clearinghouses worldwide, FIA's clearing firm members help reduce systemic risk in global financial markets. Equally important, our clearing firm members provide access to the commodity futures markets, which allows a wide range of companies in the commodity supply chain to manage their price risks.

Prior to serving as the President and CEO of FIA, I had the honor of serving as a Commissioner of the Commodity Futures Trading Commission from August 2002 to June 2009. During that time, I served as the Acting Chairman from June 2007 to January 2009.

Earlier this month, a separate House Agriculture Subcommittee held a hearing titled “The State of U.S. Agricultural Products in Foreign Markets.” There was agreement from Members on both sides of the aisle that American farmers, growers, and ranchers, and the farm economy more broadly, benefit from fair access to foreign markets.

The same holds true when it comes to our financial markets. The American farm economy benefits from open and fair access to global derivatives markets. Without this access, the costs to hedge risk become greater. Ultimately, this would be felt by American consumers when they visit their local grocery stores or order food at a restaurant.

Dating back to my time as a CFTC Commissioner, and even prior, the derivatives markets have been global in nature. Transactions, clearing and settlement often take place in different countries and across different time zones and continents.

Ultimately, market participants benefit from the global nature of the markets. The more participants, the stronger the market for those seeking to hedge risks. Open markets improve competition, keep costs affordable for customers and grow the economy. Our markets are not defined by borders—they are defined by the ingenuity and determination of buyers and sellers—no matter their location.

Cross-Border Trading Statistics

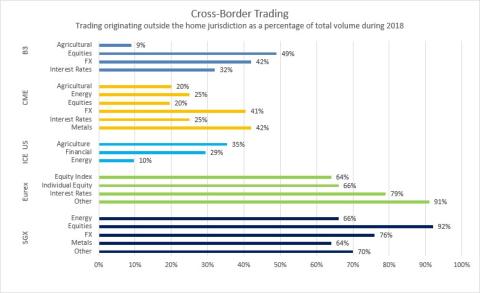

To illustrate the global nature of the markets, FIA has polled several of its member exchanges regarding the percentage of their volume that comes from foreign counterparties. The results are notable.

As made clear by these statistics, the ability to access customers on a cross-border basis strengthens markets. CME Group reports 42 percent of its metals contract volume originating in jurisdictions outside the U.S. ICE Futures US data shows that approximately 35 percent of the volume in its agricultural business comes from overseas. Without access to global markets, end-users—including farmers and ranchers seeking to hedge their risks in the derivatives markets—are harmed.

A Cause of Global Market Fragmentation

At the time of the financial crisis in 2008, I was serving as the Chairman of the CFTC. I vividly remember the panic and pain felt by so many Americans. The entire financial system was on the brink of collapse, and I was being called to the White House weekly as the President, the Treasury Secretary and policymakers of the highest levels searched for answers.

In the aftermath of the crisis, the member nations of the Group of Twenty (G20) engaged in a fundamental restructuring of the regulatory framework for OTC derivatives markets. The goal was simple: to improve transparency, mitigate systemic risk and protect against market abuse.

When the G20 held a summit in Pittsburgh in 2009, jurisdictions from across the globe were on the same page. They agreed on general principles and reforms, including mandates to clear all standardized over-the-counter derivatives.

For a time following the summit, implementation of the core principles and reforms agreed upon at the summit was going smoothly. There was an understanding that global implementation of identical rules, on a line-by-line basis, was impracticable. Rather, the G20 sought to ensure the principles and reforms agreed upon in Pittsburgh would be implemented to achieve equivalent regulatory outcomes.

Unfortunately, intervening political events have caused this alignment to be tested over time. The best example is Brexit. Now, we find ourselves with a radically different situation in Europe with the financial center of Europe soon to be located outside the EU. This will make it even more difficult to have consistent implementation of those G20 standards.

FIA Advocacy Related to Brexit

Since the United Kingdom voted to leave the European Union (EU) in 2016, FIA has worked tirelessly to inform and work with our members, policymakers, and the general public about the operational and market impact of a possible no-deal Brexit scenario on the listed and cleared derivatives market.

Unless the U.K. and the EU reach an agreement that delivers a smooth transition in the Brexit process, market participants will be faced with the prospects of significant disruption, financial instability, and regulatory uncertainty. Preparations for Brexit are continuing in the EU and U.K. and FIA firms have taken significant steps to ensure continued access to financial services in the EU and U.K after Britain leaves the EU.

As we set out to address these challenges, our focus at FIA has remained on:

- Minimizing disruption

- Avoiding fragmentation of liquidity by regulatory actions

- Maintaining global access to markets and counterparties

FIA worked extensively with our member firms and other trade associations to secure a commitment from the European Commission to allow U.K. clearinghouses temporary continued access to the EU in the event of a no-deal Brexit. This commitment by the European Commission was announced in December 2018[1] and was an enormous success for market participants across the globe, including in the United States. In response, the European Securities and Markets Authority (ESMA) followed suit by adopting recognition decisions for three U.K. CCPs.

FIA, however, is closely monitoring several areas of concern that could impact access to European and U.S. markets as the Brexit debate continues. Recent revisions to the European Market Infrastructure Regulation legislation (EMIR 2.2) on clearinghouse supervision may require direct compliance with substantial elements of EU law and supervision by EU regulators for U.S. clearinghouses deemed systemic unless EU regulators find U.S. supervision to be equivalent.

If implemented without the proper recognition of home country supervision, this could lead to contradictory requirements, duplicative supervision and counter-reactions by global regulatory authorities. These EU consultations, which are currently out for public comment, may impact access to global markets if not properly clarified and implemented. The current Chairman of the CFTC has also announced his intention to strengthen the CFTC’s ability to recognize and defer to home country supervision for foreign CCPs. FIA stands ready to comment on all these proposals to ensure the proven regulatory deference and recognition approach remains the standard for cross-border regulation.

Additional Examples of Cross-Border Challenges

The listed and cleared derivatives markets are facing potential regulatory change driven by a range of geopolitical developments that pose a threat to the global markets.

As jurisdictions around the world implement G20 principles from the 2009 summit, they sometimes vary, overlap or contradict with the implementation of other jurisdictions.

I’d like to highlight some specific examples of problematic approaches which have taken place or been proposed in recent years:

Clearing: Japan requires certain transactions to be cleared within its borders, rather than by a third country CCP. In this case, the level of local compliance is such that a local entity must be established, which is costly and inefficient for many market participants. These requirements greatly impact the number of market participants available to offer clearing services in a specific jurisdiction.

Reporting: The EU and the U.S. have introduced similar but separate derivatives trade reporting rules. Although the goals are the same, they did not coordinate the substance of what is reported nor the timing of the implementation. As a result, regulators in these two jurisdictions have imposed highly operationally intensive rules that require firms to devote significant operational resources on multiple separate occasions to ensure effective compliance with the separate rule sets.

Capital: Divergence in capital requirements across jurisdictions is not uncommon. However, in the world of the listed and cleared derivatives markets, this type of divergence can have vast implications.

Responding to the financial crisis, the Basel Committee for Banking Supervision adopted a leverage ratio as a backstop that requires banks to hold capital against actual exposures to loss. The Federal Reserve Board, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) have implemented the Basel supplementary leverage ratio (SLR) in the United States.

FIA strongly believes that capital requirements need to be recalibrated so that it reflects the true amount of risk in this activity. Unfortunately, the SLR fails to recognize the collection of customer initial margin in the central clearing process as an offset to a bank’s exposures. Other jurisdictions such as the EU have recognized client cleared initial margin as exposure reducing under the leverage ratio. If the U.S. does not correct course and do the same, capital costs associated with central clearing in the U.S. will not be competitive with the EU’s. This impacts end users and businesses across a wide variety of industries that rely on derivatives for risk management purposes, including agricultural businesses and manufacturers.

It has also left end-users with less competition and access to clearing services. The number of firms providing client clearing services in the U.S. has dropped from 84 in 2008 to 55 in 2018. This result runs counter with the clearing mandates contained in Title VII of the Dodd-Frank Act. This tax on clearing places clearing firms and their customers in the U.S. at a disadvantage relative to their foreign competitors as jurisdictions outside of the U.S. have offered or plan to offer an offset for client margin.

FIA was pleased to learn that last week the Basel Committee on Banking Supervision agreed on allowing client initial margin to offset the exposure amounts under the leverage ratio. We look forward to the U.S. prudential regulators implementing this global revision. FIA thanks Chairmen Peterson and Scott, and Ranking Members Conaway and Scott, along with the current Commissioners of the CFTC for their leadership on this issue. FIA also thanks the Commissioners for their recent bipartisan comment letter to the prudential regulators supporting this needed recalibration.

The U.S. prudential regulators are currently consulting on a rulemaking related to implementation of the standardized approach for counterparty credit risk (SA-CCR) capital framework. FIA has responded seeking an offset for client cleared margin. In addition, FIA believes that this rulemaking raises several concerns with FIA members, including its commodity members.

Among the concerns are the very limited recognition of margin under the risk weighted asset (RWA) capital requirements and the punitive treatment of commodities trading. It is not certain when and in what form SA-CCR will be adopted in other jurisdictions that participate in the Basel Committee process. If mandatory compliance with SA-CCR is required prior to its adoption in other jurisdictions, U.S.-based commercial end users may be susceptible to significant competitive disadvantages. FIA is also concerned, broadly, that the SA-CCR proposal in its current form may have a significant adverse impact on the liquidity of derivatives markets, especially commodities markets.[2]

FIA Recommendations to Reduce Market Fragmentation

To better identify and address these growing concerns and the cross-border uncertainty driven by a range of geopolitical developments, FIA published a white paper in March 2019 titled: Mitigating the Risk of Market Fragmentation.[3] To summarize, we encouraged regulators around the world to:

- Rely on counterparts in other jurisdictions to supervise certain cross-border activity through “deference” or “substituted compliance”;

- Work collectively to develop international standards and implementation guidelines while recognizing local flexibility and conditions; and

- Put in place mechanisms for cross-border cooperation, information-sharing, and crisis-management planning, which is critical for the day-to-day supervision of cross-border business.

As noted in our March white paper, FIA strongly supports the regulatory recognition and deference model that has been the foundation of the futures industry for years. Deference raises standards in global markets as it is used to assess whether jurisdictions have adopted comparable rules to those in the U.S. This tested tool is one way to bring other countries into compliance with global standards and make the markets safer.

We were excited to see that earlier this month, the Financial Stability Board (FSB) published a report, which was delivered to G20 Finance Ministers and Central Bank Governors ahead of their meetings in Fukuoka, Japan on June 8 and 9, 2019. The report lays out approaches and mechanisms to improve international cooperation and mitigate market fragmentation.[4]

Additionally, we are pleased to see that the issues of market fragmentation will be discussed at the highest levels of government as it will be on the agenda for the upcoming G20 Summit in Osaka, Japan later this week. We hope that regulators will take from this meeting the same commitment to working across borders as they did at the 2009 G20 meeting in Pittsburgh.

A History of the CFTC’s Approach to Cross-Border

The CFTC has been a global regulatory leader in promoting the principles of deference and regulatory recognition. In 1980, the CFTC was one of the first regulators to put in place a cross-border recognition approach for market participants. At that time, the CFTC adopted a position that, notwithstanding the potential broad scope of the CFTC’s jurisdiction under the Commodity Exchange Act (CEA), “it is appropriate at this time to focus [the CFTC’s] activities upon domestic firms and firms soliciting or accepting orders from domestic users of the futures markets and that the protection of foreign customers of firms confining their activities to areas outside of this country. . . may best be for local authorities in such areas.”

Congress also deserves credit for the agency's historical support for the principles of recognition and deference.

In 1982, Congress amended the CEA to authorize the CFTC to adopt rules governing the offer and sale of foreign futures to persons located in the U.S. Congress was careful to limit the CFTC’s authority to the regulation of intermediaries that deal directly with persons located in the U.S., while expressly prohibiting the CFTC from adopting any rule that “(1) requires [CFTC] approval of any contract, rule, regulation, or action of any foreign board of trade, exchange, or market or clearinghouse for such board of trade, exchange or market, or (2) governs in any way any rule or contract term or action of any foreign board of trade, exchange, market or clearinghouse for such board of trade, exchange or market.”

The CFTC has allowed U.S. participants direct electronic access to foreign markets if the non-U.S. entities have rules that are comparable with the CFTC’s. That process was formalized by Congress in the Dodd-Frank Act, which authorized the CFTC to register Foreign Boards of Trade (FBOT) that wish to permit direct access from the U.S. but deferring to the home country regulator and rules where the rules are comparable. Today, there are 18 registered FBOTs with the CFTC.

Finally, earlier this month, at FIA’s annual International Derivatives Expo conference in London, CFTC Chairman Christopher Giancarlo highlighted the principles of his cross-border policy. Specifically, he stated “the CFTC should act with deference to non-U.S. regulators in jurisdictions that have adopted comparable G20 swaps reforms.” He went on to say, “Mutual commitment to cross-border regulatory deference ideally should mean that market participants can rely on one set of rules—in their totality—without fear that another jurisdiction will seek to selectively impose an additional layer of particular regulatory obligations that reflect differences in policy emphasis, or application of local market-driven policy choices beyond the local market. This approach is essential to ensuring strong and stable derivatives markets that support economic growth both in the U.S. and around the globe.”

FIA agrees with Chairman Giancarlo and looks forward to working with the CFTC on future cross-border rulemakings

The CFTC has for decades, under Chairs from both parties, understood that market fragmentation created though a patchwork of international regulation undermines the resilience of the clearing derivatives system and therefore weakens the safety mechanisms built into the clearing system.

Cross-Border Fintech Challenges

With the international focus of this hearing, I would like to take a moment to recognize an area where the CFTC is lagging other international regulators, by no fault of its own.

According to CFTC Chairman Giancarlo, the agency has limitations in its ability to test, demo, and generate proof of concepts around emerging technologies and systems. At a recent hearing before this committee he said, “Specifically, the CFTC lacks the legal authority to partner and collaborate with outside entities engaging directly with fintech within a research and testing environment, including when the CFTC receives something of value absent a formal procurement.” [5]

This is problematic and prevents the CFTC from keeping pace with emerging technologies and puts the U.S. at a competitive disadvantage relative to its overseas counterparts. For example, the U.K. offers regulatory sandboxes where fintech firms can work with the regulator and receive feedback and answer questions about their products.

Given the global nature of our markets, it is important that regulators in the U.S. have access to the same emerging technology available to regulators in the U.K. and elsewhere.

That is why I would like to recognize and thank Ranking Member Austin Scott (R-GA) for his legislative efforts to provide the CFTC with the necessary transaction authority to engage in public-private partnerships with financial technology developers. FIA stands ready to work with the committee on solutions that provides the tools needed by the CFTC and market participants alike.

Conclusion

FIA greatly appreciates the Subcommittee’s interest in these critical topics that affect the global financial markets and the end-users who rely on derivatives products for price certainty and to hedge their risks.

FIA strongly supports the regulatory recognition and deference model that has been the foundation of the futures industry for years. Identical rules, on a line-by-line basis, implemented globally across jurisdictions is impracticable. Rather, the goal we should strive to achieve is ensuring equivalent regulatory outcomes.

The good news is we have a window of opportunity to reset the global approach to cross-border regulation. It is imperative we get these cross-border issues right, especially with Brexit looming. The stakes are incredibly high. Without common ground, we may find ourselves with fragmented markets and regulation. That doesn’t benefit anyone, especially customers and end-users.

I appreciate the Committee’s attention to this important topic.

[1] Due to the extension of the Article 50 of the Treaty of the European Union deadline, an amended equivalence decision in relation to the U.K. CCPs was adopted by the European Commission on April 3, 2019

[2] https://fia.org/sites/default/files/2019-09/FIA-Supplemental-Comment-Letter-on-behalf-of-Commodities-Members-re-SA-CRR-031819.pdf

[3] https://fia.org/sites/default/files/2019-08/FIA-WP-MItigating-Risk-26062019.pdf

[4] https://www.fsb.org/wp-content/uploads/P040619-2.pdf

[5] https://www.cftc.gov/PressRoom/SpeechesTestimony/opagiancarlo70