Obituaries

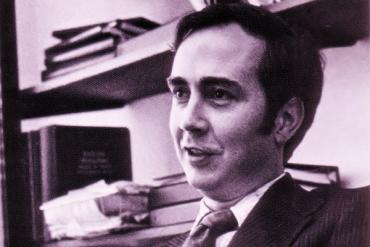

Joseph Sullivan, the former political reporter turned founder of the Chicago Board Options Exchange, passed away on 2 October in his hometown of Knoxville, Tennessee at the age of 82. Sullivan will be remembered for helping define Chicago as a center of financial innovation and augmenting its position as the financial derivatives capital of the world.

Sullivan began his career as a reporter for the Wall Street Journal before joining the Chicago Board of Trade in 1968, and eventually launching the Chicago Board Options Exchange on April 26, 1973. Over those five years, he worked tenaciously to win over both industry sceptics and regulators at the US Securities and Exchange Commission to launch a marketplace for trading listed stock options, then an obscure corner of the financial markets. Sullivan served as the inaugural president of the CBOE until 1979, and the CBOE – now Cboe – grew into one of the largest options exchanges in the world.

In a statement, Ed Tilly, chairman, president and CEO of Cboe Global Markets said: “On behalf of all of Cboe, we are deeply saddened to lose a visionary leader like Joe Sullivan. His dedication, determination and commitment to launching Cboe, in spite of many challenges, laid the foundation for the vibrant options market that exists today. Joe was immensely proud of what Cboe and the US options industry would become. Our industry simply would not be what it is without Joe’s innovative thinking and leadership and we are forever grateful for his passion and genius.”

The OCC, the clearinghouse for the US options exchanges, said in a statement that Sullivan's leadership resulted in a strong and vibrant marketplace that provided a powerful risk management tool for investors and created economic opportunity for many in Chicago and the US.

Sullivan reflected on Cboe’s founding in his 2019 memoir, “The Advent of the Chicago Board Options Exchange: A Golden Anniversary Memoir by its Founding President.”

FIA is saddened to report that Ed Netter, a long-time executive in the derivatives clearing business, has passed away aged 65. Netter was a director at SG Americas Securities based in Chicago. Before that he spent 16 years at Newedge, which was acquired by Société Générale, in a variety of senior operations roles, including global head of electronic trading client onboarding and global head of esolutions support. Netter started his career in market surveillance at the Chicago Mercantile Exchange.

People News

Citi has appointed Chris Perkins and Sabrina Wilson as global co-heads of futures, OTC clearing and FX prime brokerage (FCX), following the retirement of Jerome Kemp, the former head of those businesses. Perkins and Wilson report to Okan Pekin, the global head of securities services.

Perkins, who serves on FIA's board and executive committee, joined Citi in 2008 and founded its global OTC clearing business. In 2018, he took charge of global FX prime brokerage and led its integration with the bank's futures, clearing and collateral business. Prior to Citi, he ran the derivatives intermediation business at Lehman Brothers. Earlier in his career, he served as a captain in the US Marine Corps.

Wilson joined Citi in 2017 as the European head of the futures, clearing and collateral business and global head of electronic and algorithmic execution for listed derivatives. Prior to this, she held a variety of leadership roles in New York, London and Singapore across sales and product development at JPMorgan, Goldman Sachs and Deutsche Bank. Wilson is also a member of FIA's European Advisory Board.

In other news, Citi has appointed Baskar Ramachandran as global head of in-business risk for the FCX business, based in New York. He joins from LCH where he served as Americas head of in-business risk with responsibility for risk management across SwapClear, ForexClear and SwapAgent. He also chaired the default management group in New York for Swapclear and ForexClear. Before joining LCH in 2013, Ramachandran was director of credit valuation adjustment trading at UBS, managing the bank’s FX CVA book in the US. Prior to that, he held senior market risk roles at Barclays, Lehman Brothers and HSBC. At Citi, he reports to Perkins, Wilson and Ashley Matteo, head of in-business risk for equities and securities.

Eurex has promoted Vassilis Vergotis to head of strategy. Vergotis will work with Michael Peters, the new chief executive officer of the exchange, and other members of its executive management team on developing its strategy in the areas of product, distribution, transparency, regional expansion and digitization. He also will be involved in revenue planning and cost monitoring, project management and implementation for several Eurex strategic projects, identification of inorganic growth opportunities, and overview of contractual agreements with index providers and other third parties. Vergotis previously was global head of product design and strategy for equity, index and digital assets. Before moving to the company's Frankfurt headquarters in 2018, he spent almost 15 years in its Chicago office in several sales and business development leadership roles.

Citi has appointed Alastair Hawker as head of electronic execution for futures in North America. He joined the firm from Quantitative Brokers, where he was global head of sales. Before that, he was North America head of futures electronic trading at Goldman Sachs. He is based in New York and reports to Antonio Reyes, the Americas head of futures, OTC clearing and FX prime brokerage at Citi.

Eric Pan, the former head of international affairs at the Commodity Futures Trading Commission, has been appointed president and chief executive officer of the Investment Company Institute, a global association for regulated funds. Pan will take over from Paul Schott Stevens, who is retiring at the end of the year. Pan was previously a managing director at Rock Creek Global Advisors, an international economic policy advisory firm. From 2015-2019, he was director of the Office of International Affairs at the CFTC. During this time, he also chaired the IOSCO Committee on Derivatives, the OTC Derivatives Regulators Group, and the Financial Stability Board's working group on data standards governance. Before joining the CFTC, Pan oversaw international regulatory policy at the US Securities and Exchange Commission. He began his career as a lawyer in Washington, D.C.

Vincent Johnson, the former head of regulatory affairs and commercial advocacy at BP, has joined food and beverage company Mondelez International as senior counsel – compliance and securities, based at the company's headquarters in Chicago. Johnson worked at BP for nearly 14 years as a member of the management team for BP’s Supply & Trading business, providing legal and regulatory guidance on a range of issues and representing BP with trade associations, government policy advisory groups and industry partners. Prior to BP, Johnson worked at the CFTC as a senior attorney in the Division of Enforcement.

Société Générale has appointed Toby Lawson as chief country officer for India. His responsibilities include managing its branch and overseeing its securities and derivatives execution and clearing business in India. Lawson previously worked for the bank in Australia, where he was head of global markets.

Financial data company Refinitiv has appointed Dean Berry as global head of trading, based in London. Berry was most recently the global head of electronic and hybrid markets at interdealer broker BGC Partners. Prior to this, he spent six years at Icap as chief executive officer for the global e-commerce division, and before that was chief operating officer for Icap's Asia Pacific business. He has also worked at Bank of Ireland, Societe General, Nordea, Dresdner Kleinwort and Deutsche Bank in derivatives trading roles. In a statement, Refinitiv said Berry's background gives him a deep understanding of its trading customers’ data, analytics and workflow needs.

Eventus Systems, a trade surveillance and risk management software platform provider, has appointed Vincent Turcotte as sales director for the Asia Pacific region. Based in Hong Kong, he reports to Scott Schroeder, global head of sales. Turcotte previously represented ICE in the marketing of its platforms in Hong Kong and Singapore. Before that, he was managing director, Asia Pacific and head of futures and options at Nomura International. He also held senior production and sales management positions at Newedge Group, UBS and JPMorgan Chase in London, Tokyo, Hong Kong and Singapore.

Illuminate Financial, a venture capital company that invests in early-stage capital markets fintechs, has opened an office in Singapore and named Luca Zorzino to lead the firm's efforts in the Asia Pacific region. Zorzino joined Illuminate in late 2015 after working as a senior consultant at trading and risk management vendor Murex in Singapore. This is the third office location for Illuminate Financial, which has offices in London and New York.

Edward Pla, a former managing director at UBS and FIA board member, has joined Digital Swiss Gold and Gilded, a platform for investors to buy, sell, send and deliver physical gold, as chief commercial officer and partner. Pla was previously global co-head of execution and clearing at UBS, with responsibility for listed derivatives execution and clearing and OTC swap clearing. He also served on the board of FIA for four years until 2018, most recently as chairman, and on the CFTC’s Market Risk Advisory Committee from 2015 to 2018. A veteran of 24 years at UBS, Pla led the growth of the bank's FX prime brokerage business from startup to large global enterprise before overseeing execution and clearing. He joins former UBS colleagues Ashraf Rizvi, CEO and founder of Digital Swiss Gold and Gilded, Michael Bolin, Saira Rizvi and Eugenio Ferrigno at the company.

Galaxy Digital Holdings, the digital asset trading firm and asset manager headed by Mike Novogratz, has appointed Damien Vanderwilt as co-president and head of global markets. Vanderwilt joined the firm from Goldman Sachs where he worked for 20 years, most recently as partner and global head of the bank's FICC execution services. In that role he was responsible for leading the bank's efforts to consolidate voice and systematic market making.

Jennifer Liu, the former chief financial officer of cryptocurrency derivatives exchange LedgerX, has joined Anchorage as general manager of its New York office. The San Francisco-based company provides digital asset custody for institutional investors and has the backing of Visa, Blockchain Capital and Andreessen Horowitz. Before joining LedgerX in 2016, Liu worked at Alibaba, JP Morgan Asset Management and Morgan Stanley.